- 40 Marks

Question

Okuku State University is a parastatal under Okuku State, not classified as a Government Business Enterprise (GBE). The following is the statement of financial position for the University as of December 31, 2018:

Statement of Financial Position (as at Dec 31, 2018)

| Item | Cost (₦’million) | Accumulated Depreciation (₦’million) | Carrying Amount (₦’million) |

|---|---|---|---|

| Land and Buildings | 15,000 | 250 | 14,750 |

| Equipment | 1,000 | 100 | 900 |

| Furniture | 800 | 80 | 720 |

| Plant & Machinery | 550 | 50 | 500 |

| Motor Vehicles | 450 | 45 | 405 |

| Total Non-Current Assets | 17,800 | 525 | 17,275 |

| Inventories | 11,000 | – | – |

| Receivables | 15,000 | – | – |

| Bank | 3,000 | – | – |

| Total Current Assets | – | – | 29,000 |

| Total Assets | – | – | 46,275 |

| Non-Current Liabilities | – | – | 30,000 |

| Current Liabilities | – | – | 8,000 |

| Total Liabilities | – | – | 38,000 |

| Net Assets | – | – | 8,275 |

| Reserves | – | – | 8,275 |

Additional Information:

- Office equipment was purchased for ₦150,000,000 from Joko Nigeria Limited, with installation and transportation costing ₦3,000,000. Half was paid during the year, with the remainder in January 2019. The University also acquired a building valued at ₦500,000,000 from a defunct State College.

- The University Teaching Hospital received motor vehicles and laboratory equipment donations worth ₦20,000,000 and ₦50,000,000, respectively, from a UK-based research institute.

- A motor vehicle bought on January 1, 2017, for ₦8,000,000 with a five-year life was sold for ₦4,000,000 at year-end.

- Computers bought in 2017 for ₦1,000,000, with an expected five-year lifespan, were damaged in a fire and written off.

- Land was bought for ₦50,000,000 for constructing a plaza valued at ₦250,000,000, with an estimated 25-year life.

- One building, valued at ₦160,000,000, was damaged by fire, with a post-fire valuation of ₦130,000,000.

- A motor vehicle was acquired on January 1, 2018, for ₦150,000,000.

- The University’s depreciation policy includes full-year depreciation with rates: Motor Vehicle 20%, Building 4%, Furniture 10%, Equipment (including Lab and Computers) 20%, and Plant and Machinery 15%.

Required:

a. Identify FOUR characteristics of Government Business Enterprises (GBEs) as

stated in IPSAS 1 on presentation of financial statements. (2 Marks)

b. Prepare the necessary journal entries to record the above transactions for

the year ended December 31, 2018. (10 Marks)

c. Prepare the adjusted statement of financial position as at December 31,

2018. (20 Marks)

d. Identify and explain FOUR qualitative characteristics of financial reporting as

required by appendix 2 of IPSAS 1 on presentation of financial statements.

(8 Marks)

Answer

a. Government Business Enterprise (GBE) is an entity that has all the following

characteristics:

i. It is an entity with the power to contract in its own name;

ii. It has been assigned the financial and operational authority to carry on a

business;

iii. It sells goods and services, in the normal course of its business to other

entities at a profit or full cost recovery;

iv. It is not reliant on continuing government funding to be a going concern

(other than purchases of outputs at arm‟s length); and

v. It is controlled by a public sector entity.

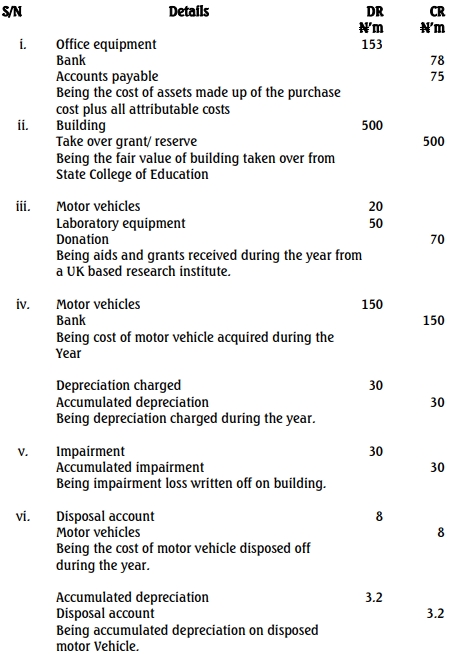

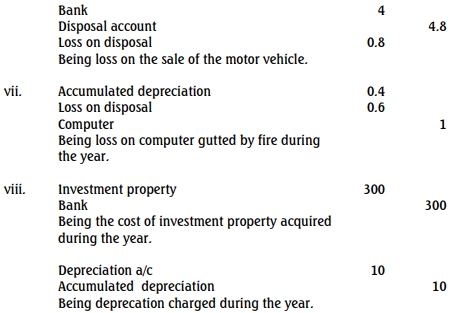

b.

Okuku State University

Journal entries to record transactions not recognised

for the year ended December 31, 2018

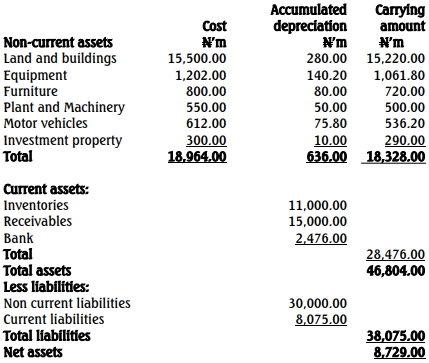

c. Okuku State University

Statement of financial position as at December 31, 2018

![]()

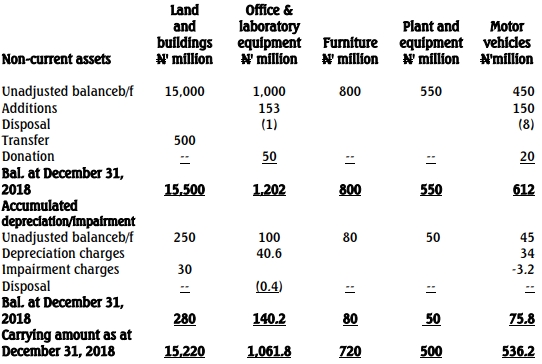

Workings

W (i) Property, Plant and Equipment (PPE)

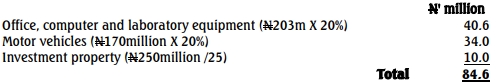

W (ii) Calculation of additional depreciation charges for the year

W (iii) Calculation of adjusted cash balance for the year ended December 31, 2018

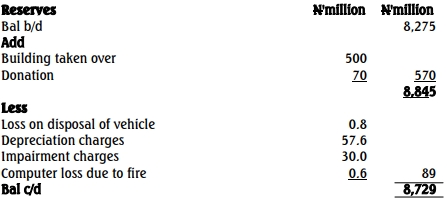

Calculation of adjusted reserves balance for the year ended December 31, 2018

d) Qualitative Characteristics of Financial Reporting:

- Relevance: Information aids decision-making.

- Reliability: Reflects true financial condition.

- Comparability: Consistent over time.

- Timeliness: Available when needed for decisions.

- Topic: Public Sector Financial Statements

- Series: MAY 2021

- Uploader: Kwame Aikins