- 20 Marks

Question

Toma Paste Nigeria Limited produces tomato paste which serves as an alternative for an immediate stew for working mothers instead of using fresh tomatoes. For the forthcoming period, the company’s budgeted fixed costs were ₦600,000 and budgeted production and sales were 13,000 units.

The product has the following standard cost:

| Description | Cost (N) |

|---|---|

| Selling price | 500 |

| Materials: 5kg @ ₦40/kg | 200 |

| Labour: 3hrs @ ₦40/hr | 120 |

| Variable overheads: 3hrs @ ₦30/hr | 90 |

Actual results for the period were:

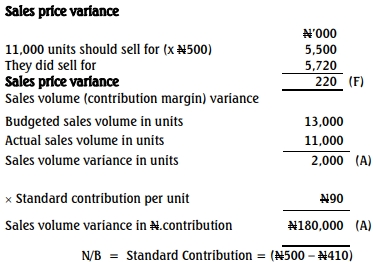

- 11,000 units were made and sold, earning revenue of ₦5,720,000.

- 66,000 kg of materials were bought at a cost of ₦2,970,000, but only 63,000 kg were used.

- 36,000 hours of labour were paid for at a cost of ₦1,422,000.

- The total cost for variable overheads was ₦1,170,700 and fixed costs were ₦400,000.

The company uses marginal costing and values all inventory at standard cost.

Required:

a. Prepare a statement reconciling actual and budgeted profit using appropriate variances. (12 Marks)

b. Recalculate the fixed production overhead variances, assuming the company uses absorption costing. (4 Marks)

c. Discuss possible causes for the labour variances you have calculated. (4 Marks)

Answer

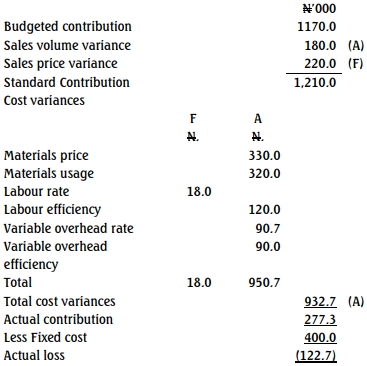

(a) Reconciliation Statement between Budgeted and Actual Profit

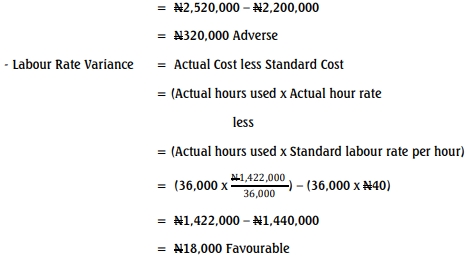

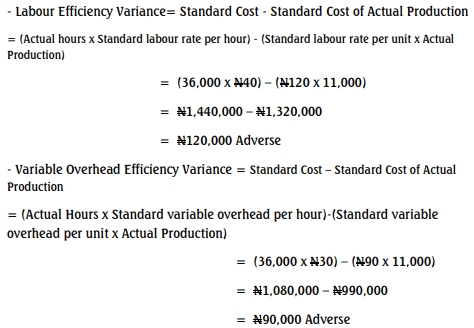

Workings

TOMA PASTE NIGERIA LIMITED

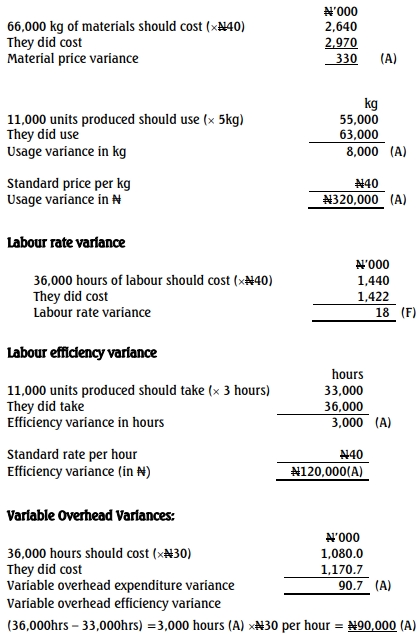

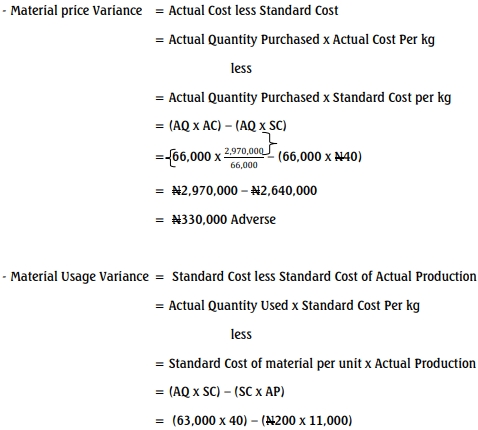

Materials price variance: based on quantities purchased since inventories are

valued at standard cost.

ALTERNATIVE TO COMPUTING VARIANCES

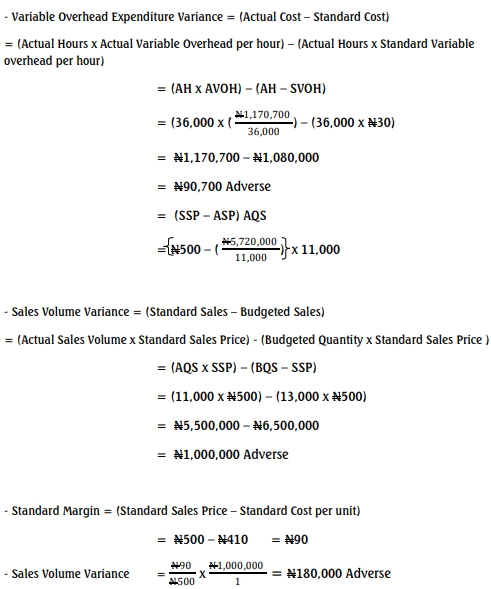

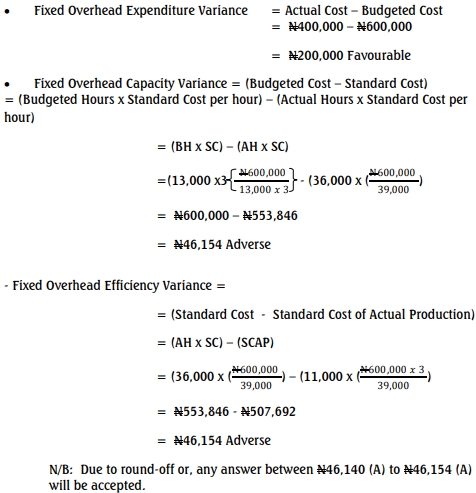

If the company uses absorption costing with a direct labour hour absorption

rate, we can calculate an expenditure, capacity and efficiency variance for

fixed production overheads.

Budgeted absorption rate per hour:

Budgeted labour hours: 13,000 x 3 = 39,000 hrs

Budgeted fixed cost N600,000

Budgeted absorption rate: N600,000 /39,000 = N15.38

ALTERNATIVE SOLUTION

(c) Labour rate

The labour rate variance is favourable indicating a lower rate per hour was

paid than expected. This is perhaps because lower grade of labour were

used during production. Though less likely, it is possible that staff had a

pay cut imposed upon them/decrease in buy rate. Finally, an incorrect or

outdated standard could have been used.

Labour efficiency

This is significantly adverse, indicating staff took much longer than

expected to complete the output. This may relate to the favourable labour

rate variance, reflecting employment of less skilled or experienced staff.

Staff demotivated by a pay cut are also less likely to work efficiently.

It may also relate to the reliability of machinery as staff may have been

prevented from reaching full efficiency by unreliable equipment. Others

include:

- Decrease in machine set up time

- Idle time

- Lack of motivation

- Faulty equipment/Machine breakdown

- Topic: Standard Costing and Variance Analysis

- Series: NOV 2020

- Uploader: Kwame Aikins