- 17 Marks

Question

Answer

Consolidated statement of profit or loss and other comprehensive income for the year ended 30 September 2019

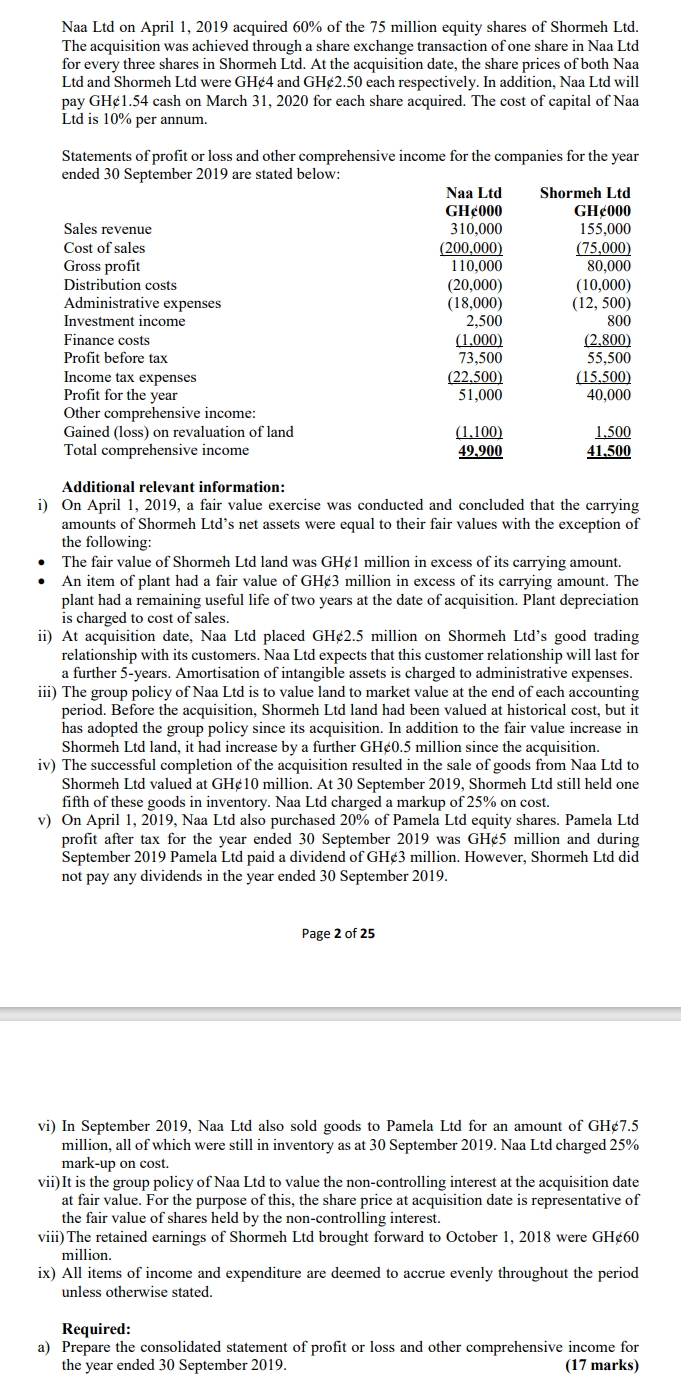

| Description | GH¢000 |

|---|---|

| Sales revenue (GH¢310,000 + (GH¢155,000 x 6/12) – GH¢10,000) | 377,500 |

| Cost of sales (W3) | (228,950) |

| Gross profit | 148,550 |

| Distribution costs (GH¢20,000 + (GH¢10,000 x 6/12)) | (25,000) |

| Admin expenses (GH¢18,000 + (GH¢12,500 x 6/12) + (GH¢2,500/5yrs x 6/12)) | (24,500) |

| Investment income: share of profit from associate (GH¢5,000 x 20% x 6/12) | 500 |

| Other investment income (GH¢2,500 – GH¢600 div from associate + GH¢800 x 6/12) | 2,300 |

| Finance costs (GH¢1,000 + (GH¢2,800 x 6/12) + (GH¢63,000 x 10% x 6/12)) | (5,550) |

| Profit before tax | 96,300 |

| Income tax expense (GH¢22,500 + (GH¢15,500 x 6/12)) | (30,250) |

| Profit for the year | 66,050 |

| Other comprehensive income: | |

| Loss on revaluation ((GH¢1,100) – (GH¢1,500 – GH¢1,000)) | (600) |

| Total comprehensive income | 65,450 |

Profit for the year attributable to:

- Shareholders of parent (GH¢66,050 – GH¢7,600): GH¢58,450

- Non-controlling interest (GH¢40,000 x 6/12 – GH¢750 – GH¢250 x 40%): GH¢7,600

Total: GH¢66,050

Total comprehensive income attributable to:

- Shareholders of the parent (GH¢65,450 – GH¢7,800): GH¢57,650

- Non-controlling interest (GH¢7,600 + (GH¢1,500 – GH¢1,000 x 40%)): GH¢7,800

Total: GH¢65,450

W2 Net assets – Shormeh Ltd

| Description | Acquisition date (GH¢000) | Reporting date (GH¢000) |

|---|---|---|

| Share capital | 75,000 | 75,000 |

| Retained earnings: | ||

| – Bal b/f | 60,000 | |

| – Plus (6/12 x GH¢40,000) | 20,000 | |

| Total | 80,000 | 100,000 |

| Fair value at acquisition date: | ||

| a) Land | 1,000 | 1,000 |

| b) Plant | 3,000 | 3,000 |

| – Addition Depreciation (GH¢3m/2yrs x 6/12) | — | (750) |

| Customer relationship asset at acquisition | 2,500 | 2,500 |

| – Additional amortization (GH¢2.5/5yrs x 6/12) | – | (250) |

| Total net assets | 161,500 | 180,500 |

W3 Group cost of sales

| Description | GH¢000 |

|---|---|

| Naa Ltd | 200,000 |

| Shormeh Ltd (GH¢75,000 x 6/12) | 37,500 |

| Intra-group purchases | (10,000) |

| Additional depreciation (GH¢3m / 2yrs x 6/12) | 750 |

| Unrealized profit in inventories: | |

| Sales to Shormeh Ltd (GH¢10,000 x 1/5 x 25/125) | 400 |

| Sales to Pamela Ltd (GH¢7,500 x 20% x 25/125) | 300 |

| Total | 228,950 |

Goodwill calculation

| Description | GH¢000 |

|---|---|

| Purchase consideration: | |

| – Shares (60% x 75,000 shares x 1/3 x GH¢4) | 60,000 |

| – Deferred consideration (60% x 75,000 shares x GH¢1.54 x 1/1.1) | 63,000 |

| Total | 123,000 |

| Fair value of NCI at acquisition date (40% x 75,000 shares x GH¢2.50) | 75,000 |

| Net asset at acquisition date | (161,500) |

| Goodwill | 36,500 |

Alternative Working for goodwill

| Description | GH¢000 |

|---|---|

| Purchase consideration | 123,000 |

| Share of net assets (60% x GH¢161,500) | (96,900) |

| Total | 26,100 |

| Fair value of NCI at acquisition date | 75,000 |

| NCI share of net assets at acquisition date (40% x GH¢161,500) | (64,600) |

| Total | 10,400 |

| Goodwill | 36,500 |

- Uploader: Olaoluwa