- 20 Marks

CSMCE – OCT 2022 – L2 – Q7 – Short Notes on Marketing Concepts

Short notes on reach, product life cycle, interpersonal skills, and distribution channels.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The management of a bank has decided to establish five new branches at vantage locations in the next quarter to attract new customers. You are the chairperson of a committee that is to conduct market research and identify the locations for establishing the new branches. Given the importance of the report, and the limited time available, the Committee has decided to adopt Information Technology in the conduct of the research.

a) Identify five (5) ways in which Information Technology could be applied in the conduct of the market research. [10 Marks]

b) Describe five (5) methods for collecting qualitative data and explain how IT could be used in any two of the data collection methods. [10 Marks]

[Total: 20 Marks]

Find Related Questions by Tags, levels, etc.

The COVID-19 global pandemic and associated lockdowns compelled many financial institutions to adopt virtual approaches to service delivery to their customers. With many researchers predicting the reoccurrence of such pandemics, executives of financial institutions have expressed a keen interest in the concept of a virtual organization (VO), how to run an effective virtual organization, and the ensuing challenges. Explain what a virtual organization is and discuss the managerial and technical issues in running a virtual organization.

[20 Marks

Find Related Questions by Tags, levels, etc.

The Accountant advised the CEO that to strengthen governance, the Board should concern itself with the establishment of strong internal control systems. Failures or weaknesses in internal controls will have adverse consequences for HPC’s finances, financial reporting, operational efficiency and effectiveness, or regulatory compliance.

Required:

Write a paper, explaining FIVE (5) factors to the Board the nature of internal controls that could be instituted by HPC to strengthen governance. (10 marks)

Find Related Questions by Tags, levels, etc.

In reference to Ghana’s Code of Best Practices in Corporate Governance, discuss FOUR (4) key issues that could determine how well or badly HPC is governed, taking into consideration the intention and business relationship of the Board Chairman. (10 marks)

Find Related Questions by Tags, levels, etc.

a) For the two strategic development options being considered by HPC, compute:

i) the Net Present Value of Option 1.

ii) the Net Present Value of Option 2.

iii) the Net Present Value for the worst-case outcome for Option 1. (10 marks)

b) Discuss THREE (3) potential benefits and TWO (2) difficulties for HPC of undertaking each of the strategic development options. Your answer should include an evaluation of the calculations of the profitability index of each option. (10 marks)

Find Related Questions by Tags, levels, etc.

In their Annual Business Review meeting, the Board of HPC discussed a report on Internal Controls and Risk Management, presented by the Internal Auditor. The Board Chairman in his comments mentioned that he would have been more comfortable with a Risk Management report categorized according to the Turnbull Report.

Required:

With reference to the Turnbull Report and the comments made by the Board Chairman, write a report discussing EIGHT (8) categories of business risks faced by HPC and recommendations to mitigate the identified risks. (20 marks)

Find Related Questions by Tags, levels, etc.

The Chief Executive Officer is concerned that with the expansion of the operations of HPC to other countries, she would further have to divulge authority and power to other Managers because of how the company would grow in size and complexity.

Required:

Explain to the CEO why HPC’s decentralized system of internal organizational relationship is preferable to a centralized system. (10 marks)

Find Related Questions by Tags, levels, etc.

Consistent with its strategic ambition to expand its business into other countries, HPC is considering expanding to Nigeria and Togo.

Required:

Using Porter’s six principles of strategic positioning, analyse how HPC can achieve sustainable competitive advantage if it decides to expand the business to Nigeria and Togo. (10 marks)

Find Related Questions by Tags, levels, etc.

favourable or unfavourable to its present survival and future success. The influences (current influences and possible future influences) of the business environment of HPC need to be analysed to ensure that none are over-looked.

Required:

a) Using PESTEL analysis, discuss HPC’s external business environment that appears to be either favourable or unfavourable to its present survival and future success. (8 marks)

b) Discuss TWO (2) limitations of PESTEL as a technique in analysing the environmental influences of HPC. (2 marks)

Find Related Questions by Tags, levels, etc.

