- 15 Marks

Question

a. Distinguish between net present value (NPV) and internal rate of return (IRR) and state the decision rule under both criteria. (8 Marks)

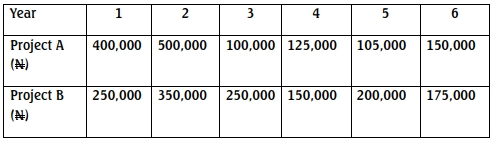

b. Two projects A and B have initial capital investment of N900,000 each. The cash inflows of the two projects are as follows:

Required:

i. As a financial analyst, calculate the net present value (NPV) of the two projects given a cost of capital of 12%. (6 Marks)

ii. Based on the results obtained in (i), which of the projects should be chosen? (1 Mark)

Answer

a. Net present value (NPV) This method refers to the equivalents in present value terms of the cash inflows and outflows from a project when discounted at a particular or given cost of capital. The appropriate discount rate chosen is one firm‟s or entity‟s opportunity cost of capital, which is equal to the required rate of return.

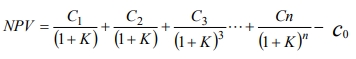

The formula for the computation of Net Present Value is:

Where C series represent cash inflows,

‘K’ the opportunity cost of capital,

Co is the initial cost of the investment and

‘n’ the project‟s expected life.

Decision rule

The decision criterion is that a project is acceptable if it has a positive NPV, and rejected, if it has a negative NPV. In total, the present value of cash inflows should be greater than that of cash outflows. The positive nature of the net present value pre-supposes the potential increase in consumption made possible by the investment, valued in present day terms. For mutually exclusive projects, they would be ranked. The one with the highest net present value is selected.

Internal rate of return (IRR)

The approach is also known as “discounted cash flow yield.” The “internal rate of return” is the discount rate, which when applied, gives zero net present value. It can be found by either drawing a “present value profile” or graph, or mathematically through linear interpolation, using the formula stated thus:

Decision rule

In using the internal rate of return model, the ‘decision rule’ is to accept the project appraised where the calculated rate is greater than the entity‟s cost of capital. The project with the highest percentage of internal rate of return is picked where two or more mutually exclusive investments are being considered.

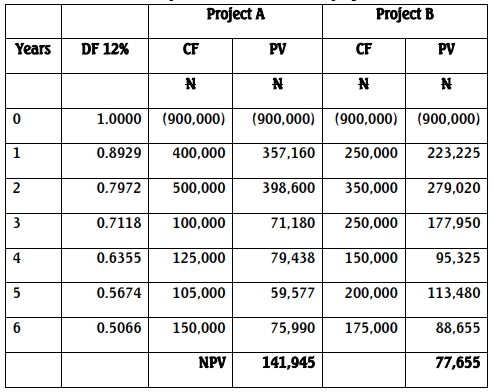

b. i. Calculation of the net present value of the two projects

ii Decision

Based on the results obtained in (bi) above, project A should be selected because it gives the higher NPV of N141,945

- Series: MAY 2019

- Uploader: Kwame Aikins