- 12 Marks

Question

The following details were taken from the records of KK Company Limited for the 2020 year of assessment.

| Item | GH¢ |

|---|---|

| Profit before tax | 132,000 |

| Total Financial Gain from derivatives | 42,000 |

| Total Financial Cost from derivatives | 300,000 |

Required:

i) State what constitutes financial cost from derivatives? (3 marks)

ii) Explain the tax treatment of financial cost from derivatives under a company such as KK Company Limited that is neither a mining nor petroleum company. (2 marks)

iii) Compute and explain the allowable financial cost from derivatives. (3 marks)

iv) Assume all facts are the same except that Financial gain from derivatives is GH¢60,000 and Financial Cost from derivatives is GH¢30,000. Compute and explain the allowable financial cost from derivatives.

Answer

i) What Constitutes Financial Cost from Derivatives

Financial costs from derivatives refer to the interest or losses with respect to financial instruments, which are tax-deductible under certain conditions. These instruments include:

- Debt claims or debt obligations, such as debentures, treasury bills, promissory notes, and bonds.

- Derivative instruments, which are financial contracts that derive their value from underlying assets, like interest rates, prices, or foreign exchange rates.

- A foreign currency instrument or any other financial instrument prescribed by regulations or generally accepted accounting principles.

(3 marks)

ii) Tax Treatment of Financial Cost from Derivatives

The financial costs are allowed as a deduction up to the following limit:

- The total financial gains derived by the company that are included in its income for the year; plus

- 50% of the company’s chargeable income for the year, excluding financial gains or deductions for financial costs.

Any disallowed financial costs may be carried forward for five years.

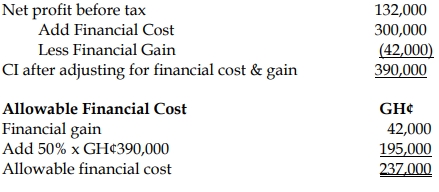

iii) Computation of Allowable Financial Cost from Derivatives

Since the total financial cost was GH¢300,000, the disallowed amount will be GH¢63,000 (300,000 – 237,000), which can be carried forward for the next five years.

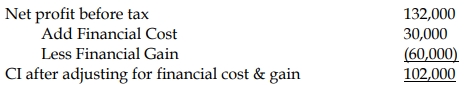

iv) Computation of Allowable Financial Cost (Revised Figures)

In this case, since the total financial cost is only GH¢30,000, the entire amount is allowed, and no amount will be carried forward.

- Tags: Derivatives, Financial Costs, Financial instruments, Tax deductions

- Level: Level 2

- Topic: Income Tax Liabilities

- Series: MAY 2021

- Uploader: Theophilus