- 20 Marks

CSMCE – OCT 2022 – L2 – Q7 – Short Notes on Marketing Concepts

Short notes on reach, product life cycle, interpersonal skills, and distribution channels.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The management of a bank has decided to establish five new branches at vantage locations in the next quarter to attract new customers. You are the chairperson of a committee that is to conduct market research and identify the locations for establishing the new branches. Given the importance of the report, and the limited time available, the Committee has decided to adopt Information Technology in the conduct of the research.

a) Identify five (5) ways in which Information Technology could be applied in the conduct of the market research. [10 Marks]

b) Describe five (5) methods for collecting qualitative data and explain how IT could be used in any two of the data collection methods. [10 Marks]

[Total: 20 Marks]

Find Related Questions by Tags, levels, etc.

The COVID-19 global pandemic and associated lockdowns compelled many financial institutions to adopt virtual approaches to service delivery to their customers. With many researchers predicting the reoccurrence of such pandemics, executives of financial institutions have expressed a keen interest in the concept of a virtual organization (VO), how to run an effective virtual organization, and the ensuing challenges. Explain what a virtual organization is and discuss the managerial and technical issues in running a virtual organization.

[20 Marks

Find Related Questions by Tags, levels, etc.

The Accountant advised the CEO that to strengthen governance, the Board should concern itself with the establishment of strong internal control systems. Failures or weaknesses in internal controls will have adverse consequences for HPC’s finances, financial reporting, operational efficiency and effectiveness, or regulatory compliance.

Required:

Write a paper, explaining FIVE (5) factors to the Board the nature of internal controls that could be instituted by HPC to strengthen governance. (10 marks)

Find Related Questions by Tags, levels, etc.

In reference to Ghana’s Code of Best Practices in Corporate Governance, discuss FOUR (4) key issues that could determine how well or badly HPC is governed, taking into consideration the intention and business relationship of the Board Chairman. (10 marks)

Find Related Questions by Tags, levels, etc.

a) Budgeting is an essential element of Public Financial Management and it is a requirement of the Constitution and other Public Financial Management enactments. Budgeting is a process that requires the engagement and participation of citizens for accountability purposes. The prime objective of budgeting is to set out the financial plans of government for the ensuing year and how government plans and programs will be financed.

Required:

i) Explain TWO (2) provisions in the 1992 Constitution relating to budgeting. (4 marks)

ii) Explain Citizen’s Budget and identify THREE (3) of its benefits in Public Financial Management. (5 marks)

iii) Explain the role of budget guidelines in budgeting and identify FOUR (4) items of information to be expected in a budget guideline. (6 marks)

b) A Public Sector entity that applies IPSAS is currently faced with a particular financial transaction for which no IPSAS exists for dealing with the issue. The management is undecided on the choice of accounting policy to apply.

Required:

Discuss how the matter can be dealt with by the management of the entity. (5 marks)

Find Related Questions by Tags, levels, etc.

a) Banky Construction Ltd has tendered for several contracts that were advertised, but in each case, they failed to win these contracts. The company is now worried about their situation, as it may lead to the liquidation of the company. They have just contacted you for advice on how to reverse this unfortunate downturn.

Required:

Explain FOUR (4) challenges that are likely to be the reason why they are failing to win contracts. (4 marks)

b) Explain the following terms and practices as used in Public Procurement:

i) Tender Security

ii) Least Cost Selection

iii) Tender Evaluation Panel

iv) Board of Survey

(6 marks)

c) Discuss how each of the elements of Financial Statements listed below are recognized and measured under IPSAS 32: Service Concession – Grantor:

i) Service concession asset

ii) Liability

iii) Revenue

(10 marks)

Find Related Questions by Tags, levels, etc.

Below is the Revenue and Expenditure Extract of Nkong District Assembly for the year ended 31 December, 2020.

| Description | Annual Budget (GH¢’ 000) | Revised Budget (GH¢’ 000) | Actual Performance (GH¢’ 000) |

|---|---|---|---|

| Decentralised Transfer | 32,000 | 35,000 | 42,000 |

| Internally Generated Fund | 56,000 | 45,000 | 33,000 |

| Compensation | 23,000 | 20,000 | 25,700 |

| Goods and Services | 13,000 | 18,000 | 24,000 |

| Non-Financial Asset | 18,000 | 15,000 | 12,000 |

Required:

i) Prepare a Budget Performance Report of Nkong District Assembly based on the extract above. (5 marks)

ii) Write a report analyzing the Budget Outturn while assessing the likely causes of the variances during the year. (5 marks)

Find Related Questions by Tags, levels, etc.

