- 20 Marks

Question

Mr. Babangida Muhammed was employed as General Manager by Casio Nigeria Limited, a subsidiary of a United Kingdom-based holding company. He commenced the employment on 1 January 2013. He has provided the following details:

| 2013 (₦’000) | 2014 (₦’000) | |

|---|---|---|

| Basic salary | 5,400 | 6,000 |

| Rent subsidy | 1,800 | 1,800 |

| Furniture grant | 600 | 600 |

| Entertainment allowance | 660 | 660 |

| Other benefits | ||

| – Brand new car (valued at) | 3,800,000 | |

| – Scholarship for children | 500 | 500 |

Mr. Babangida Muhammed has approached your firm to assist him in determining his personal income tax liability for the last two years and assist in obtaining a current Tax Clearance Certificate on his behalf from his relevant tax authority. Your firm is also to determine whether he had underpaid his tax for the previous two years and if so, how much additional tax he may be required to pay.

Additional information provided:

| Income/Expense Category | 2013 (₦’000) | 2014 (₦’000) |

|---|---|---|

| Gratuity from former employment | 240 | – |

| Rental income (Gross) | 600 | 600 |

| Interest on Fixed Deposit | 75 | 90 |

| Life Assurance Premium | 100 | 100 |

| Contribution to NHF (2.5% of Basic Salary) | 2.5% | 2.5% |

| Contribution to National Pension Scheme (7.5% of Total Emoluments) | 7.5% | 7.5% |

| Repair expenses for property | – | 45 |

| Maintenance of aged parents | 480 | – |

| Personal Income Tax paid | 850 | 960 |

Required:

a. The Personal Income Tax payable in 2013 and 2014 Years of Assessment.

(16 Marks)

b. The effect of previous payments on the tax payable.

(4 Marks)

(Total: 20 Marks)

Answer

(a)

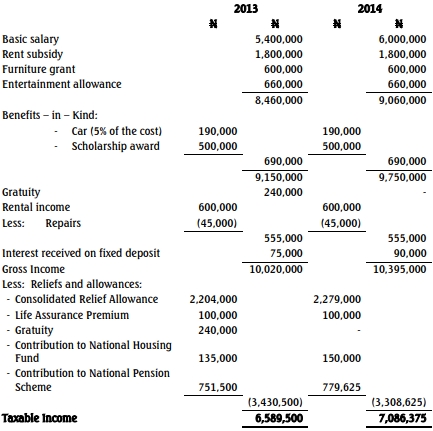

MR BABANGIDA MUHAMMED

COMPUTATION OF PERSONAL INCOME TAX PAYABLE

FOR 2013 AND 2014 YEARS OF ASSESSMENT

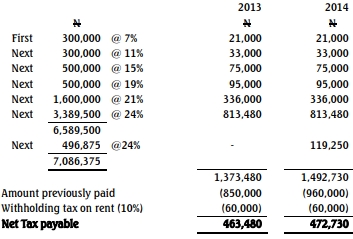

COMPUTATION OF TAX PAYABLE

(b)

Given the computation of Personal Income Tax payable shown above, Mr

Babangida Muhammed will be advised to pay additional personal income tax of

N463,480 and N472,730 for 2013 and 2014 years respectively.

- Topic: Personal Income Tax

- Series: NOV 2015

- Uploader: Kwame Aikins