- 20 Marks

CSMCE – OCT 2022 – L2 – Q7 – Short Notes on Marketing Concepts

Short notes on reach, product life cycle, interpersonal skills, and distribution channels.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The management of a bank has decided to establish five new branches at vantage locations in the next quarter to attract new customers. You are the chairperson of a committee that is to conduct market research and identify the locations for establishing the new branches. Given the importance of the report, and the limited time available, the Committee has decided to adopt Information Technology in the conduct of the research.

a) Identify five (5) ways in which Information Technology could be applied in the conduct of the market research. [10 Marks]

b) Describe five (5) methods for collecting qualitative data and explain how IT could be used in any two of the data collection methods. [10 Marks]

[Total: 20 Marks]

Find Related Questions by Tags, levels, etc.

The COVID-19 global pandemic and associated lockdowns compelled many financial institutions to adopt virtual approaches to service delivery to their customers. With many researchers predicting the reoccurrence of such pandemics, executives of financial institutions have expressed a keen interest in the concept of a virtual organization (VO), how to run an effective virtual organization, and the ensuing challenges. Explain what a virtual organization is and discuss the managerial and technical issues in running a virtual organization.

[20 Marks

Find Related Questions by Tags, levels, etc.

The Accountant advised the CEO that to strengthen governance, the Board should concern itself with the establishment of strong internal control systems. Failures or weaknesses in internal controls will have adverse consequences for HPC’s finances, financial reporting, operational efficiency and effectiveness, or regulatory compliance.

Required:

Write a paper, explaining FIVE (5) factors to the Board the nature of internal controls that could be instituted by HPC to strengthen governance. (10 marks)

Find Related Questions by Tags, levels, etc.

In reference to Ghana’s Code of Best Practices in Corporate Governance, discuss FOUR (4) key issues that could determine how well or badly HPC is governed, taking into consideration the intention and business relationship of the Board Chairman. (10 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

ISA 520: “Analytical Procedures” provides guidance to auditors on the use of analytical procedures during the course of an external audit.

Required:

Explain FIVE (5) factors to consider when determining the extent of reliance that can be placed on the results of such procedures. (5 marks)

Find Related Questions by Tags, levels, etc.

Audit is the examination or inspection of various books of accounts by an auditor to certify that the accounts have been prepared according to the principles of accounting and to determine whether the Financial Statements prepared reflect a true and fair view of the state of affairs of a business.

Required:

i) State the Primary objective of an audit.

ii) State the Secondary objectives of an audit. (5 marks)

Find Related Questions by Tags, levels, etc.

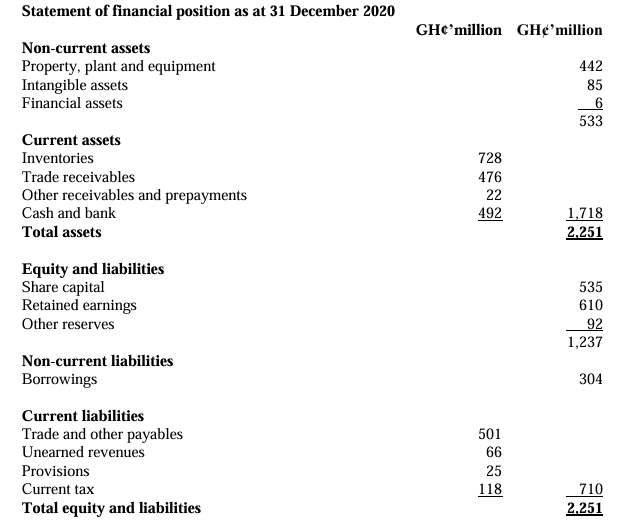

Azure Plc is a company that trades its ordinary shares on the Ghana Stock Exchange. Below are the statements of profit or loss for the year ended 31 December 2020 and for the first three quarters in 2020 published in line with the Ghana Stock Exchange regulations:

Statements of profit or loss of Azure Plc:

| Description | Year Ended 31 Dec 2020 (Audited) | Quarter 3 (Unaudited) | Quarter 2 (U

naudited) |

Quarter 1 (Unaudited) |

|---|---|---|---|---|

| Revenue | GH¢ 2,829 million | GH¢ 544 million | GH¢ 810 million | GH¢ 624 million |

| Cost of sales | (GH¢ 1,754 million) | (GH¢ 346 million) | (GH¢ 489 million) | (GH¢ 412 million) |

| Gross profit | GH¢ 1,075 million | GH¢ 198 million | GH¢ 321 million | GH¢ 212 million |

| Other operating income | GH¢ 72 million | GH¢ 32 million | GH¢ 21 million | GH¢ 23 million |

| Administrative expenses | (GH¢ 572 million) | (GH¢ 94 million) | (GH¢ 183 million) | (GH¢ 146 million) |

| Distribution costs | (GH¢ 265 million) | (GH¢ 73 million) | (GH¢ 62 million) | (GH¢ 65 million) |

| Finance costs | (GH¢ 15 million) | (GH¢ 11 million) | (GH¢ 2 million) | (GH¢ 2 million) |

| Profit before tax | GH¢ 295 million | GH¢ 52 million | GH¢ 95 million | GH¢ 22 million |

| Tax | (GH¢ 101 million) | (GH¢ 17 million) | (GH¢ 31 million) | (GH¢ 11 million) |

| Profit for the year | GH¢ 194 million | GH¢ 35 million | GH¢ 64 million | GH¢ 11 million |

Additional information:

The following ratios have been calculated for the relevant sector for the year ended 31 December 2020:

Required:

Write a report to the Board of Directors of Azure Plc, analyzing the financial performance and financial position of the company using the above information to assist the Board in determining whether strategic adjustments are required and where, if any.

(20 marks)

Find Related Questions by Tags, levels, etc.

b) All business combinations are accounted for by the acquisition method, which involves identifying the acquirer. However, it might not be easy to identify the acquirer.

Required:

Explain TWO (2) reasons why it might be difficult to identify the acquirer.

(4 marks)

Find Related Questions by Tags, levels, etc.

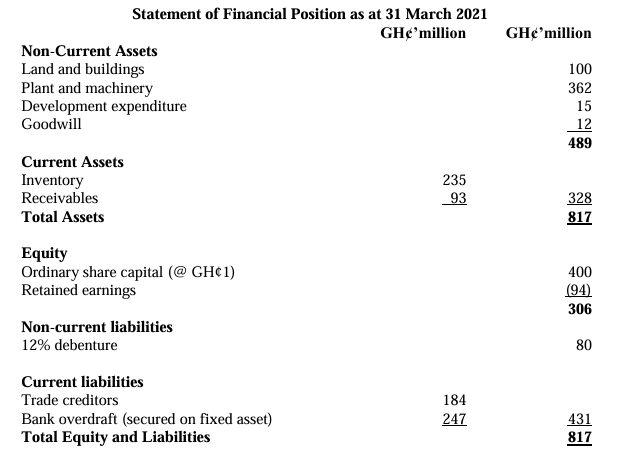

a) Ega Ltd is a Private Limited Liability company operating in the agro-processing industry, currently facing trading difficulties. The most recent statement of financial position as at 31 March 2021 is as follows:

Additional information: The following financial reorganization scheme has been drawn up:

Required:

i) Calculate the amount to be written off the existing share capital. (4 marks)

ii) Prepare a revised Statement of Financial Position of Ega Ltd as at 1 April 2021, incorporating the proposed scheme for reorganization. (6 marks)

iii) Provide an assessment of the proposal for the future prospects of the company. (6 marks)

Find Related Questions by Tags, levels, etc.

b) You are a newly qualified accountant in your fifth year of employment in a limited liability company. Your immediate supervisor has been on sick leave, and you are due for study leave. You have been told by the Finance Director that, before you go on leave, you must finish a task that should have been completed by your immediate supervisor. The deadline suggested to complete the task appears unrealistic, given the complexity of the task.

You feel that you are not sufficiently experienced to complete the task alone and would need additional supervision to complete it to the required standard. The Finance Director appears unable to offer the necessary support in this regard. Should you try to complete the work within the proposed timeframe but fail to meet the expected quality, you could face repercussions on your return from study leave. You feel slightly intimidated by the Finance Director and also feel pressure to do what you can for the company in these challenging times.

Required:

i) Using the IFAC Code of Ethics as a guide, explain the ethical principles that apply in the above scenario. (5 marks)

ii) Recommend the possible actions that you should take as a member of the Institute of Chartered Accountants, Ghana (ICAG), in dealing with this ethical dilemma. (5 marks)

Find Related Questions by Tags, levels, etc.

a) Zeus Ltd manufactures equipment for lease or sale. The following transactions relate to Zeus Ltd for the year ended 31 December 2020:

i) On 31 December 2020, Zeus Ltd leased out equipment under a 10-year finance lease. The selling price of the leased item was GH¢50 million, and the net present value of the minimum lease payments was GH¢47 million. The carrying value of the leased asset was GH¢40 million, and the present value of the residual value of the product when it reverts to Zeus Ltd at the end of the lease term is GH¢2.8 million. Zeus Ltd has shown sales of GH¢50 million and cost of sales of GH¢40 million in its financial statements.

(5 marks)

ii) On 1 January 2020, Zeus Ltd raised finance by issuing a two-year deeply discounted 2% bond with a nominal value of GH¢20,000 that was issued at a discount of 5% and is redeemable at a premium of GH¢2,150. There were no issue costs. The bond has an effective interest rate of 10%.

(5 marks)

Required:

Recommend to the directors of Zeus Ltd how the above transactions should be accounted for in the financial statements for the year ended 31 December 2020 in accordance with relevant International Financial Reporting Standards.

Find Related Questions by Tags, levels, etc.

On 1 January 2020, Kalimba Ltd had 2 million ordinary shares in issue. On 30 April 2020, the company issued 270,000 ordinary shares at full market price. On 31 July 2020, the company made a rights issue of 1 for 10 at GH¢2. The fair value of the shares on the last day before the rights issue was GH¢3.10. On 30 September 2020, the company made a 1 for 20 bonus issue. Profit for the period was GH¢400,000. The reported earnings per share for the year ended 31 December 2019 was GH¢0.186.

Required:

Calculate the earnings per share (EPS) for the year ended 31 December 2020, and the restated EPS for the year ended 31 December 2019, in accordance with relevant International Financial Reporting Standards (IFRS).

Find Related Questions by Tags, levels, etc.

Kaase Ltd, a public limited company, operates in the technology sector in Ghana. The company has decided to restructure one of its business segments, affecting employees in two locations. In the first location (A), half of the factory units were closed by 31 March 2021, and the affected employees’ pension benefits were frozen. After restructuring, the present value of the defined benefit obligation in this location was GH¢8 million. Before restructuring, the value was GH¢10 million, and the fair value of plan assets was GH¢7 million, resulting in a net pension liability of GH¢3 million.

In the second location (B), all activities were discontinued, and employees will receive GH¢4 million in exchange for a pension liability of GH¢2.4 million. Kaase Ltd estimates that restructuring costs excluding pension costs will be GH¢6 million. No formal announcement has been made due to a planned rights issue. The pension liability is currently included in non-current liabilities.

Required:

Recommend the accounting treatment of the above transaction in the financial statement of Kaase Ltd, including financial statement extracts for the year ended 31 March 2021, in accordance with relevant International Financial Reporting Standards (IFRS).

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan