IPSAS 33, gives a transition relief (exemption) of up to three years within which to develop models for transiting to IPSAS accrual. However, the government of Nigeria adopted accrual IPSAS on revenue from exchange transactions effective January 1, 2016.

Oranta State Government mandated the Accountant-General of the State to implement the IPSAS accrual in the preparation of their financial statements with effect from January 2018 which was complied with accordingly.

For the smooth implementation of IPSAS accrual, the State Executive Council approved the following:

(i) Asset valuation committee to be chaired by the Deputy Governor with the Commissioner of Finance, Commissioner of Budget and Planning, Chairman State Internal Revenue Service, Accountant-General of the State, and Head of Service as members while a Director in the Office of the Secretary to the State Government was appointed as the Secretary.

(ii) The Committee was mandated to value all the State assets and liabilities on or before the implementation of IPSAS accrual.

(iii) The Committee was allowed to engage the services of competent valuers for the job.

(iv) The valuation of the assets and liabilities should be on a continuous basis and any value agreed and approved by the State Executive Council should be brought into the books in the year of valuation.

(v) All assets and liabilities incurred after implementation of IPSAS accrual should be recognized in the year they occurred.

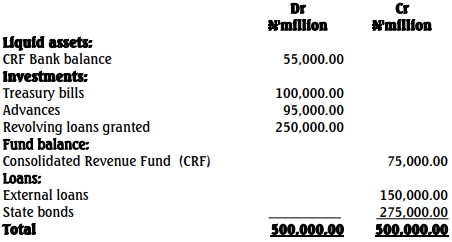

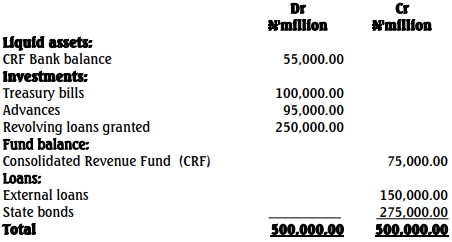

The consolidated trial balance for the year ended December 31, 2017, based on IPSAS cash is as follows:

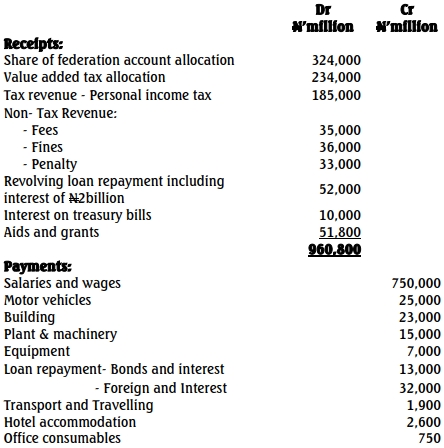

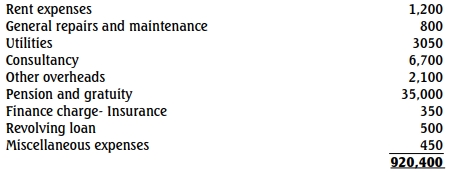

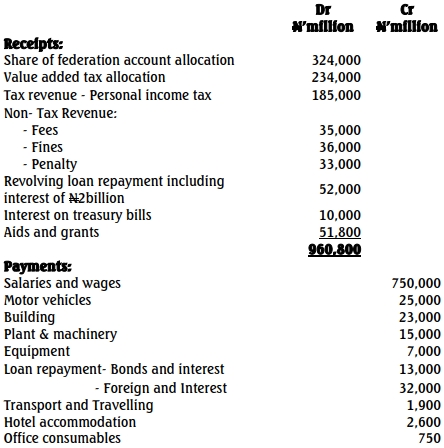

Extracted consolidated cashbook for the year 2018:

The following information is relevant:

(i) The employees‟ salaries and wages bill for the month of December 2018

amounting to N6.5billion was outstanding at the end of the year.

(ii) The following information was extracted from the unit in charge of

accounting for property, plant and equipment (PPE): 100 sets of HP

computers were received from Koko Computers Limited to assist the State

government to eradicate ghost workers from the payroll- the HP series

P1120, 2016 model. Based on this information, a call was made to three of

their computer suppliers to find out the current price of the HP P1120. Two of

the suppliers quoted N450,000 each, while one quoted N500,500 each.

Based on this information, the fair value of the computers, were taken as

N500,000 each.

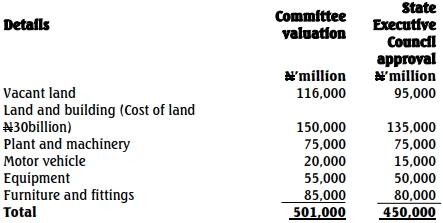

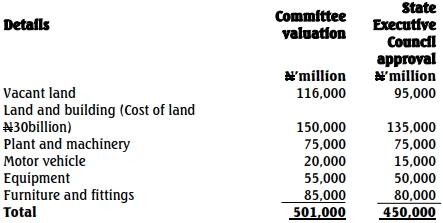

(iii) The government during the year received an asset valuation report from the

Asset Valuation Committee that was set up to carry out the valuation of the

old assets and liabilities of the State.

(iv) The following values were recommended and approved by the State

Executive Council respectively:

(v) Pension and gratuity of N15 billion was outstanding at the end of the year

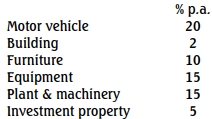

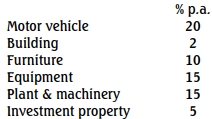

(vi) Some of the accounting policies adopted by the government for depreciation

include the following rates;

(vii) During the year, one of the contractors took the State to court for breach of

contract. The case was still in court as at the end of the year and from all

indications, judgment will eventually be in his favour. The legal adviser

estimated the judgment debt to be N50million.

(viii) Value of office consumables based on inventory sheet as at December 31,

2018 was N550million.

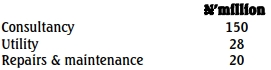

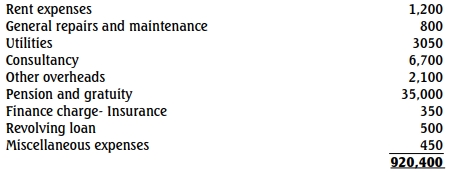

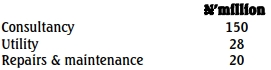

(ix) The following expenses were incurred but not settled as at end of the year.

(x) An extract from the foreign loan amortisation schedule indicates that a total

sum of N32billion comprising principal and interest of N2billion was due

and paid during the year. Also domestic loan of N13billion comprising

principal and interest of N1billion was paid during the year. The interest

payable on domestic and external loans at the end of the year amounted to

N3billion and N5 billion respectively.

(xi) The investment of 10% treasury bills for 360 days was due to mature on

January 1, 2018 and reinvested immediately for another term.

(xii) The revolving loan attracts interest of 4% per annum and it is paid along

with the principal.

Required:

a. In line with the provisions of IPSAS 33, explain how the following revenue

from exchange transactions should be recognised:

i. Aid and grants receivable as at December 31, 2015 (2 Marks)

ii. Debt forgiveness approved on or after January 1, 2016 (2 Marks)

iii. Personal income tax on or after January 1, 2016 (2 Marks)

b. Prepare in vertical form:

i. Statement of financial performance for the year December 31, 2018.

(17 Marks)

ii. Statement of financial position for the year December 31, 2018.

(17 Marks)

(Total 40 Marks)