- 20 Marks

Question

a) The transactions below relate to Affram Ltd for the year ended 30 April 2022:

1 May 2021 balance b/d:

| Account | GHȼ |

|---|---|

| Sales Ledger Control Account | 180,000 Dr |

Totals for the year 1 May 2021 to 30 April 2022:

| Item | Amount (GHȼ) |

|---|---|

| Credit sales | 600,500 |

| Receipts from customers | 690,100 |

| Discount allowed | 12,000 |

| Irrecoverable debts | 5,400 |

| Sales returns | 4,600 |

| Dishonoured cheques from customers | 3,000 |

| Contras between sales and purchases | 14,000 |

The Sales Ledger Control Account balance failed to agree with the total receivables of GHȼ67,800 as shown by the Schedule of Receivables.

The following errors were subsequently discovered:

- The discount allowed total in the Cash Book had been overstated by GHȼ400.

- The total of sales in the Sales Journal had been understated by GHȼ3,000.

- A cheque received from a customer for GHȼ2,000, correctly processed through the books, had subsequently been dishonoured. This item had been correctly dealt with in the customer’s account, but no other entry has yet been made.

- Goods costing GHȼ5,000 had been returned by a customer. The transaction had been correctly recorded in the Sales Ledger Control Account, but this has not been entered in the customer’s account.

- Papa Yaw, a customer, has been declared bankrupt and his debt of GHȼ1,500 is to be written off. No entries have yet been made.

Required:

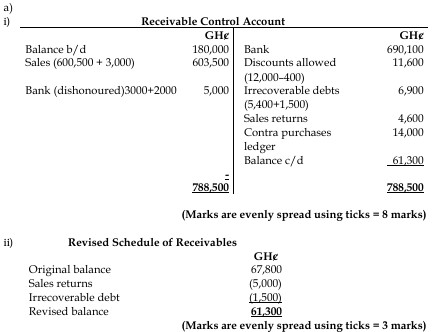

i) Prepare the Receivables Control Account for the year ended 30 April 2022. (8 marks)

ii) Prepare a statement reconciling the corrected balance on the Receivables Control Account with the corrected balance on the Schedule of Receivables. (3 marks)

b) Book-keeping is the process of recording financial transactions in the accounting records (the books) of an entity. Transactions are initially recorded in books of prime entry also known as books of original entry.

Required:

Identify SIX (6) books of prime entry and their functions. (9 marks)

Answer

b) Books of Prime Entry:

- Sales Day Book:

- Records credit sales transactions. This book captures details of sales made to customers on credit, including the date, customer name, sales amount, and relevant accounts affected.

- Purchases Day Book:

- Records credit purchases transactions. It records purchases made on credit, including the date, supplier name, purchase amount, and relevant accounts impacted.

- Cash Book:

- Records cash receipts and payments. It records all cash transactions, including cash receipts from customers, cash payments to suppliers, and other cash-related activities.

- General Journal:

- Records non-routine or adjusting entries. It is used for transactions that cannot be recorded in the other specialized journals. This includes adjusting entries, corrections, and any other miscellaneous transactions.

- Sales Return Day Book:

- Records returns of goods by customers. This journal captures details of goods returned by customers, including the date, customer name, return amount, and relevant accounts affected.

- Purchases Return Day Book:

- Records returns of goods to suppliers. It records details of goods returned to suppliers, including the date, supplier name, return amount, and relevant accounts impacted.

- Petty Cash Book:

- Records routine or unexpected petty or small cash payments.

(6 day books well explained @ 1.5 marks each = 9 marks)

- Topic: Control accounts and account reconciliations

- Series: JULY 2023

- Uploader: Theophilus