- 9 Marks

Question

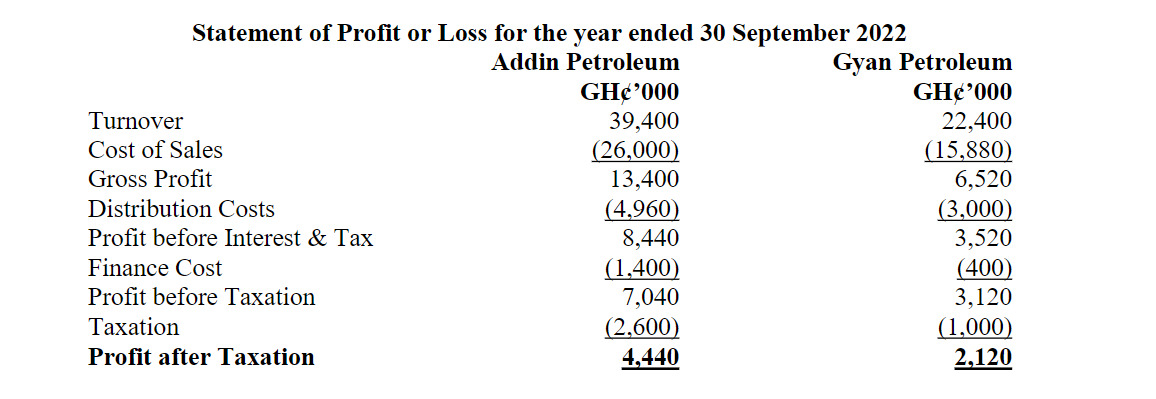

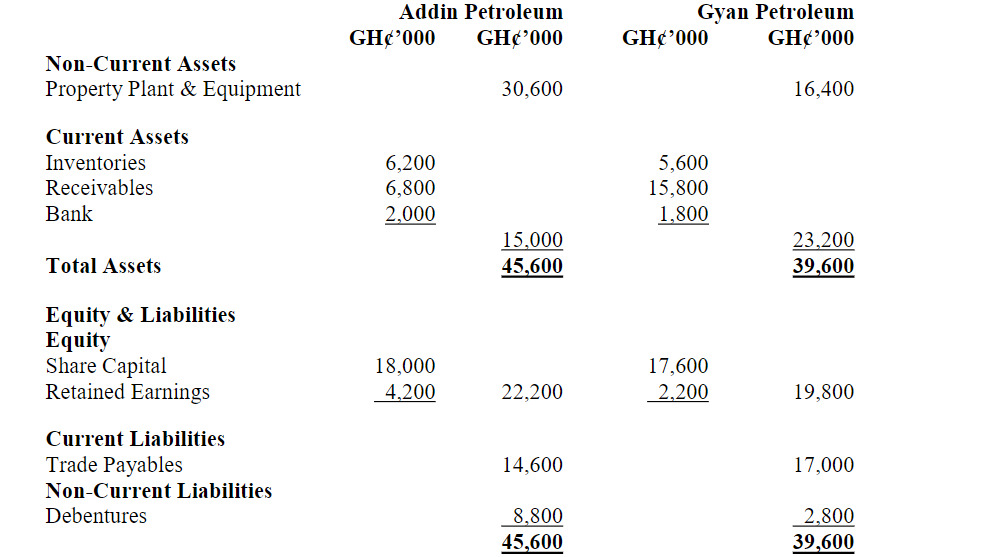

You are the Chief Finance Officer of LizOil Co. Ltd, a holding company with subsidiaries that have diversified interests. The company’s Board of Directors are interested in acquiring a new subsidiary in the Downstream Petroleum Sector. Two companies have been identified as potentials for the acquisitions: Addin Petroleum and Gyan Petroleum. The following are the summaries of their respective financial statements:

Statement of Profit or Loss for the year ended 30 September 2022

Statement of Financial Position as at 30 September 2022

Required:

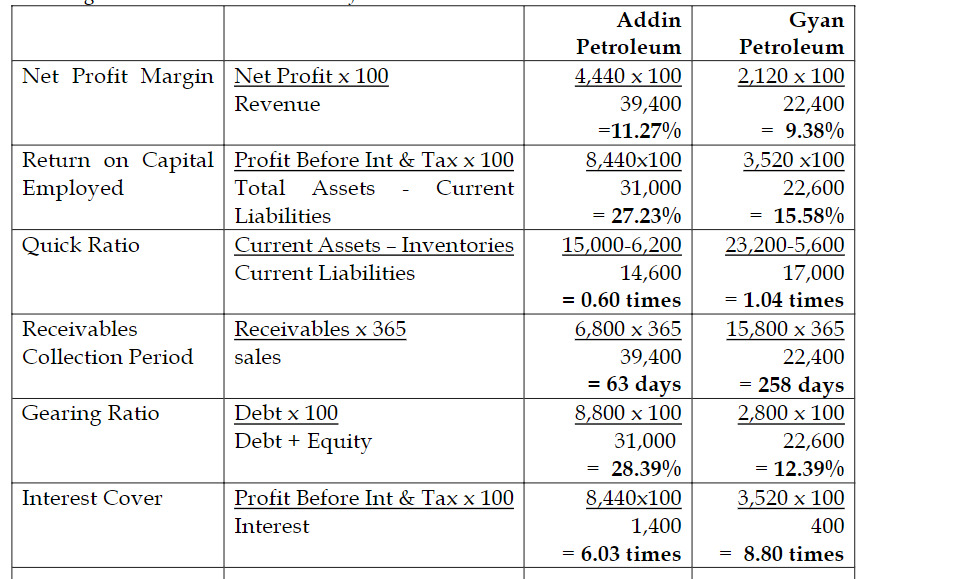

a) Calculate the following ratios for each of the two companies: i) Net profit margin ii) Return on year-end capital employed iii) Quick ratio iv) Trade receivables’ collection period (in days) v) Gearing (debt over debt plus equity) vi) Interest cover (9 marks)

b) Write a report to the Chairperson of the board based on a comparable analysis of performance of both companies using the ratios computed in (a) above. (9 marks)

c) State TWO (2) limitations of ratios. (2 marks)

Answer

a) Computation of ratios

Note: Figures used are in thousands of Ghana Cedis.

(6 ratios @ 1.5 marks each = 9 marks)

- Tags: Acquisition, Financial Ratios, Liquidity Ratios, Profitability Ratios

- Level: Level 2

- Topic: Financial Statement Analysis, Ratio Analysis

- Series: NOV 2023

- Uploader: Cheoli