The goal of the Minister for Finance is to build a robust, resilient, open, and orderly Public Financial Management (PFM) system for the country by the end of 2022. This ambitious target has huge budgetary implications for the government due to the difficult fiscal position imposed by the COVID-19 pandemic. The Minister is optimistic that investing more in PFM systems today will produce the expected outcome in the immediate future.

Required:

i) Discuss THREE (3) challenges of the current Public Financial Management systems of the country. (3 marks)

ii) Explain THREE (3) expected outcomes of an open and orderly Public Financial Management system of the country. (3 marks)

iii) Explain FOUR (4) ways by which the Public Expenditure and Financial Accountability (PEFA) framework can help the Minister build an orderly and open Public Financial Management system for the country. (4 marks)

Find Related Questions by Tags, levels, etc.

Citizen Transport Corporation (CTC) is a Public Transportation company in Ghana, which seeks to provide reliable and affordable means of transport for commuters within villages, towns, and cities as well as provide intercity movement and transport consultancy services.

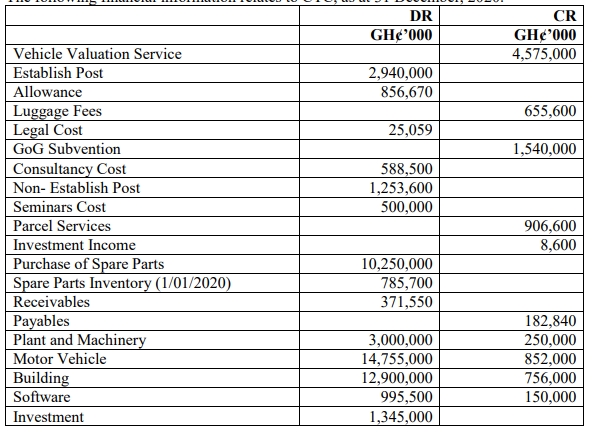

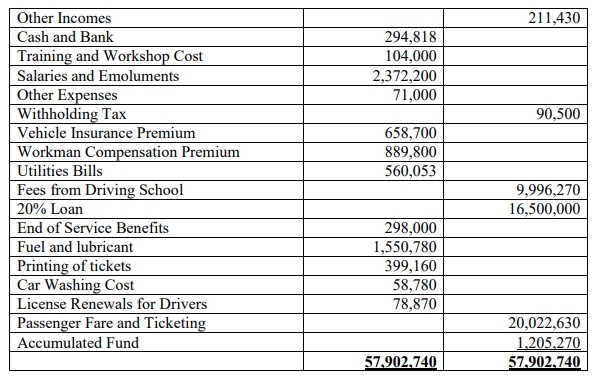

The following financial information relates to CTC, as at 31 December, 2020:

Additional information:

| Spare Parts | GH¢’ 000 |

|---|---|

| Historical Cost | 900,000 |

| Replacement Cost | 802,000 |

| Net Realisable Value | 995,000 |

| Assets | Useful Life |

|---|---|

| Plant and Machinery | 15 years |

| Motor Vehicle | 20 years |

| Building | 30 years |

| Software | 10 years |

Required:

In compliance with IPSAS and relevant legislations, prepare for CTC:

a) Statement of Financial Performance for the year ended 31 December 2020. (9 marks)

b) Statement of Financial Position as at 31 December 2020. (7 marks)

c) Explain TWO (2) Guiding Principles for formulating accounting policy. (2 marks)

d) Explain TWO (2) Conditions that mandate a change in accounting policy. (2 marks)

Find Related Questions by Tags, levels, etc.

The Financial Statements below were submitted on 15 February 2021, to the Finance and Administration Committee of Makambi District Assembly for consideration. Some members of the committee condemned the quality of the financial statements on two grounds:

Makambi District Assembly Statement of Financial Performance for the year ended 31 December 2020

| Revenues | Actual (GH¢’000) | Budget (GH¢’000) |

|---|---|---|

| Decentralised transfers | 341,000 | 304,100 |

| Internally Generated Fund | 117,000 | 187,300 |

| Donations and grants | 34,000 | 25,000 |

| Total Revenues | 492,000 | 516,400 |

| Expenses | Actual (GH¢’000) | Budget (GH¢’000) |

|---|---|---|

| Compensation for employees | 318,900 | 300,000 |

| Use of goods and services | 114,000 | 145,000 |

| Consumption of fixed assets | 12,000 | – |

| Interest | 9,000 | 9,400 |

| Subsidies | 500 | 800 |

| Other expenses | 8,600 | 6,600 |

| Total Expenses | 463,000 | 461,800 |

Net operating result: 29,000 (Actual) vs 54,600 (Budget)

