- 12 Marks

Question

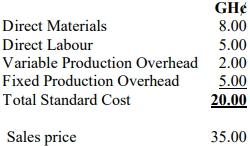

a) Resol Ltd commenced trading on 1 April 2011 making the product Resol. The standard cost sheet for Resol is as follows:

The fixed production overhead figure has been calculated on the basis of a budgeted normal output of 24,000 units per annum. Fixed Sales and Administration costs are estimated at GH¢24,000 per annum. You may assume that all budgeted fixed expenses are incurred evenly over the year.

The sales price is GH¢35.00 and the actual number of units produced and sold was as follows:

| April | May | |

|---|---|---|

| Production – units | 2,000 | 2,500 |

| Sales – units | 1,500 | 3,000 |

Required:

Prepare a profit statement for each of the months April and May using:

- Standard costing

- Absorption costing

Answer

(i) Standard Costing Profit Statement

| April | May | |

|---|---|---|

| Sales | 52,500 | 105,000 |

| Cost of Sales | 7500 | |

| Opening Stock | 30,000 | 37,500 |

| Variable production cost | (7,500) | |

| Closing Stock | 22,500 | 45,000 |

| Contribution | 30,000 | 60,000 |

| Fixed production Overheads | (10,000) | (10,000) |

| Sales & Administration Overheads | (2,000) | (12,000) |

| Profit for period | 18,000 | 48,000 |

(ii) Absorption Costing Profit Statement

| April | May | |

|---|---|---|

| Sales | 52,500 | 105,000 |

| Cost of Sales | ||

| Opening Stock | 0 | 10,000 |

| Production cost (total) | 40,000 | 50,000 |

| Closing Stock | (10,000) | 0 |

| Gross Profit | 22,500 | 45,000 |

| Sales & Administration Overheads | (2,000) | (2,000) |

| Over-absorbed fixed production overhead | 0 | (2,500) |

| Profit for period | 20,500 | 45,500 |

Workings:

Calculation of Unit Costs

| Cost Component | GH¢ |

|---|---|

| Direct Materials | 8.00 |

| Direct Labour | 5.00 |

| Variable Overhead | 2.00 |

| Variable Production Cost | 15.00 |

| Fixed Overhead | 5.00 |

| Total Production Cost | 20.00 |

Closing Stock Calculations

| Month | Units | Standard Costing | Absorption Costing |

|---|---|---|---|

| April | 500 | GH¢7,500 | GH¢10,000 |

Fixed Production Overhead

| Calculation | GH¢ |

|---|---|

| Budgeted production (24,000 units) | 120,000 |

| Fixed overhead per month | 10,000 |

| Over absorption of fixed production overhead | 2,500 |

Fixed Sales and Administration Cost

| Calculation | GH¢ |

|---|---|

| Total annual cost | 24,000 |

| Monthly cost | 2,000 |

- Tags: Fixed Overheads, Profit Statement, Standard Costing, Variable Costs, Variance Analysis

- Level: Level 2

- Topic: Standard Costing and Variance Analysis

- Series: MAY 2018

- Uploader: Kwame Aikins