- 20 Marks

Question

a) Adjei Departmental Stores’ demand for cash has been quite volatile recently, with the standard deviation in daily cash demand rising to GH¢60,000. The managers of the company are therefore considering using the Miller-Orr model to manage its cash flows. The minimum cash balance would be set to GH¢300,000. The annual interest rate is expected to be 18.25% while the cost of trading investments in securities is GH¢10,000 per transaction.

Required:

i) Compute the cash return point. (4 marks)

ii) Compute the upper cash limit. (2 marks)

iii) Explain how the minimum cash limit, upper cash limit, and cash return point would be used to manage the cash balances of Adjei Departmental Stores. (3 marks)

b) The Founder of a growing technology company has questioned her Chief Finance Officer about the company’s holdings of cash in demand deposit accounts and on hand when the money could be invested in financial securities for returns.

Required:

Explain to the Founder THREE (3) motives for holding cash. (6 marks)

c) Serwaa Home Décor Ltd, a trading company based in Ghana, usually buys foreign currency to settle invoices for imports. The Treasury Manager is considering ways of hedging the company’s foreign currency risk exposures. After considering various options available to her, she has settled on both forwards and futures contracts.

Required:

Explain TWO (2) advantages of currency forwards over currency futures contract. (5 marks)

Answer

a) Adjei Departmental Stores’ cash management plan:

i) Compute the cash return point:

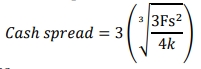

The cash return point is estimated as under:![]()

Where:

- Lower cash limit, L = GH¢300,000

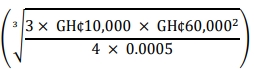

- Cash spread = GH¢1,133,928.96, computed as under:

Trading cost, F = GH¢10,000

Standard deviation in daily cash usage, s = GH¢60,000

Daily interest rate, k = 18.25% / 365 = 0.05%

𝐶𝑎𝑠ℎ 𝑠𝑝𝑟𝑒𝑎𝑑 = 3 = 3 × 377,976.32

= 3 × 377,976.32

= GH¢1,133,928.96

![]()

Suggested marks allocation:

Computation of the cash spread = 2 marks

Computation of the cash return point = 2 marks

ii) Computation of the upper cash limit. (2 marks)

The upper cash level is computed as under.

𝑈 = 𝐿 + 𝐶𝑎𝑠ℎ 𝑠𝑝𝑟𝑒𝑎𝑑

𝑈 = GHS300,000 + GH¢1,133,928.96 = GH¢1,433,928.96

iii) Explanation of how the minimum cash limit, upper cash limit, and cash return point would be used:

With the Miller-Orr cash management model, the cash balance is managed around three critical cash levels: the minimum cash limit, the cash return point, and the upper cash limit.

- Minimum Cash Limit (L): When the cash balance hits or drops below the minimum cash limit (i.e., GH¢300,000), the cash balance would be considered too low. The company would then sell off some of its investments in marketable securities to raise additional cash to restore the cash balance to the cash return point (GH¢677,976.32).

- Upper Cash Limit (U): When the cash balance hits or rises above the upper cash limit (i.e., GH¢1,433,928.96), the cash balance would be considered too high. The company would then invest the excess cash in marketable securities and thus bring the cash balance down to the cash return point.

- Cash Return Point (RP): The cash balance is allowed to float around the cash return point, and action is only taken when it hits the lower or upper cash limits.

(Suggested marks allocation: The essence of the cash return point = 1 mark, The essence of the lower limit and expected action when the cash balance hits it = 1 mark, The essence of the upper limit and expected action when the cash balance hits it = 1 mark = 3 marks)

b) Motives for holding cash:

The main motives for holding cash are as follows:

- Transaction Motive:

This is the need to hold cash to meet day-to-day expenses. Businesses need cash to pay for things like wages, utilities, and materials. The transaction motive ensures that a business can continue its operations smoothly. - Precautionary Motive:

This is the need to hold cash as a safety buffer to cover unexpected expenses or emergencies. Companies maintain precautionary balances to guard against the risk of unexpected events like a sudden drop in sales or an unplanned expense. - Speculative Motive:

The speculative motive for holding cash arises when a company wants to take advantage of unexpected opportunities. For example, a company might hold cash to quickly invest in an attractive business opportunity that may arise unexpectedly.

(Suggested marks allocation: Explanation of motives = 2 marks for each of three = 6 marks)

c) Advantages of currency forwards over currency futures contract:

The advantages of using currency forwards over currency futures include:

- Customization:

Forward contracts are customizable in terms of amount, maturity, and the underlying asset, which allows companies like Serwaa Home Décor Ltd to tailor the contract to their specific needs. Futures contracts, on the other hand, are standardized and may not meet the specific requirements of the company. - No Initial Margin Requirement:

Unlike futures contracts, forward contracts do not require an initial margin deposit. This means that the company can use its cash for other purposes rather than locking it up as margin. In contrast, futures require both an initial margin and maintenance margins, tying up capital that could be used elsewhere. - Hedging with a forward contract presents a guaranteed outcome as the forward

exchange rate is locked when the contract is initiated. Basis risk is inherent in

hedging with futures contracts. For futures contracts, there is the risk that the

futures price may move by a different amount from the price of the underlying

asset. - Under a forward arrangement, Serwaa Home Décor can arrange to trade the exact

quantity of the foreign currency to achieve a perfect hedge. With futures contracts,

however, the contract size cannot be tailored to the precise requirements of Serwaa

Home Décor. In some cases, the company may have to buy more or fewer futures

contracts than necessary, resulting in hedge inefficiency.

- Tags: Cash Flow Management, Currency Forwards and Futures, Miller-Orr Model

- Level: Level 2

- Uploader: Kwame Aikins