- 15 Marks

Question

Chief Zeta created a Trust many years ago for the benefit of his four children, Alpha, Beta, Cepha, and Delphi. A lawyer was appointed as the Trustee to his Estate.

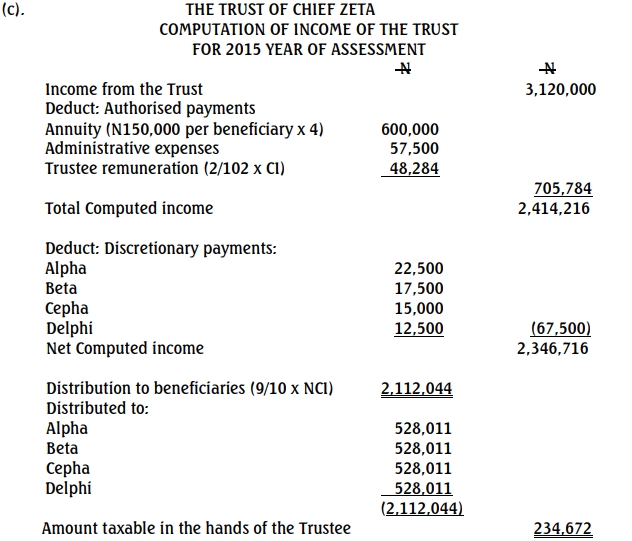

For the year ended 30 September 2014, the Trust income amounted to ₦3,120,000. Each of the beneficiaries receives an annuity of ₦150,000 every year while the expenses incurred on the administration of the Trust was ₦57,500 per annum. The trustee is on a remuneration of 2% of the Computed Income.

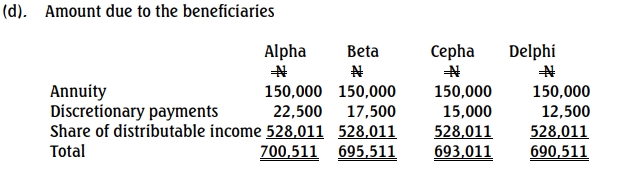

Chief Zeta instructed that discretionary payments of ₦22,500, ₦17,500, ₦15,000, and ₦12,500 respectively should be made to Alpha, Beta, Cepha, and Delphi respectively. In addition, nine of the ten portions of the remainder of the Computed Income should be shared equally among the four children.

Chief Zeta has requested you to supervise the administration of the above Trust.

You are requested to:

a. State the basis of assessment of Estates, Trusts or Settlements. (1 Mark)

b. Identify the persons chargeable to Income Tax under the Trust or Settlement created by Chief Zeta. (3 Marks)

c. Compute the income of the Trust. (3 Marks)

d. Determine the amount due to each beneficiary. (6 Marks)

e. Explain how the Computed Income should be apportioned and how the Income Tax burden will be shared by all the parties. (Ignore Withholding tax). (2 Marks)

Answer

a. Basis of Assessment of Estates, Trusts, or Settlements (1 Mark)

The basis of assessment for estates, trusts, or settlements is the Computed Income of the trust, which refers to the total income generated by the trust after deducting allowable expenses, annuities, trustee remuneration, and other administrative costs. The net income is then subject to income tax based on the relevant tax laws.

b. Persons Chargeable to Income Tax Under the Trust or Settlement (3 Marks)

- Trustees: The trustee is liable to pay tax on the income of the trust, particularly where income has not been distributed to beneficiaries within a specific assessment year.

- Beneficiaries: Beneficiaries are liable for tax on income distributed to them by the trust, such as annuities or other discretionary payments.

- Settlor: In certain cases, the settlor (Chief Zeta) may also be liable if the income of the trust reverts back to him, particularly if certain conditions specified by the tax authorities are met.

e. Apportionment of Computed Income and Sharing of Tax Burden (2 Marks)

- Apportionment of Computed Income: The computed income is first used to cover fixed annuities and discretionary payments. The remaining income is apportioned as instructed by Chief Zeta, with nine out of ten portions being shared equally among the beneficiaries.

- Sharing of Tax Burden: The income tax burden is shared between the trust and beneficiaries based on their respective income portions:

- Trustee: The trustee is liable for tax on income retained by the trust.

- Beneficiaries: Beneficiaries are liable for tax on the amounts distributed to them, which include annuities, discretionary payments, and portions of the remaining income.

- Tags: Beneficiaries, Computed Income, Discretionary Payments, Estates, Income Tax, Trusts

- Level: Level 2

- Topic: Taxation of Trusts and Estates

- Series: MAY 2015

- Uploader: Theophilus