As part of a review of the strategic position of HPC and its move to expand the business, management identified its major stakeholder groups, their power, and their expectations that could either fast-track or delay the implementation of the decision. These major stakeholder groups are the employees, farmers, regulatory authorities, and customers.

Required:

Using two matrices of approach to stakeholder mapping, discuss and show (with diagrams) the relative significance of stakeholder groups identified and their real and potential influences over HPC and its expansion strategies. (Use the stakeholder position/importance matrix and the stakeholder power/interest matrix – Mendelow matrix.) (10 marks)

Find Related Questions by Tags, levels, etc.

c) On 1 June 2020, Karikari Ltd received a Government of Ghana grant of GH¢8 million towards the purchase of a new plant with a gross cost of GH¢64 million. The plant has an estimated life of 10 years and is depreciated on a straight-line basis. One of the terms of the grant is that the sale of the plant before 31 May 2024 would trigger a repayment on a sliding scale as follows:

The directors propose to credit the statement of profit or loss with GH¢2 million (GH¢8 million @ 25%) being the amount of the grant they believe has been earned in the year ended 31 May 2021. Karikari Ltd accounts for government grants as a separate item of deferred credit in its statement of financial position. Karikari Ltd has no intention of selling the plant before the end of its useful economic life.

Required:

Explain with computations, the appropriate accounting treatment of the above transaction in accordance with IAS 20 Government Grants and Disclosure of Government Assistance in the financial statements of Karikari Ltd for the year ended 31 May 2021. (3 marks)

Find Related Questions by Tags, levels, etc.

b) Kundugu Ltd (Kundugu) is a manufacturing company located in the Savannah Region. The reporting date of Kundugu is 31 December, and the company reports under International Financial Reporting Standards (IFRSs). Kundugu intends to expand its production to take advantage of emerging economic activities in the new region.

On 1 January 2020, the company entered into a lease agreement for production equipment with a useful economic life of 8 years. The lease term is for four years, and Kundugu agrees to pay annual rent of GH¢50,000 commencing on 1 January 2020 and annually thereafter. The interest rate implicit in the lease is 7.5%, and the lessee’s incremental borrowing rate is 10%. The present value of lease payments not yet paid on 1 January 2020 is GH¢130,026. Kundugu paid legal fees of GH¢1,000 to set up the lease.

Required:

Prepare extracts for the Statement of Financial Position and Statement of Profit or Loss for 2020 and 2021, showing how Kundugu should account for this transaction. (6 marks)

Find Related Questions by Tags, levels, etc.

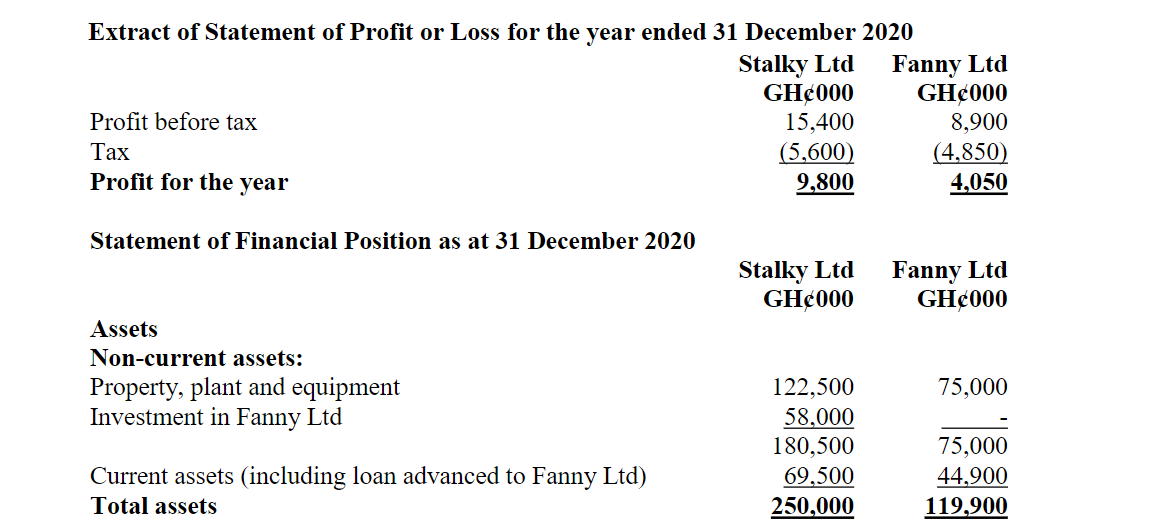

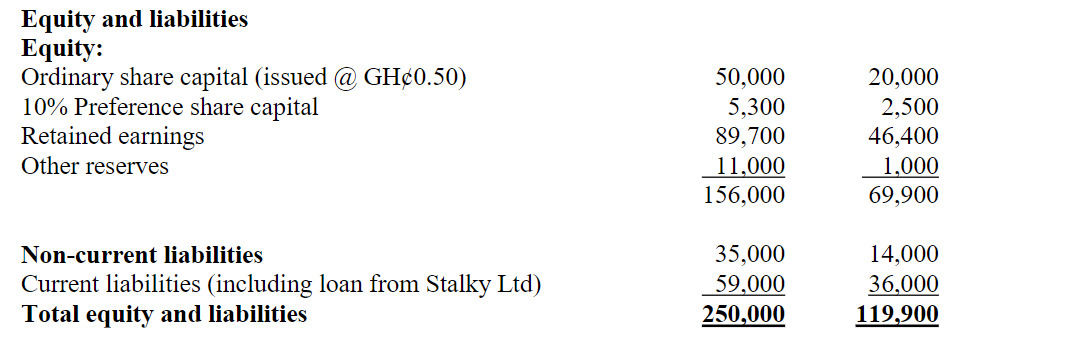

The following financial statements relate to Stalky Ltd and Fanny Ltd:

Additional information:

1. Stalky Ltd acquired 30 million ordinary shares of Fanny Ltd on 1 January 2019 when the book value of Fanny Ltd’s share capital (including preference share capital) plus reserves stood at GH¢58 million. The recorded investment includes GH¢1.5 million due diligence costs incurred by Stalky Ltd to facilitate its acquisition of Fanny Ltd. Stalky Ltd has no interest in Fanny Ltd’s issued preference shares.

2. Fair value exercise conducted at the time of Fanny Ltd’s acquisition revealed the following:

3. During the year, Stalky Ltd sold goods worth GH¢25 million to Fanny Ltd with a mark-up of one-third. At 31 December 2020, Fanny Ltd’s inventories included GH¢4.8 million of these goods. At 31 December 2019, Fanny Ltd’s inventories included GH¢3 million worth of goods purchased from Stalky Ltd at the same mark-up. Ignore deferred tax implications on these items.

4. The trade receivables of Stalky Ltd included GH¢8 million receivable from Fanny Ltd. This balance did not agree with the equivalent trade payable in Fanny Ltd’s books due to payment of GH¢2 million made on 30 December 2020 by Fanny Ltd to Stalky Ltd.

5. The group’s policy is to measure the non-controlling interests in subsidiaries at fair value. The fair value per ordinary share in Fanny Ltd at acquisition was GH¢1.50. Goodwill was impaired by 10% for the year ended 31 December 2019. A further impairment of 10% of the remaining goodwill is required in the current period. All impairment losses are charged to operating expenses.

Required:

Prepare the Consolidated Statement of Financial Position as at 31 December 2020 for Stalky Ltd Group.

Find Related Questions by Tags, levels, etc.

d) The recognition, measurement, and disclosure of an Investment Property in accordance with IAS 40: Investment Property appears straightforward. However, this could get complicated when measured either under the fair value model or under the revaluation model.

Required:

i) Define Investment Property under IAS 40 and explain the rationale behind its accounting treatment. (2 marks)

ii) Explain how the treatment of an investment property carried under the fair value model differs from an owner-occupied property carried under the revaluation model. (2 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan