- 20 Marks

CSMCE – OCT 2022 – L2 – Q7 – Short Notes on Marketing Concepts

Short notes on reach, product life cycle, interpersonal skills, and distribution channels.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The management of a bank has decided to establish five new branches at vantage locations in the next quarter to attract new customers. You are the chairperson of a committee that is to conduct market research and identify the locations for establishing the new branches. Given the importance of the report, and the limited time available, the Committee has decided to adopt Information Technology in the conduct of the research.

a) Identify five (5) ways in which Information Technology could be applied in the conduct of the market research. [10 Marks]

b) Describe five (5) methods for collecting qualitative data and explain how IT could be used in any two of the data collection methods. [10 Marks]

[Total: 20 Marks]

Find Related Questions by Tags, levels, etc.

The COVID-19 global pandemic and associated lockdowns compelled many financial institutions to adopt virtual approaches to service delivery to their customers. With many researchers predicting the reoccurrence of such pandemics, executives of financial institutions have expressed a keen interest in the concept of a virtual organization (VO), how to run an effective virtual organization, and the ensuing challenges. Explain what a virtual organization is and discuss the managerial and technical issues in running a virtual organization.

[20 Marks

Find Related Questions by Tags, levels, etc.

The Accountant advised the CEO that to strengthen governance, the Board should concern itself with the establishment of strong internal control systems. Failures or weaknesses in internal controls will have adverse consequences for HPC’s finances, financial reporting, operational efficiency and effectiveness, or regulatory compliance.

Required:

Write a paper, explaining FIVE (5) factors to the Board the nature of internal controls that could be instituted by HPC to strengthen governance. (10 marks)

Find Related Questions by Tags, levels, etc.

In reference to Ghana’s Code of Best Practices in Corporate Governance, discuss FOUR (4) key issues that could determine how well or badly HPC is governed, taking into consideration the intention and business relationship of the Board Chairman. (10 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

b) Maame Agyeiwaa is a junior staff member of KayDee Ltd. Her monthly basic salary is GH¢800. She was paid an overtime allowance totalling GH¢100 during the month of January 2021. In February 2021, Maame Agyeiwaa was paid overtime allowance totalling GH¢500.

Required:

i) Compute her tax liability on the overtime allowance for the month of January 2021.

(2 marks)

ii) Compute her tax liability on the overtime allowance payments for the month of February 2021.

(3 marks)

Find Related Questions by Tags, levels, etc.

c) Bawa is a junior staff member of Blinks Ltd. Her monthly basic salary is GH¢2,000. She was paid an overtime allowance totalling GH¢500 during the month of February 2021.

Required:

What is the tax implication of the overtime allowance paid?

(3 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

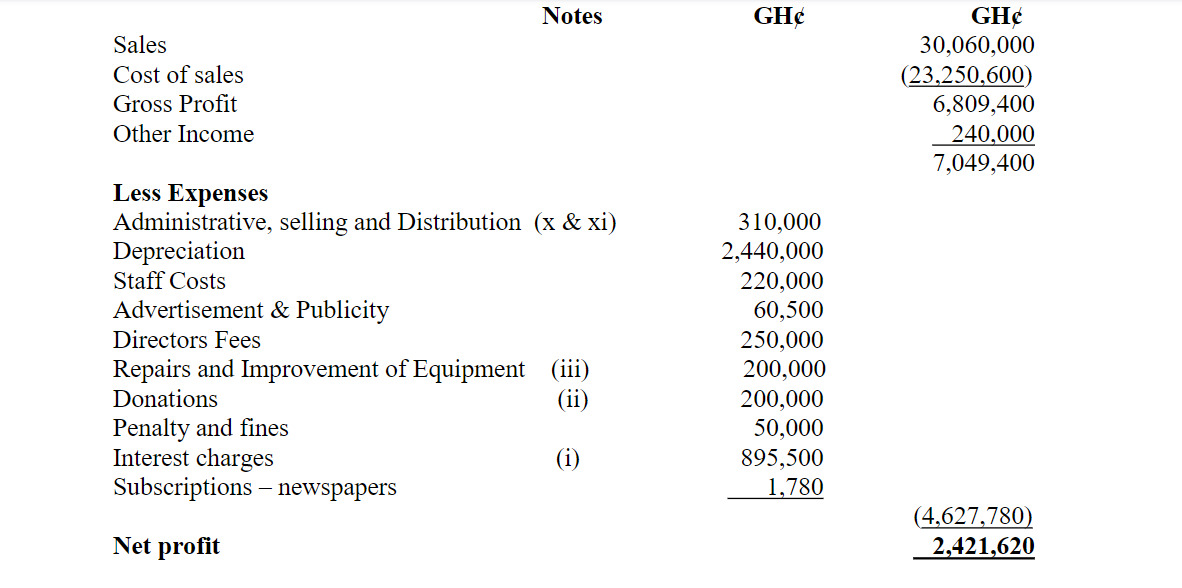

The following extract relates to the financial data of Therry Ltd, a company resident in Ghana with a basis period from January to December each year. Therry Ltd has submitted its tax returns to GRA for the 2020 year of assessment:

The following additional information is available:

Interest Charges:

a. Interest on loan for MD’s personal housing project GH¢500,000

b. Foreign exchange loss on loan GH¢320,500

c. Bank charges GH¢75,000

Donations:

a. Osu Children Home GH¢10,000

b. Pastor (Azigi Church) GH¢30,000

c. Labone Senior High School GH¢20,000

d. National Disaster Management Organisation GH¢50,000

e. Political Parties Fundraising GH¢90,000

An amount of GH¢200,000 disclosed in the accounts was paid for repairs and improvements of an old machine bought three years ago. It is hoped that the performance of the machine will be enhanced after the improvements.

Creditors of the company agreed to cancel an amount of GH¢120,000 standing as part of the credit balance as incentive to the company. This has not been taken into account by the company in its tax returns to GRA.

An amount of GH¢300,000 being cost price of goods was issued to a related party outside Ghana at cost. The margin on the goods waived was sighted as GH¢40,000 in a correspondence with the related party.

Tax paid on account was GH¢20,000.

The company booked capital allowance unutilised certified by GRA from 2019 year of assessment as GH¢300,000.

Capital allowance agreed with GRA after taking into account all relevant issues was GH¢1,050,000 for 2020 year of assessment.

The machine (Pool 3 asset) had a written down value of GH¢4,000,000 as at 1 January 2020.

An allowable bad debt included in the selling and distribution expenses for 2019 amounted to GH¢100,000. The company recovered the amount in 2020 but no transaction was recorded in 2020.

Therry Ltd disposed off one of its capital assets for GH¢250,000 to the Managing Director. It cost the company GH¢300,000 to acquire the asset some years ago. An investigation revealed that the market value of the asset at the time of the sale was GH¢350,000. The company has already included the loss of the sale of the asset in administration expenses.

Required:

Determine the tax payable for the 2020 year of assessment. (20 marks)

Find Related Questions by Tags, levels, etc.

Although the scope of withholding tax covers employment, business, and investment income, not every income is subject to withholding tax in accordance with the Income Tax Act, 2015 (Act 896) as amended.

Required:

Explain FOUR (4) of these withholding tax exemptions.

(10 marks)

Find Related Questions by Tags, levels, etc.

A gain made by a person from the realisation of an asset is the total amount of consideration received for the sale of the asset less the cost of the asset at the time of realisation.

Required:

When is an asset realised? (5 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

c) You have been offered an appointment by Bumu Manufacturing Company (BMC) as Tax Manager responsible for preparing and filing tax returns on behalf of the company. BMC files its returns with the Osu Medium Taxpayers Office of the Ghana Revenue Authority. The company’s Tax Identification Number is C0000261178. The company prepares accounts to 31 December each year.

BMC estimated its chargeable income for the 2019 year of assessment as GH¢3,000,000. Subsequently, the company secured a Government contract and anticipates in the third (3rd) quarter that its chargeable income would be GH¢4,500,000.

Additional Information:

Tax paid on account:

1st quarter GH¢100,000

2nd quarter GH¢120,000

3rd quarter GH¢200,000

Required:

Compute the taxes payable for BMC for each quarter.

(10 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan