- 20 Marks

Question

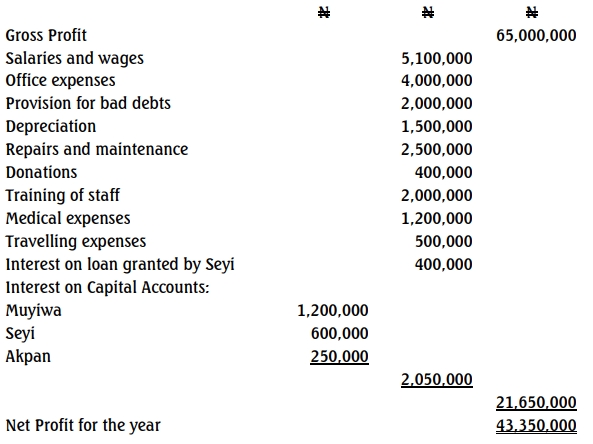

Muyiwa, Seyi, and Akpan are partners in an accounting firm in Lagos, Museak & Co (Chartered Accountants). The Statement of Profit or Loss for the year ended December 31, 2015, is shown below:

Additional Information:

- Donation was for laying the foundation of a new church.

- Repairs for Muyiwa’s wife’s vehicle, costing ₦550,000, were included under repairs and maintenance.

- Medical expenses of ₦500,000 were incurred for flying a partner’s father-in-law abroad.

- Akpan contributed ₦500,000 under the Pension Reforms Act 2004 (as amended).

- Capital allowances agreed with the tax authority were ₦4,000,000.

- Partners’ profit-sharing ratio: Muyiwa 6; Seyi 4; Akpan 2.

Required:

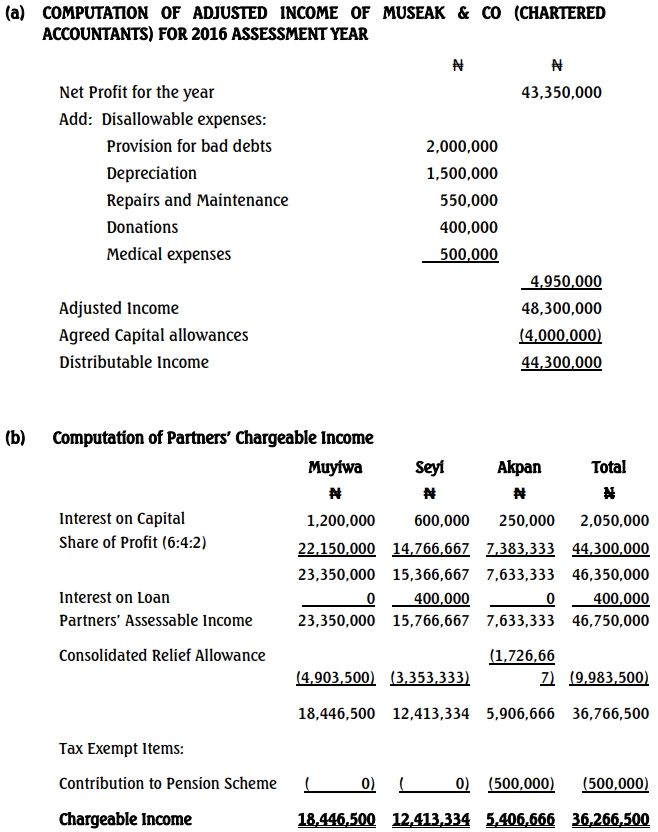

- Compute the adjusted income of Museak & Co for tax purposes. (6 Marks)

- Compute the chargeable income of each partner. (6 Marks)

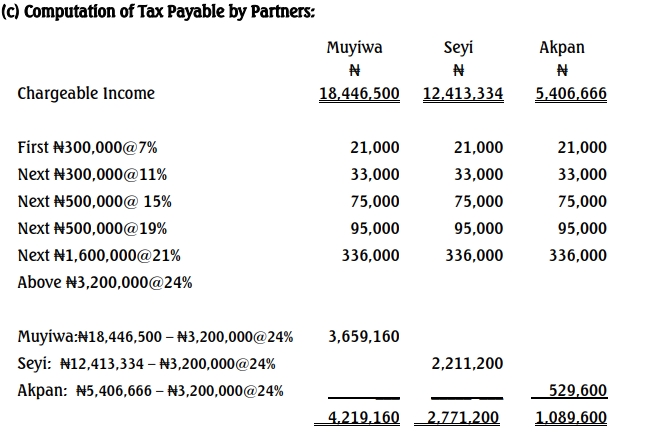

- Compute the tax payable by each partner. (8 Marks)

Answer

NOTES:

i. Consolidated Relief Allowance is the higher of N200,000 or 1% of Gross Income plus 20% of Gross Income.

ii. The deduction of Capital allowances from the Adjusted Income before arriving at the Distributable Income is preferable to sharing of Capital Allowances amongst the partners.

- Tags: Adjusted Income, chargeable income, Distributable Income, Partnership Income

- Level: Level 2

- Topic: Taxation of Partnerships and Sole Proprietorships

- Series: MAY 2017

- Uploader: Theophilus