- 20 Marks

Question

Lunda Limited manufactures a range of products, many of which have short product lifecycles. Research and development staff recently designed three new products which would be manufactured in a single production cell of the company’s factory. The combined monthly manufacturing overhead costs of the three products are summarized as follows:

| Activity | Costs (₦) |

|---|

| Production set-ups (10 per month) | 200,000 |

| Material movements (400 per month) | 1,800,000 |

| Repairs (4,000 per month) | 3,000,000 |

| Total manufacturing overheads per month | ₦5,000,000 |

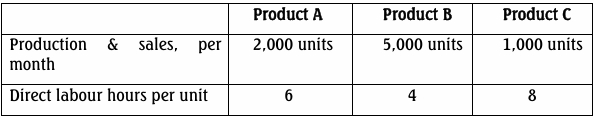

The following information is available concerning the three new products:

The company’s target costing task group expressed the view that the new products

would not be profitable, given the likely market prices and the cost of

manufacturing the products using the proposed design. In response, the product

designers indicated that no design changes were possible in relation to Product A

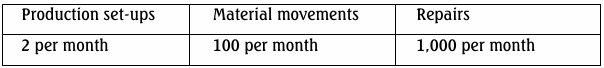

or B, but that changes in the design of Product C would bring about the following

reductions in the amount of monthly activity involved in manufacturing that

product without compromising either the quality or quantity of output:

Calculate the reduction in the cost per unit of each of the three products

which would occur as a result of the design changes to Product C, in each of

the following circumstances:

• If manufacturing overheads are allocated to products using activitybased costing (ABC);

• If manufacturing overheads are allocated to products on a direct labour

hour basis. (10 Marks)

b. Discuss the view that an ABC system is essential for the implementation of

target costing. Use the case of Lunda Limited to illustrate your answer.

(5 Marks)

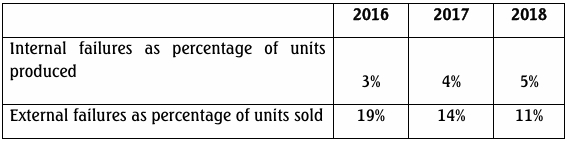

c. The following data relates to another product of Lunda

Comment on the trends in this data set. (5 Marks)

Answer

a) Cost driver rates:

• Production set-ups ₦200,000/10 = ₦20,000 each

• Materials movements ₦1,800,000/400 = ₦4,500 each

• Repairs ₦3,000,000/4,000 = ₦750 each

Cost savings (reduction in cost) as a result of the design changes:

= (2 × ₦20,000) + (100 × ₦4,500) + (1,000 × ₦750) = ₦1,240,000

If ABC is used, all of the cost savings will be traced directly to Product C. Hence,

the cost reductions will be:

• Product A: NIL

• Product B: NIL

• Product C: ₦1,240,000/1,000 = ₦1,240 per unit.

If overheads are allocated on a direct labour hour basis then the cost saving will

be spread among all three products in proportion to their labour content:

• Total DLH = (2,000 × 6) + (5,000 × 4) + (1,000 × 8) = 40,000 DLH

• Cost saving = ₦1,240,000/40,000 DLH = ₦31 per DLH

• Product A: ₦31 × 6 = ₦186 per unit

• Product B: ₦31 × 4 = ₦124 per unit

• Product C: ₦31 × 8 = ₦248 per unit

77

b) When the anticipated cost of manufacturing a product according to a particular

design is unacceptably high, a ‘target’ for cost reductions is set. These cost

reductions must be brought about by design changes to the product. Otherwise

the product cannot be manufactured.

• In the case of Luanda an ABC system is essential in order to ensure that cost

savings made as a result of changing the design of Product C are fully

reflected in the cost of the product.

• For example, if overheads are allocated on a labour hour basis then it

appears that the cost of Product C has been reduced by only ₦248 per unit.

Management may well decide that this is an inadequate reduction to justify

production of the product. ABC analysis is needed in order to show that the

cost saving is actually a much more substantial ₦124 per unit.

• Similarly, the ABC system rightly shows that there has been no change in the

cost of Products A or B (because there have been no design changes).

However, the non-ABC allocation gives the completely false impression that

the unit costs of these products have been reduced. Management might

decide that these apparent cost savings constitute sufficient grounds to begin

producing these products, even though in reality nothing has changed.

• ABC is used to get a better grasp on costs, allowing companies to form a more

appropriate pricing strategy.

• It is used for product profitability analysis.

• It ensures the cost estimates used are realistic.

• It uses overhead cost estimation

• It helps in assessing the activities that limit the production of products.

c) External failure rates have decreased considerably over time. Admittedly, this

has to some extent been accompanied by an increase in the rate of internal

failure. However, the overall trend is a positive one for two reasons:

1) The combined (internal plus external) failure rate is decreasing

2) An internal failure is less costly than an external failure. For example, an

external failure creates costs (such as loss of customer goodwill and

additional transportcosts to and from the customer’s premises) which are

avoided if the defective item is detected internally by Luanda Ltd.

It seems likely that Luanda has made some efforts to increase the effectiveness of

its internal quality control procedures. Thus, the proportion of defective items

detected internally is increasing (hence the growing internal failure rate) but the

proportion of defective items reaching the customer is decreasing.

78

It is disturbing that the vast majority of failures are still being detected by

customers rather than by the company’s internal quality procedures. As well as

trying to improve the overall level of quality, the company should try to improve

much further the effectiveness of its internal quality control procedures.

- Tags: ABC, Cost reduction, Direct Labour Hours, Manufacturing Overheads, Target costing

- Level: Level 2

- Topic: Costing Systems and Techniques

- Series: NOV 2019

- Uploader: Kofi