- 20 Marks

Question

The following are the accounts of Bebebe Ltd (Bebebe), a company that manufactures playground equipment for the year ended 30 November 2020.

Statement of Comprehensive Income for the year ended 30 November:

Required:

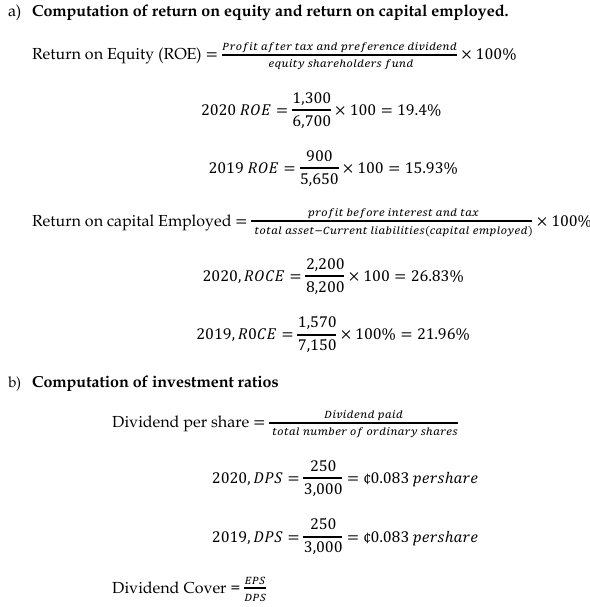

a) Calculate, for both years, the return on equity and the return on capital employed. (4 marks)

b) Calculate, for both years, TWO (2) investment ratios to a potential investor. (4 marks)

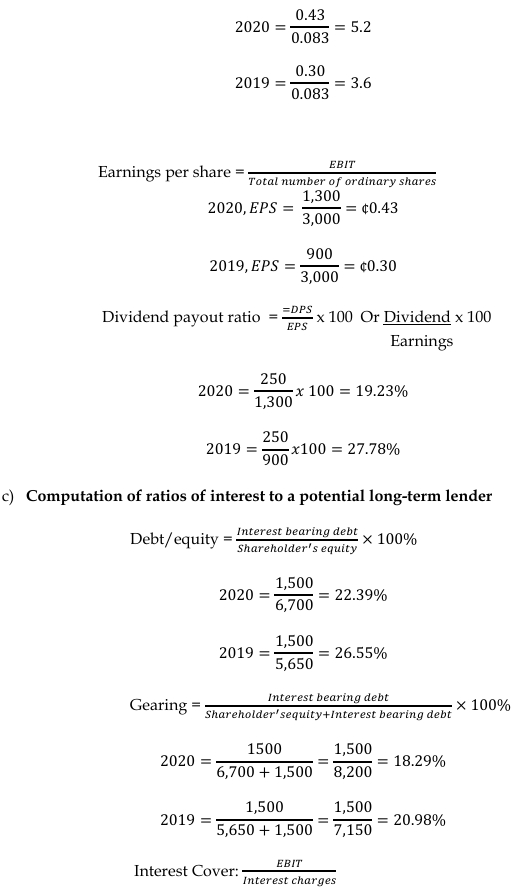

c) Calculate, for both years, TWO (2) ratios of interest to a potential long-term lender. (4 marks)

d) Comment on the performance of Bebebe to a potential shareholder and lender using the ratios calculated above. (5 marks)

e) Explain THREE (3) weaknesses in these ratios.

(3 marks)

Answer

From the viewpoint of a potential shareholder who would be interested in the returns on their investment, ratios such as Return on Equity (ROE), Dividend per Share (DPS), and Earnings per Share (EPS) are crucial.

- The ROE has improved from 15.93% in 2019 to 19.4% in 2020, indicating better utilization of shareholders’ funds.

- EPS increased from GH¢0.30 to GH¢0.43, which could boost shareholder confidence as it suggests that the company is generating higher earnings per share.

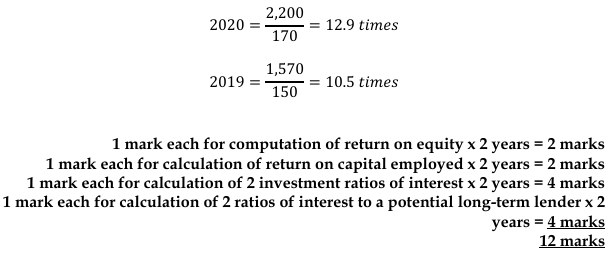

From the viewpoint of a potential lender, the company’s Interest Cover ratio and Debt/Equity ratio would be key indicators of its ability to meet debt obligations:

- Interest Cover has increased from 10.5 times in 2019 to 12.9 times in 2020, suggesting that the company is generating sufficient profits to cover its interest payments comfortably.

- The Debt/Equity ratio decreased from 26.55% to 22.39%, indicating a decrease in financial risk as the company relies less on debt relative to equity.

e) Weaknesses in Ratios:

- Historical Nature:

Ratios are based on historical financial information, and therefore may not reflect future performance. - Comparability Issues:

Different companies use different accounting policies, which can affect the comparability of ratios, such as using different depreciation methods. - Industry Differences:

Ratios may vary significantly across different industries, making it difficult to benchmark a company’s performance against others outside of its industry.

- Topic: Financial Statement Analysis

- Series: NOV 2021

- Uploader: Dotse