- 15 Marks

Question

Zuba Construction Company Limited is an irrigation and building construction company. The company has been in the business for many years.

The company appointed you as the tax representative to provide tax advisory services and deal with the VAT office on its behalf.

On commencement of your assignment, you discovered that there was a dispute on the determination of the amount of VAT payable to the Revenue by the Company. To assist you in the assignment, the following information was made available to you:

| Date | Details | Amount (N) |

|---|---|---|

| 1/8/13 | Bought a concrete mixer | 700,000 |

| 2/8/13 | Bought sand | 40,000 |

| 3/8/13 | Bought gravel | 40,000 |

| 5/8/13 | Bought scaffolding | 1,800,000 |

| 5/8/13 | Bought photocopier machine | 50,000 |

| 7/8/13 | Bought tables | 15,000 |

| 14/8/13 | Bought poker vibrator | 300,000 |

| 14/8/13 | Bought chairs | 20,000 |

| 14/8/13 | Progress payment received | 2,000,000 |

| 24/8/13 | Progress payment received | 1,500,000 |

Additional Note: VAT was paid on all the company’s purchases.

You are required to:

a. Compute VAT payable (if any) for the month of August 2013.

(8 Marks)

b. Advise your client on when and how VAT payment should be made.

(4 Marks)

c. Itemize the contents of a Notice of Appeal against VAT Assessments.

(3 Marks)

Answer

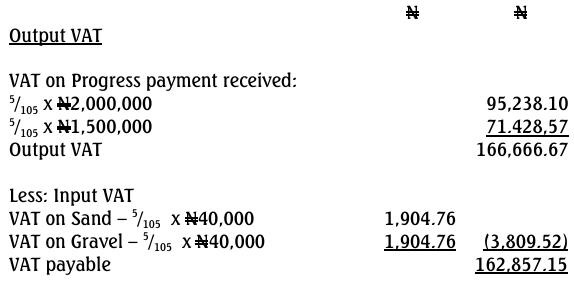

(a) ZUBA CONSTRUCTION COMPANY LIMITED

Computation of Valued Added Tax Payable for the Month August 2013

(b) DUE DATE FOR PAYMENT OF AUGUST 2013 VAT

APEX CONSULTANTS

(CHARTERED ACCOUNTANTS AND CHATERED TAX PRACTITIONERS)

30, Orange Street, Lagos

The Managing Director

Zabu Construction Company Limited

Plot 15, Moonlight Estate

Lagos

Dear Sir,

RE: DUE DATE AND MODE OF PAYMENT OF AUGUST 2013 VAT

We refer to your request on the above subject.

Please be informed that according to the provisions of the VAT Act, the due date

for the payment of monthly VAT is on or before the 21st day of the month

following the month of the transaction for which VAT is due.

Therefore, the due date for payment of VAT for the month of August 2013 should

not be later than the 21st day of September 2013.

You are to remit the VAT to the FIRS through designated Banks. An electronic

receipt i.e. e-receipt would be issued as soon as payment is made. The e-receipt

and completed VAT form 002 shall be submitted at the FIRS office not later than

the due date for submission of VAT returns i.e. 21st day of the month following

the month of the transaction.

Please note that failure to comply with the above date would result in the

imposition of a penalty of N

5,000 for every month the failure continues.

May we use this opportunity to enclose our bill in respect of the services

rendered.

Thanking you for your continuous patronage.

Yours faithfully,

Okolo Richard

Managing Partner

For: Apex Consultants

(c)

CONTENTS OF A NOTICE OF APPEAL AGAINST VAT

The contents of a Notice of Appeal against VAT are as follows:

(i)

(ii)

(iii)

(iv)

(v)

(vi)

The name and address of the taxable person

The total number of goods and services chargeable to tax in respect of

each month

Any input tax

Net amount of tax payable

The copy of assessment notices

The precise grounds of appeal against the assessment

- Uploader: Kofi