- 20 Marks

Question

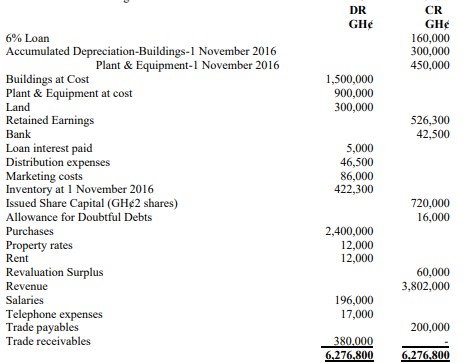

Sawaba Limited is a company involved in the construction and fitting of kitchens and wardrobes. The following trial balance was extracted from its books as at 31 October 2017:

The following information, based on your investigations, has also come to your attention:

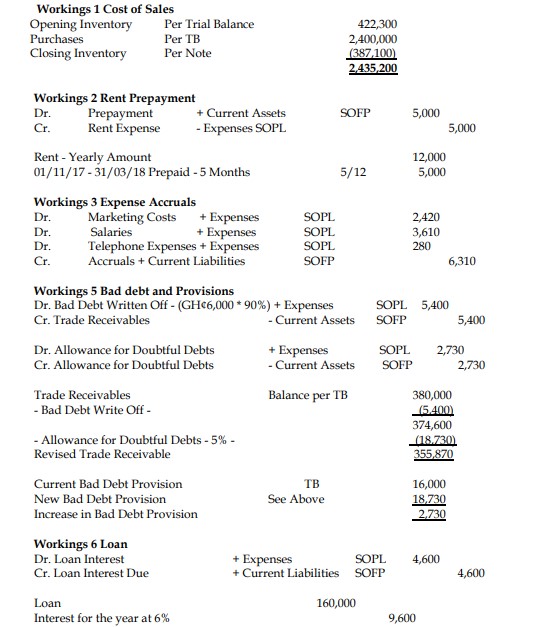

i) Inventory as at 31 October 2017 was GH¢387,100.

ii) Depreciation is to be charged as follows:

- Buildings 4% Straight Line on Cost

- Plant & Equipment 15% of Reducing Balance

- Land is not being depreciated.

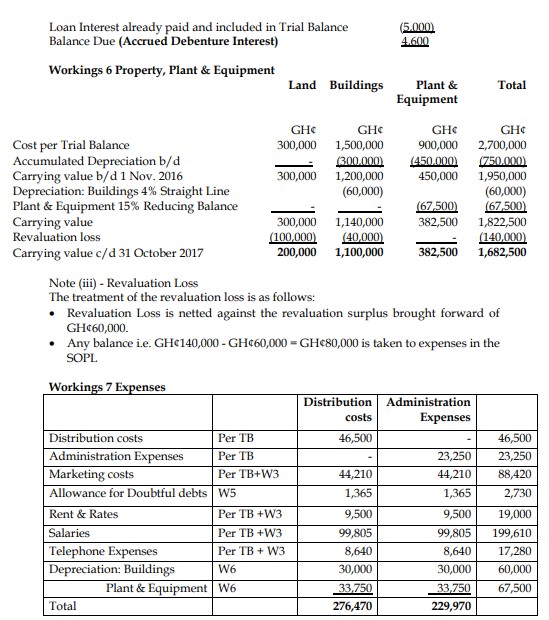

iii) The land and buildings were revalued in total at GH¢1,300,000, of which land amounted to GH¢200,000, as at 31 October 2017. This has not been recorded in the books.

iv) Rent relates to a display unit rented, and its rental period is yearly starting on 1 April each year. The yearly amount of GH¢12,000 is paid in full on this date.

v) There are outstanding balances for Marketing Costs, Salaries, and Telephone Expenses amounting to GH¢2,420, GH¢3,610, and GH¢280, respectively, which have not yet been included in the above trial balance.

vi) A customer owing GH¢6,000 went into liquidation. The liquidator has assured Sawaba Limited that it will receive 10% of the amount. Sawaba Limited has decided that the Allowance for Doubtful Debts should be set at 5%.

vii) Provide for any Loan interest due.

viii) All Expenses are to be allocated evenly between Distribution Costs and Administrative Expenses.

Required:

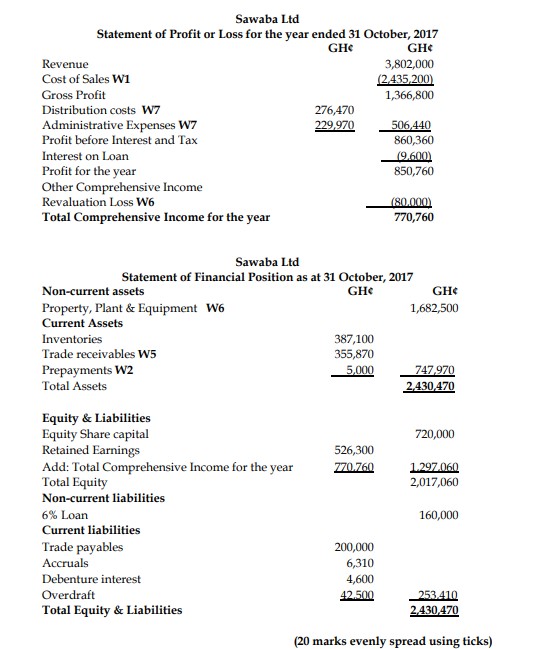

Prepare a Statement of Profit or Loss Account and Statement of Financial Position for Sawaba Limited for the financial year-ending 31 October 2017. (20 marks)

Answer

Sawaba Ltd

Statement of Profit or Loss for the year ended 31 October 2017

- Uploader: Theophilus