- 20 Marks

PSAF – Mar 2025 – L2 – Q2 – International public sector accounting standards

Explain the meaning of a qualifying asset per IPSAS for Ghana Highway Authority.

Question

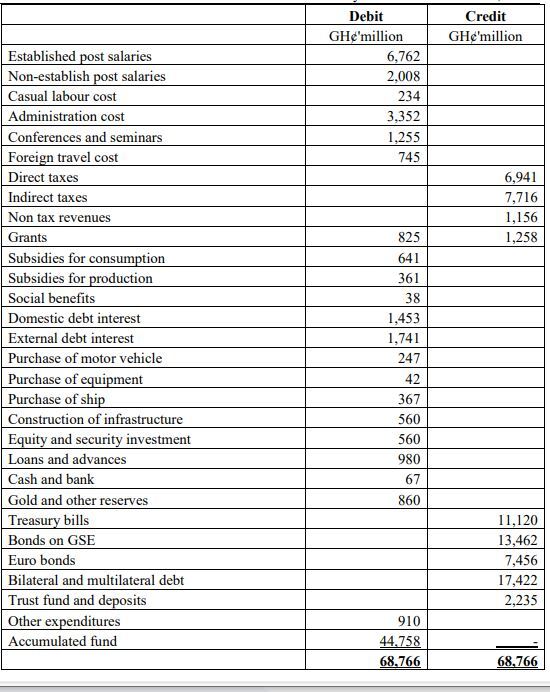

Ghana Highway Authority prepares its financial statements in accordance with International Public Sector Accounting Standards (IPSAS). The Government of Ghana has approved the sum of GH¢678,000 to the Ghana Highway Authority for the construction of a qualifying infrastructural asset.

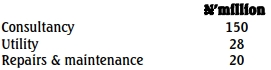

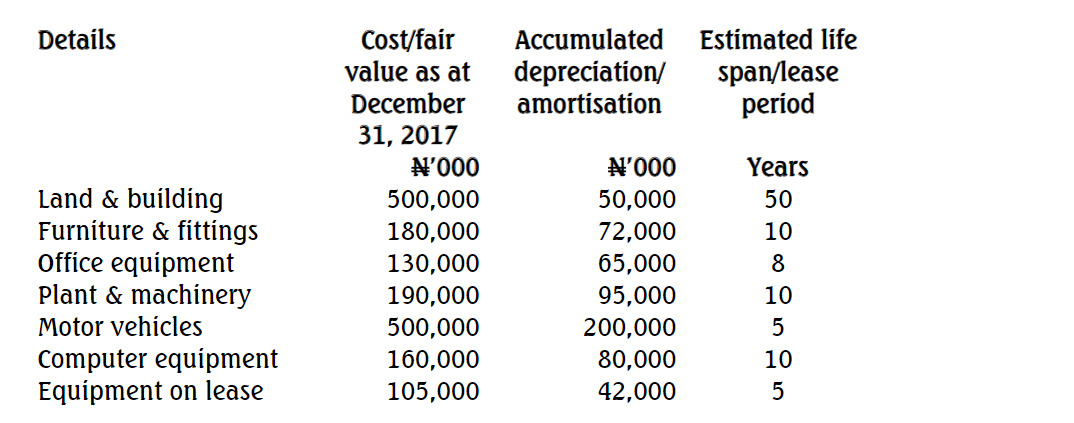

The following costs were incurred during the construction of the Asset:

i) The sector minister in the process recommended his brother as a consultant to conduct feasibility analysis on the construction of the asset. The consultant charged the Authority the sum of GH¢350,000.

ii) An installation of platforms to enable the project to be undertaken were designed and built at a cost of GH¢225,900.

iii) Some foreign elements of the service required that Letter of Credit was processed to enable execution of the project, and the legal fees charged was GH¢275,000.

iv) Importation of specific components from Germany to execute the project in question cost the Authority €58,890.

v) Haulage and Freight charges cost €5,725.

vi) Cleaning and engine oil for first testing of equipment at the project site amounted to GH¢19,430.

vii) The cost of warranty on the asset was €3,400 should the Authority take advantage of the warranty agreement.

viii) Delivery, handling and other overhead amounted to GH¢156,800 out of which 60% were attributable.

ix) The Ghana Highway Authority consequently incurred cost of GH¢398,560 in modification of an adjoining infrastructure to facilitate the project.

The Government of Ghana was not able to provide all the amount hence the Minister for Finance gave approval to the Chief Executive Officer (CEO) of the Authority to borrow the excess amount from open market which a financial institution provided at a commercial rate of 35% per annum. Government of Ghana (GoG) accounting policy adopts the allowed alternative approach of borrowing costs under IPSAS 5: Borrowing Costs.

A check from the professional website of the Institute of Architects and Engineers in Ghana indicates that the professional fee that can be charged under the service rendered by the consultant would cost only GH¢195,000.

To the extent that the funds borrowed was not GoG funds, and the fact that the funds would be required after 100 days to pay for the cost of the asset, which was provided earlier than envisaged, the CEO took advantage of the 14 weeks’ grace period for payment and invested the funds in a 91-day investment which yielded a return of 24.09% per annum at first maturity when the funds were held in anticipation of payment.

The prevailing exchange rate on the date of the contract was GH¢13.50 to €1.00, however on the day of payment the exchange rate shot up to GH¢15.57 to €1.00.

Required:

a) Explain what is meant by a qualifying asset.

b) Determine the cost of the qualifying asset for capitalization.

c) Based on the information provided, indicate FIVE notes to the accounts in the books of the Ghana Highway Authority.

d) Explain another method or approach by which the borrowing cost could be recognized under IPSAS 5: Borrowing Costs.

Find Related Questions by Tags, levels, etc.