- 20 Marks

CSMCE – OCT 2022 – L2 – Q7 – Short Notes on Marketing Concepts

Short notes on reach, product life cycle, interpersonal skills, and distribution channels.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The management of a bank has decided to establish five new branches at vantage locations in the next quarter to attract new customers. You are the chairperson of a committee that is to conduct market research and identify the locations for establishing the new branches. Given the importance of the report, and the limited time available, the Committee has decided to adopt Information Technology in the conduct of the research.

a) Identify five (5) ways in which Information Technology could be applied in the conduct of the market research. [10 Marks]

b) Describe five (5) methods for collecting qualitative data and explain how IT could be used in any two of the data collection methods. [10 Marks]

[Total: 20 Marks]

Find Related Questions by Tags, levels, etc.

The COVID-19 global pandemic and associated lockdowns compelled many financial institutions to adopt virtual approaches to service delivery to their customers. With many researchers predicting the reoccurrence of such pandemics, executives of financial institutions have expressed a keen interest in the concept of a virtual organization (VO), how to run an effective virtual organization, and the ensuing challenges. Explain what a virtual organization is and discuss the managerial and technical issues in running a virtual organization.

[20 Marks

Find Related Questions by Tags, levels, etc.

The Accountant advised the CEO that to strengthen governance, the Board should concern itself with the establishment of strong internal control systems. Failures or weaknesses in internal controls will have adverse consequences for HPC’s finances, financial reporting, operational efficiency and effectiveness, or regulatory compliance.

Required:

Write a paper, explaining FIVE (5) factors to the Board the nature of internal controls that could be instituted by HPC to strengthen governance. (10 marks)

Find Related Questions by Tags, levels, etc.

In reference to Ghana’s Code of Best Practices in Corporate Governance, discuss FOUR (4) key issues that could determine how well or badly HPC is governed, taking into consideration the intention and business relationship of the Board Chairman. (10 marks)

Find Related Questions by Tags, levels, etc.

An assessment of accounting practices for asset impairments is important in the context of financial reporting quality, especially during periods of economic uncertainty. The exercise of management judgment in impairment accounting is crucial. There are several factors that can influence the quality of impairment accounting and disclosures, including changes in circumstances, market capitalization, and the allocation of goodwill to cash-generating units.

Required:

Discuss the significance of the THREE (3) factors above when conducting an impairment test under IAS 36: Impairment of Assets.

Find Related Questions by Tags, levels, etc.

Below are the statements of financial position for three companies as of 31 July 2021:

| Statements of Financial Position as at 31 July 2021 | Papa Plc GH¢’million | Mama Plc GH¢’million | Bebe Plc GH¢’million |

|---|---|---|---|

| Non-current assets: | |||

| Property, plant, and equipment | 3,888 | 1,680 | 1,224 |

| Investments | 3,560 | 2,600 | 200 |

| Total non-current assets | 7,448 | 4,280 | 1,424 |

| Current assets: | |||

| Inventories | 1,080 | 368 | 300 |

| Trade receivables | 1,376 | 416 | 100 |

| Cash & bank | 368 | 104 | 64 |

| Total current assets | 2,824 | 888 | 464 |

| Total assets | 10,272 | 5,168 | 1,888 |

| Equity: | |||

| Share capital of GH¢1 each | 4,000 | 1,200 | 640 |

| Revaluation surplus | 2,400 | 960 | 400 |

| Retained earnings | 1,432 | 800 | 760 |

| Total equity | 7,832 | 2,960 | 1,800 |

| Current liabilities: | |||

| Trade payables | 1,144 | 1,080 | 56 |

| Taxation | 1,296 | 1,128 | 32 |

| Total current liabilities | 2,440 | 2,208 | 88 |

| Total equity and liabilities | 10,272 | 5,168 | 1,888 |

Additional information:

Required: Prepare the Consolidated Statement of Financial Position for Papa Group as of 31 July 2021, in accordance with IFRS.

Find Related Questions by Tags, levels, etc.

Jones Addoteye is a Ghanaian Citizen by birth but has also acquired a British Citizenship. He has lived in Britain for several years and relocated to Ghana in January 2015. He decided to invest his life-long savings in Ghana by incorporating a company limited by shares with his wife, Maame Abrefa who also happens to be a Ghanaian/British. Jones and his wife are the only shareholders of the company called Addofa Ltd which was registered with the Registrar Generals Department in January 2016.

Jones and his wife Maame Abrefa continue to maintain links with Britain even though they have relocated to Ghana. This is because they still have some economic interest in Britain. In view of this, they decided to share their working time in both Ghana and Britain following an advice from a Junior Tax Consultant of one of the Ghanaian Tax Firms. The junior tax consultant informed them they will be tax efficient if they share their working time.

Part of their object for setting up Addofa Ltd was to produce poultry for sale to the Ghanaian market in the first few years and later export the poultry products to other countries. It is also part of Addofa Ltd’s growth strategies that after five (5) years, it will process and package the poultry in an edible manner for export to other African markets. This poultry processing business will be carried out in a new company which they intend to set up. Both companies will be located at Cape Coast, the Central Regional Capital. Business for Addofa Ltd is expected to grow significantly in 2021.

Addofa Ltd also invested 37% equity in another Ghanaian company from which they received dividend of GH¢50,000 in 2018.

Mr. Jones Addoteye intimated to you that even though he had some initial advice, he was still not sure if his wife and himself were making optimal tax decisions for themselves and for the company. He has therefore approached you as an experienced Tax Consultant for advice. They wish to take advantage of the beneficial provisions of the Income Tax Laws to arrange their personal and company affairs to be tax efficient.

