- 30 Marks

Question

a. The following information relates to the accounts of Dovet State Government for the year ended December 31, 2022:

| Description | DR (N’M) | CR (N’M) |

|---|---|---|

| Land and buildings (cost) | 387,500 | |

| Long-term investments | 187,500 | |

| Equipment and furniture | 67,500 | |

| Accumulated depreciation: | ||

| – Land and building | 40,000 | |

| – Motor vehicles | 30,000 | |

| – Equipment and furniture | 21,250 | |

| Motor vehicles (cost) | 145,000 | |

| Federation account allocation | 287,500 | |

| VAT allocation | 87,500 | |

| Grants from Federal Government | 33,750 | |

| Internally generated fund | 97,500 | |

| Grant from donor agency | 25,000 | |

| Personnel emolument | 125,000 | |

| Maintenance of premises | 5,000 | |

| Consolidated Revenue Fund charges | 32,500 | |

| Overhead expenses | 25,000 | |

| Miscellaneous expenditure/income | 37,500 | 61,250 |

| Loan notes | 250,000 | |

| Current assets/liabilities | 38,750 | 36,250 |

| Consolidated Revenue Fund (CRF) | 81,250 | |

| Total | 1,051,250 | 1,051,250 |

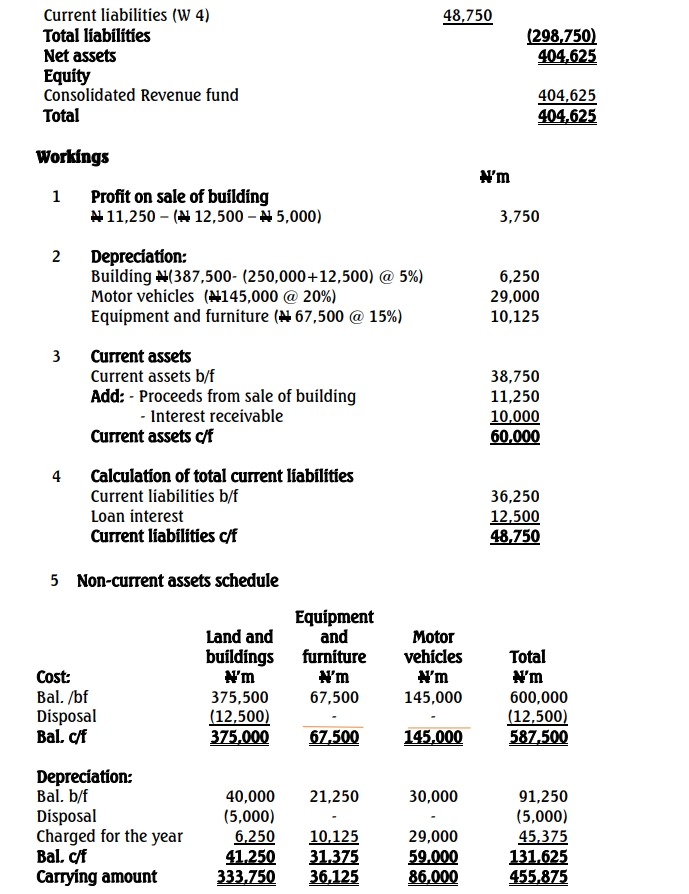

Additional Information:

- Loan interest outstanding at the end of the year was N12.5 billion.

- Depreciation on tangible assets is charged at the following rates on cost:

- Building is 5% (cost of land is N250 billion)

- Motor vehicles is 20%

- Equipment and furniture is 15%

- A building costing N12.5 billion with accumulated depreciation of N5 billion was sold for N11.25 billion. This transaction has not been adjusted in the accounts.

- Interest on receivable amounted to N10 billion.

Required:

- Prepare the Statement of Financial Performance for the year ended December 31, 2022.

- Prepare the Statement of Financial Position as at December 31, 2022.

b. Financial statements provide information that meets a number of qualitative characteristics in financial reporting.

Required:

Discuss FOUR characteristics of financial reporting.

Answer

b. The four characteristics of financial reporting are:

- Relevance:

- Financial information must be relevant to the decision-making needs of users. Relevance ensures that information can influence decisions, either by helping to predict future outcomes (predictive value) or by confirming or correcting past evaluations (confirmatory value).

- Faithful Representation:

- Information must be a faithful representation of the underlying transactions or events. To achieve this, financial information must be complete, neutral, and free from error. This ensures that the reported information gives a true and accurate depiction of the organization’s financial situation.

- Comparability:

- Comparability allows users to identify similarities and differences between entities or across different periods for the same entity. Consistent use of accounting policies and presentation methods helps achieve comparability, making financial statements more useful.

- Timeliness:

- Financial information must be provided to users in a timely manner, i.e., while it still has the capacity to influence decisions. Delays in reporting financial data could make the information less useful.

- Topic: Public Sector Financial Statements

- Series: MAY 2023

- Uploader: Theophilus