- 10 Marks

Question

Using the additional information presented by AB Consult & Associate to the Director of Finance and Operations, Mrs. Emma Owusu-Kwakye, on 4 August, prepare the following:

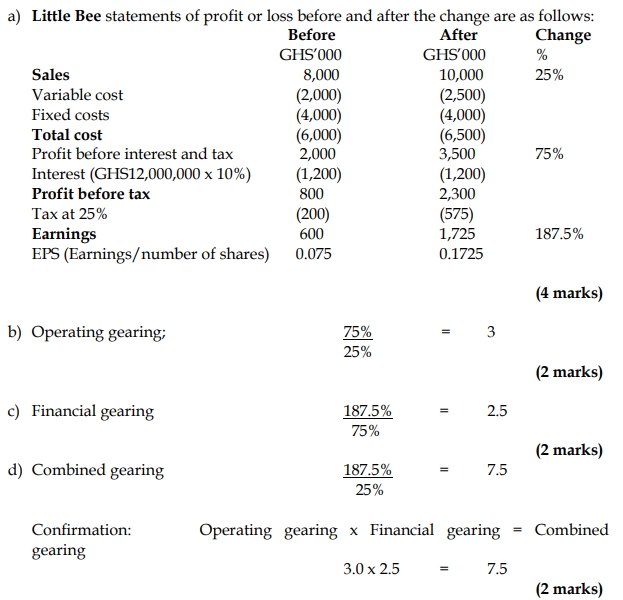

i) Little Bee new forecasted Statement of financial performance after the changes that will be discussed at the board meeting on the 5 August 2022. (4 marks)

ii) Calculate the operating gearing, measured as the ratio of the percentage increase in profit before interest and tax divided by the percentage increase in sales. (2 marks)

iii) Calculate the financial gearing, measured as the ratio of the percentage change in total earnings (or EPS) to the percentage increase in profit before interest and tax. (2 marks)

iv) Calculate the Combined gearing, measured as the ratio of the percentage change in total earnings (or EPS) to the percentage increase in sales. (2 marks)

v) Explain the significance of operating gearing and financial gearing to the management of Bazar. (10 marks)

Answer

e) Significance of Operating and Financial Gearing:

Operating Gearing:

- Operating gearing is higher when fixed costs are higher in relation to variable costs. When operating gearing is high, a given percentage change in sales will result in a much greater change in operating profits.

- The greater the operating gearing, the greater the variability in profits due to sales fluctuations, which introduces higher risk for Bazar. As demonstrated above, a 25% increase in sales results in a 75% increase in profits before interest and tax. This means that the variability in Bazar’s profits can fluctuate sharply, posing a risk for shareholders.

Financial Gearing:

- Financial gearing measures the sensitivity of earnings per share to changes in operating profits. Higher financial gearing indicates that changes in operating profit will have a more significant impact on earnings per share (EPS).

- With high financial gearing, Bazar’s earnings per share could change substantially due to even small changes in operating profits. Given Little Bee’s high financial gearing (2.5), any drop in sales or profits could lead to significant reductions in EPS, making the company riskier for shareholders.

- A company with both high operating and financial gearing, like Little Bee, is considered to have high overall risk. Volatile earnings make Little Bee a high-risk investment for Bazar.

- Topic: Financial management

- Series: AUG 2022

- Uploader: Theophilus