- 10 Marks

Question

a) Rock Beverages Ltd (RBL) is a producer of fresh fruit juice. RBL operates a fruit juice extracting machine, which costs GH¢150,000 to purchase and GH¢10,000 to install. The efficiency of the machine reduces over time. Consequently, the costs associated with its use increase over time. Two costs that are influenced by the level of efficiency of the machine are operational costs and maintenance costs. Operational costs are estimated to be GH¢30,000 during the first year of the machine’s use; GH¢35,000 during its second year; and GH¢40,000 during its third year. Maintenance costs are estimated to be GH¢11,000 during the first year of the machine’s use; GH¢13,000 during its second year; and GH¢15,000 during its third year. The resale value of the machine is GH¢40,000 at the end of the first year of use; GH¢35,000 at the end of the second year of use; and GH¢28,000 at the end of the third year of use. RBL’s cost of capital is 18%.

Required:

Determine the optimal replacement cycle length for the machine using the equivalent annual cost method. (10 marks)

Answer

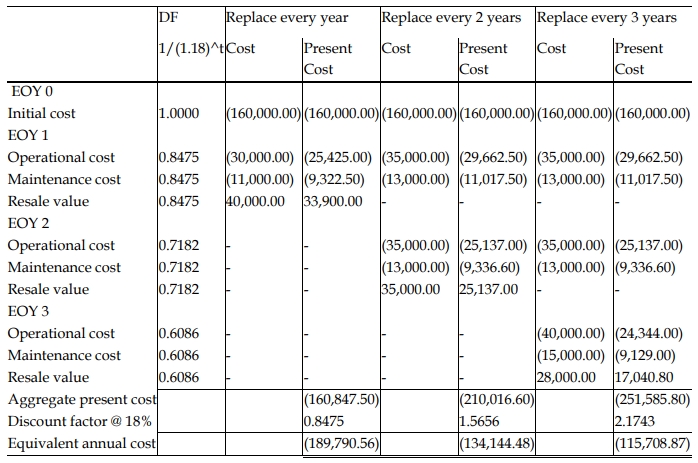

Calculation of the Equivalent Annual Cost (EAC) for different replacement cycles:

1-year Cycle: If the plant is replaced every year, the firm will incur the initial cost of GH¢160,000 now, operational cost of GH¢30,000 at the end of year one, maintenance cost of GH¢11,000 at the end of year one, and receive the resale value

of GH¢40,000 at the end of year one when the asset is replaced.

2-year Cycle: If the plant is replaced every two years, the firm will incur the initial cost of GH¢160,000 now; operational cost of GH¢30,000 and GH¢35,000 at the end of year one and year two respectively; maintenance cost of GH¢11,000 and GH¢13,000 at the end of year one and year two respectively; and receive the resale value of GH¢35,000 at the end of year two when the plant is replaced.

3-year Cycle: If the plant is replaced every three years, the firm will incur the initial cost of GH¢160,000 now; operational cost of GH¢30,000, GH¢35,000 and GH¢40,000 at the end of year one, year two and year three respectively; maintenance cost of GH¢11,000, GH¢13,000 and GH¢15,000 at the end of year one and year two respectively; and receive the resale value of GH¢28,000 at the end of year two when the plant is replaced.

Calculation of the Equivalent Annual Cost (EAC):

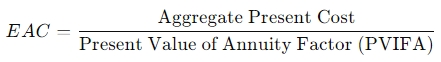

The equivalent annual cost (EAC) for each cycle can be calculated using the formula:

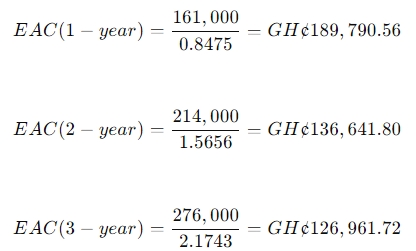

Using the cost of capital (18%):

- 1-year cycle PVIFA = 0.8475

- 2-year cycle PVIFA = 1.5656

- 3-year cycle PVIFA = 2.1743

Conclusion:

The optimal replacement cycle is the 3-year cycle because it results in the lowest equivalent annual cost of GH¢126,961.72.

(Marks allocation: 1 mark for cash flows of each of the three cycles = 3 marks; 1 mark for PVIFA for each of the three cycles = 3 marks; 0.5 marks for the equivalent annual cost for each of the three cycles = 1.5 marks; optimal replacement cycle = 1 mark = total: 10 marks)

- Topic: DCF: Specific applications

- Series: NOV 2020

- Uploader: Theophilus