Required:

a) Evaluate the tax implications on Jones Addotey and Maame Abrefa sharing their working time between Ghana and Britain. (8 marks)

b) Explain the tax implications available to Addofa Ltd if it goes into export or sell in the local market. (4 marks)

c) Explain the tax planning opportunities available to the new company to be set up. (4 marks)

d) Discuss the tax compliance obligations for Addofa Ltd at the time of commencement of operations in Ghana. (4 marks)

Find Related Questions by Tags, levels, etc.

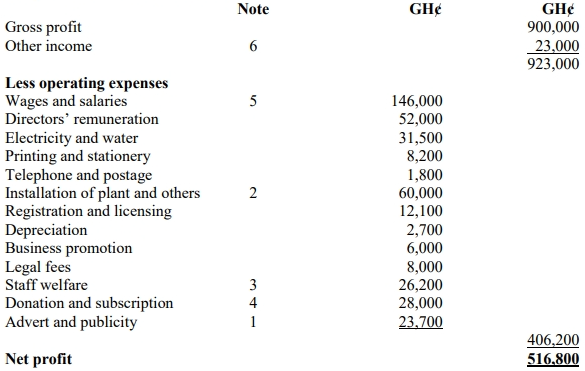

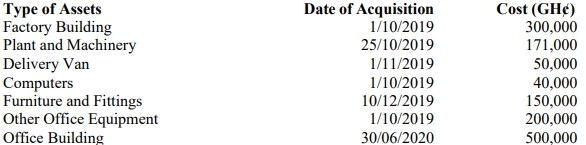

a) Joefel Company Ltd, manufacturer of fruit juice for local consumption commenced business on 1 October 2019, with accounting year-end at 31 December each year. The company submitted its accounts for 2019 and was assessed accordingly. The company submitted its tax returns for 2020 year of assessment to the Ghana Revenue Authority on 30 April 2021. Below are the details:

Additional information:

1) Advert and publicity

Radio and television 3,300

Newspaper advert 2,400

Permanent signboard at the company’s entrance in 2020 18,000

2) Installation of plant and others

Installation of plant 21,500

Heavy duty Generator bought in 2019 to support Plant and Machinery 20,500

General maintenance before the use of the plant 18,000

3) Staff Welfare

Staff medical bills 3,700

Safety wear for staff 10,500

Canteen Equipment purchased on 30 November 2020 12,000

4) Donation and Subscription

Goods given as gratis to customs officials 13,000

Donation of goods to SOS Children Village 10,000

Subscription to Association of Ghana Industries 5,000

5) Wages and Salaries

Old staff 120,000

Fresh graduates employed by Joefel Company Ltd. (Fresh graduates

constitute 1% of total workforce) 26,000

6) Other Income

Compensation from a customer for cancellation of a sale order 8,000

Compensation for loss of trading stock of the company 10,000

Compensation for cancellation of purchase order by supplier 5,000

Note 2) above has not been included in the plant and machinery acquired.

Required:

a

i) Compute the appropriate capital allowance for 2019 and 2020 years of assessment.

(8 marks)

ii) Calculate the chargeable income of the company for the 2020 year of assessment.

(6 marks)

b) Explain of the following sources of revenue accruing to the Government of Ghana from the upstream petroleum operations in Ghana:

i) Royalty.

ii) Carried Interest.

iii) Additional Interest.

iv) Additional Oil Entitlement.

(6 marks)

Find Related Questions by Tags, levels, etc.

Tax incentives have traditionally been used by governments as tools to promote a particular economic goal. They are preferential tax treatments offered to a selected group of taxpayers and may take the form of tax exemptions, tax holidays, preferential tax rates, and others.

Required:

Explain the tax implications of the following:

i) A person engaged in Farming activity

ii) A person engaged in Agro-Processing activity

iii) The rental income of a person engaged in Cocoa Farming activity

Find Related Questions by Tags, levels, etc.

Free Zone means area or building declared as a free zone by publication in commercial and industrial bulletins. It includes Single Factory Zones, Free Ports, Free Airports, and other specified areas. Free Zone operations are export-led and aimed at promoting foreign earnings for Ghana.

Required:

What mitigation measures will a Free Zone Enterprise adopt to reduce its tax liabilities and raise enough benefits to the shareholders?

Find Related Questions by Tags, levels, etc.

In response to some taxpayers’ behaviour, transfer pricing regulation has been passed to ensure that all arrangements are conducted at arm’s length. The Commissioner-General in his dealings with taxpayers must ensure that market price drives business transactions. The Commissioner-General reserves the right to allege abuse of transfer pricing if certain factors point to the fact that there is an arrangement not in accord with the dictate of market forces.

Required:

Explain FOUR (4) factors the Commissioner-General will rely on in his comparability analysis in Transfer Pricing arrangements.

Find Related Questions by Tags, levels, etc.

Lawaaba Guo is a Ghanaian born in Nigeria and has lived all his life there. He got an opportunity to relocate to Ghana and took up an appointment as a lecturer in one of the prestigious universities within the first three months of his arrival in Ghana in 2018.

He took up employment with ABB Ltd as a procurement officer. The following relates to his employment details for 2020 year of assessment:

His investment income and other returns received from Nigeria are as follows:

Additional information:

Required:

Determine the following:

i) Chargeable Income

ii) Tax Payable

iii) Amount of foreign credit relief granted

Find Related Questions by Tags, levels, etc.

“Bending the law without breaking it is said to be the way to go by businesses”. This concept of tax administration has caught up with so many businesses that they now engage experts to help shape their business transactions to create this impact for them.

Required:

How is tax avoidance different from aggressive tax avoidance?

Find Related Questions by Tags, levels, etc.

All persons can carry over their losses, so far as it can be proven that it is a loss by the person making the claim. This was mooted at a seminar organised for a business community in some parts of Accra, the capital city of Ghana.

Required:

Explain the mechanism of carryover of losses.

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan