- 10 Marks

CR – May 2020 – L3 – Q3a – Foreign Currency Transactions

Foreign currency transactions related to purchases, sales, and investment property with exchange rate variations and reporting implications.

Question

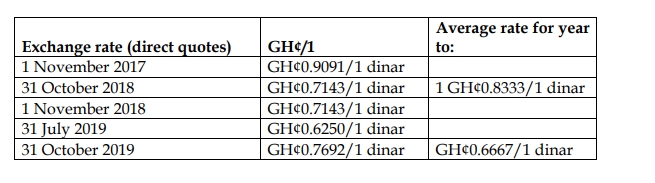

Medina Power Ltd has carried out certain transactions denominated in foreign currency during its financial year ended 31 October 2019 and has also conducted foreign operations through a foreign entity. Medina Power Ltd.’s functional and presentation currency is the cedi.

On 31 July 2019, Medina Power Ltd purchased goods from a foreign supplier for 16 million dinars. At 31 October 2019, the supplier had not yet been paid and the goods were still held in inventory by Medina Power Ltd.

On 31 July, Medina Power Ltd sold goods to a foreign customer for 8 million dinars, and it received payment for the goods in dinars on 31 October 2019.

Medina Power Ltd had also purchased an investment property on 1 November 2018 for 56 million dinars. At 31 October 2019, the investment property had a fair value of 48 million dinars. The company uses the fair value model in accounting for investment properties.

Medina Power Ltd wants advice on how to treat these transactions in the financial statements for the year ended 31 October 2019.

Required:

Discuss the accounting treatment of the above transactions in accordance with the advice required by the directors. (You should show detailed workings as well as a discussion of the accounting treatment used.)

Find Related Questions by Tags, levels, etc.