- 9 Marks

Question

Adebola Nigeria Limited has been trading for many years. The company makes up its accounts to 31 December annually. The extracts from its Statement of Comprehensive Income for the years ended 31 December 2013 and 2014 (as adjusted for tax purposes) are as follows:

| Year ended 31 December | 2014 (₦) | 2013 (₦) |

|---|---|---|

| Profit for the year | 14,000,000 | 10,000,000 |

| Bank interest received (gross) | 2,400,000 | 1,600,000 |

| Debenture interest received (gross) | 800,000 | 800,000 |

| Dividend received from Adesemowo Ltd. (Net) | 720,000 | 720,000 |

| Dividend paid to shareholders (gross) | 6,000,000 | 4,000,000 |

Required:

i. Compute the company’s tax liabilities for the relevant years of assessment. Ignore capital allowances. (5 Marks)

ii. Determine the net withholding tax payable or receivable by Adebola Nigeria Limited, arising from dividends paid and received by it. (4 Marks)

Answer

i. Computation of Adebola Nigeria Limited’s Income Tax Liabilities:

| Year | 2014 (₦) | 2013 (₦) |

|---|---|---|

| Profit of the year (adjusted) | 14,000,000 | 10,000,000 |

| Bank interest received (gross) | 2,400,000 | 1,600,000 |

| Debenture interest received (gross) | 800,000 | 800,000 |

| Total profit/assessable profit | 17,200,000 | 12,400,000 |

| Companies Income Tax (30% of Total Profit) | 5,160,000 | 3,720,000 |

| Tertiary Education Tax (2% of Assessable Profit) | 344,000 | 248,000 |

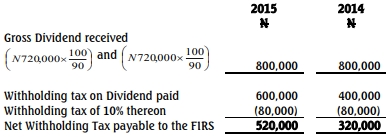

ii. Computation of Net Withholding Tax Payable or Receivable:

- Tags: Assessment, Corporate Taxation, Dividend income, Interest Income, Tax liabilities, Withholding Tax

- Level: Level 2

- Topic: Companies Income Tax (CIT), Withholding Tax (WHT)

- Series: NOV 2015

- Uploader: Kwame Aikins