- 20 Marks

Question

PK Limited manufactures two models of heavy-duty cooking racks suitable for restaurant kitchens and other commercial environments. Both models utilize the same types of raw materials and machine hours. No inventories are held. The sales budget for next year is as follows:

| Model | Sales Units | Selling Price (N) |

|---|---|---|

| A | 300,000 | 1,000 |

| B | 140,000 | 1,400 |

The following additional information is provided:

- Cost data:

| Model | Material Cost (N) | Variable Production Conversion Costs (N) |

|---|---|---|

| A | 400 | 100 |

| B | 500 | 300 |

- Fixed production overheads attributable to the manufacture of both models total N40,500,000.

- Production is completed in the machining department, where the production rate per hour is:

- Model A: 12.5 units

- Model B: 10 units

- Machine hours are limited to 30,000 hours.

Required:

a. Using marginal costing principles, calculate the optimal mix (units) of each model that will maximize net profit, and indicate the value of the net profit. (5 Marks)

b. Calculate the throughput accounting ratio for each model and briefly discuss when a product is worth producing under throughput accounting principles. Assume that the variable overhead cost, amounting to N24 million for the chosen product mix in part (a), is fixed in the short term. (7 Marks)

c. Using throughput accounting principles, advise management on the quantities of each model to produce for maximizing profit and provide a projected net profit for PK Limited next year. (5 Marks)

d. Explain two ways in which the concept of ‘contribution’ in throughput accounting differs from its use in marginal costing. (3 Marks)

Answer

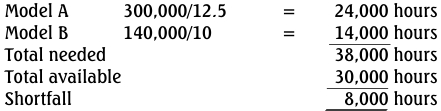

a. The machine hours are insufficient to produce all the budgeted quantity:

Hours needed:

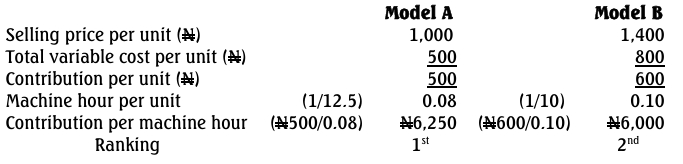

Calculation of contribution and ranking

Calculation of optimal production plan

![]()

The company should therefore produce 300,000 units of Model A and 60,000

units of Model B.

Calculation of projected profit

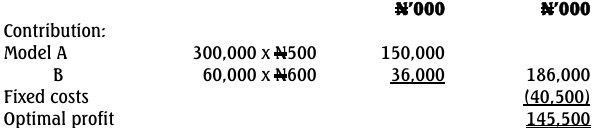

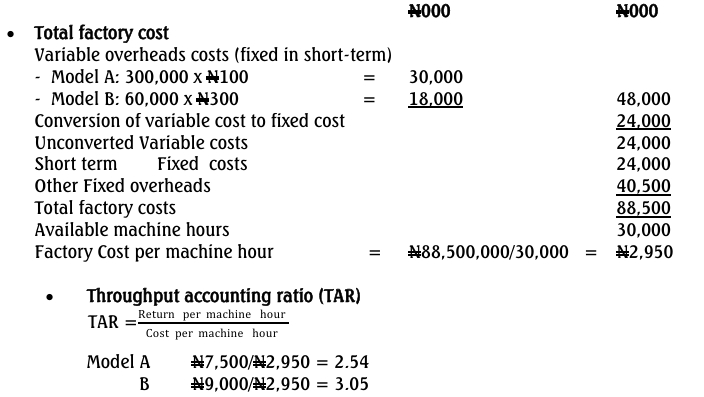

b. Throughput accounting ratio = return per factory hour/cost per factory hour

Return per factory hour = Sales – material costs/usage of bottleneck resource

Cost per machine hour = Total factory cost/Total available machine hours

Recommendation: Products with a TAR greater than 1.0 are worth producing, as the throughput return per hour exceeds the cost per factory hour.

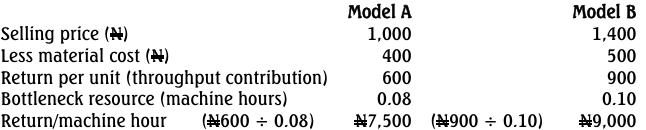

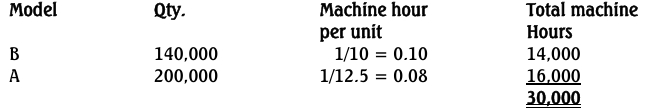

c. Since Model B has a higher return per machine hour than Model A, PK Ltd should produce Model B until it has satisfied the total demand for 140,000bunits. The production mix will therefore be as follows:

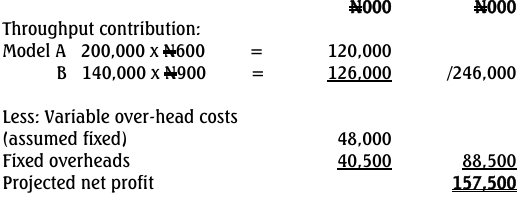

Calculation of projected profit

d. Differences in ‘Contribution’ in Throughput Accounting vs. Marginal Costing

- Variable Costs Considered: Throughput accounting only considers direct material costs as variable, while marginal costing includes direct labor and variable overheads in the calculation of contribution.

- Inventory Focus: Throughput accounting aligns with Just-in-Time philosophy, valuing only materials purchased for immediate production, while marginal costing may include material costs based on usage within the period, irrespective of timing in the production cycle.

- Topic: Decision-making techniques

- Uploader: Kofi