Statement of Financial Position as at 31 December 2020

| Assets | GH¢’000 |

|---|---|

| Non-Current Assets | |

| Property, plant and equipment | 1,200,000 |

| Investment | 300,000 |

| Total Non-Current Assets | 1,500,000 |

| Current Assets | |

| Receivables | 23,000 |

| Loans | 50,000 |

| Cash and Bank | 160,000 |

| Total Current Assets | 233,000 |

| Total Assets | 1,733,000 |

Liabilities and Funds

| Liabilities and Funds | GH¢’000 |

|---|---|

| Liabilities | |

| Loans | 900,000 |

| Payables | 106,000 |

| Total Liabilities | 1,006,000 |

| Funds | |

| Accumulated fund | 727,000 |

| Total Liabilities and Funds | 1,733,000 |

Required:

i) Discuss the merit or otherwise on the first ground of condemnation of the financial statements presented to the Finance and Administration Committee. (2 marks)

ii) Using an appropriate framework of assessing the quality of a general-purpose financial statement under the Conceptual Framework, assess the quality of the financial statements presented to the Finance and Administration Committee to the extent that the information available allows. (8 marks)

Find Related Questions by Tags, levels, etc.

Accrual basis of Accounting has been recommended as the best approach to ensure accountability and transparency in the management of public funds. Despite its favorable advantages, many countries are yet to implement a full accrual public sector accounting system.

Required:

Discuss FOUR (4) reasons why many countries have not been able to implement a full accrual public sector accounting system. (10 marks)

Find Related Questions by Tags, levels, etc.

Exactly two years ago, JBL Plc took a 5-year US$ 20 million loan at a fixed interest of 12% from an investment bank to finance a plant expansion project. At the time the loan was taken, JBL was exporting a significant proportion of its output to a foreign market. Thus, it was sure that it would be able to earn U.S. dollars to make dollar payments on the loan. For about a year now, JBL has not been able to export its output to its foreign market due to trade restrictions. It sells only to buyers in Ghana for the Ghana cedi. The company now prefers to have its interest obligation in Ghana cedi rather than U.S. dollar.

On the advice of the Treasury Manager, JBL has entered a currency swap arrangement with a bank to manage the underlying risk exposure. Per the terms of the swap, JBL will continue to honour its obligations under the actual loan. Under the swap, JBL and the bank will exchange interests and principals in the appropriate currencies. With a pre-arranged exchange rate of GH¢6.5000/USD1, the notional principals under the swap arrangement are agreed at US$20 million and GH¢130 million. The 12% interest rate on the existing dollar loan will continue to apply to both the original dollar loan and the dollar interest payments under the swap arrangement. The interest rate that will apply to the cedi notional principal is set to 15%.

Required:

Evaluate how JBL Plc can use the currency swap to manage the underlying risk exposure. (5 marks)

Find Related Questions by Tags, levels, etc.

Poh-Poh Electronics Ltd is a wholesale distributor of household electrical products of major electronic brands. The company currently sells on credit to all its customers. Although the credit term is net 20 days, the receivables turnover days have been 15 days. The company’s annual credit sales revenue is GH¢80 million, and its contribution margin ratio is 30%. Bad debt is 2% of sales revenue, and credit collection cost is GH¢50,000 per annum.

Management is considering extending the credit period to net 30 days. It is expected that the implementation of this proposal would attract new customers, and the annual revenue would increase by 20%. It is also expected that both the existing and the new customers will probably take the full 30 days credit. To mitigate the probable lengthening in the receivables turnover days, management proposes that the extension in the credit period be combined with the introduction of a cash discount policy of 2% on all payments made within the first 10 days of the credit period. It is expected that 30% of all customers will pay their accounts early to take the discount. Consequently, the receivables turnover days would increase to 24 days. While the bad debt will remain at 2% of sales revenue, the annual credit collection cost will increase to GH¢65,000.

The company’s cost of capital is 24%.

Required:

i) Evaluate the proposed change in the credit policy and recommend whether the proposed change should be implemented. (9 marks)

ii) Advise the management team on THREE (3) procedures for the collection of its receivables. (6 marks)

Find Related Questions by Tags, levels, etc.

Existing shareholders have some advantages available to them that potential shareholders interested in buying shares from the company do not have. Some of those advantages are pre-emptive rights and rights issues.

Required:

i) Explain the term Pre-emptive rights. (2 marks)

ii) Explain the concept of a Rights issue and explain ONE (1) advantage to a company for using rights issues to raise additional capital. (3 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan