- 10 Marks

Question

In discussing the report presented by AB Consult & Associate, the Director of Finance and Operations made a strong point for acquisition and mergers as a growth strategy instead of internal development. She gave her full support to the decision to acquire the 20 stores.

Required:

Write a report detailing the advantages of an acquisition and mergers method of growth instead of an internal development. Conclude your report by explaining why the financial position and financial performance of Bazar will support or not support the decision to acquire the 20 stores.

Answer

From: Student

To: Board and Management of Bazar

Through: Director of Finance and Operations (Mrs. Emmah Owusu-Kwakye)

Date: 5th August 2022

Internal Report: In Support of Acquisitions & Mergers of Little Bee, as a method of growth of Bazar rather than using the process of Internal Development

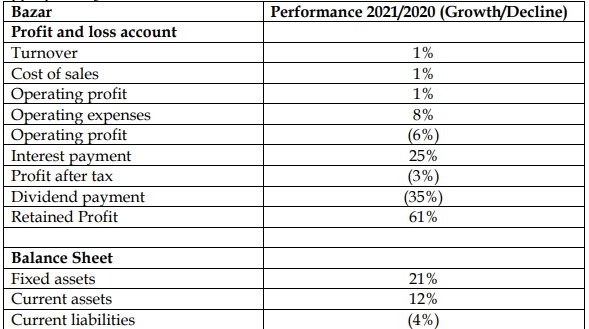

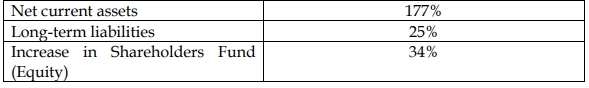

An entity can grow quickly by means of mergers and acquisitions as has been reviewed using the limited data provided by AB Consult and Associate in relation to 2021/2020 incomplete financial statement of Bazar.

Both mergers and acquisitions involve the creation of a single entity from two separate entities. With a merger, the two entities that come together are approximately the same size, while in an acquisition, one entity is usually larger than the other and acquires ownership and control by purchasing a majority of the equity shares. This appears to be the case under consideration, with Bazar acquiring the ownership and control of Little Bee. Bazar is far bigger in size and operations compared to Little Bee, which has 75 stores, sales volume, and profit margins, whereas Little Bee has only 20 stores with a limited geographical footprint of operations in Ghana. Acquisitions are therefore more common than mergers.

Acquisitions and mergers have several advantages as a strategy for growth, compared with a strategy of internal development, including the following:

- Growth Speed: Growth by acquisition or merger is much faster than through internal development. This is advantageous for Bazar, considering its stagnant growth of approximately 1% in turnover between the financial years 2020 and 2021.

- Market Access: An acquisition can give the buyer immediate ownership of new markets, new customers, and new suppliers, which would be difficult to obtain through internal development, especially given the geographical constraints in Ghana.

- Overcoming High Barriers to Entry: An acquisition enables Bazar to enter new markets where barriers to entry are high, such as land acquisition, construction of new stores, recruiting, and training new staff to manage the stores. This would make it very difficult to set up a new business in competition with existing players.

- Competitor Prevention: Acquisitions can prevent a competitor from making the acquisition instead, thus avoiding a competitive threat.

- Cost Savings and Synergy: Acquisitions might result in cost savings and higher profits (synergies) through possible operational changes from information acquired via the acquisition.

The above are just some of the benefits of acquisitions. However, based on Bazar’s incomplete financial performance and the summary financial data analyzed below, other factors need to be considered.

A successful growth strategy through acquisition requires financial strength. A company such as Bazar needs one or more of the following to support the ongoing discussion: a large amount of cash available for long-term investment. Bazar may need a “war chest” of cash to buy target companies.

Financial Strength:

Access to additional funding, either through new equity (from new share issues) or borrowing (bonds or loans), would be required to finance the acquisition. However, this approach might be a challenge since the organization is “family-centric” and may not want to dilute ownership through issuing new shares, especially as Bazar already carries a high loan burden, as does Little Bee.

Many acquisitions are negotiated as a share-for-share exchange, with shareholders in the target company accepting shares in the acquiring company as payment. Bazar may only succeed with the acquisition of Little Bee through financing using a share-for-share exchange.

While the acquisition of Little Bee is feasible, it would depend on available cash through loans or if Bazar’s shareholders are willing to dilute share ownership. Considering the company’s current performance and stagnant growth, acquisition remains possible but hinges on acceptable share ownership and financing options. Much will depend on the appetite of Bazar’s governing board and its chairman, Mr. Sushil Sheriff.

Conclusion:

Based on the information in the case and additional data from AB Consult & Associate, I advise management to consider the following before finalizing their decision:

- The rationale behind the acquisition

- Understanding what is being acquired

- Appointing a third-party mediator

- Managing expectations

- Familiarizing themselves with Little Bee’s management

- Developing a proper integration plan

- Focusing on human capital

- Considering the financial impact on Bazar.

The financial data summarized below should be considered as part of the decision-making process.

- Tags: Acquisitions, Financial strategy, Growth Strategy, Internal Development, Mergers

- Level: Level 3

- Topic: Strategy implementation

- Series: AUG 2022

- Uploader: Theophilus