- 20 Marks

Question

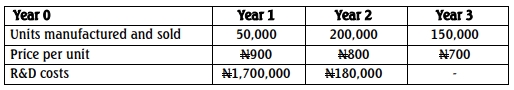

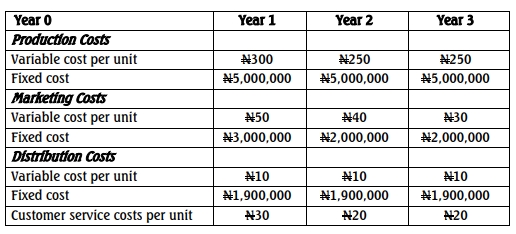

Tadesco Limited manufactures Compact Disks. It is planning to introduce a new model and production will begin very soon. It expects the new product to have a life cycle of three years and the following costs have been estimated.

You are required to:

a. Explain Life Cycle Costing and state what distinguishes it from traditional costing technique. (10 Marks)

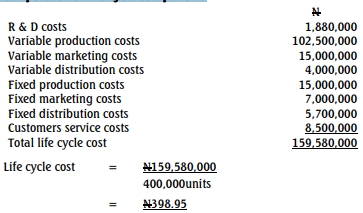

b. Calculate the cost per unit over the whole life cycle and comment on the price to be charged. (10 Marks)

Answer

a) Life Cycle Costing

Life cycle costing is a cost accounting system which tracks and accumulates costs and revenues attributable to each product over the entire product’s life cycle. The product’s life cycle costs are incurred from the design stage, development to market launch, production, marketing and sales, and finally to its eventual withdrawal from the market. The product’s life cycle by summary involves:

i) Development costs ii) Introduction costs iii) Growth costs iv) Maturity costs v) Acquisition costs vi) Product distribution costs vii) Maintenance costs viii) Operation costs ix) Training costs x) Inventory costs xi) Decline costs xii) Disposal costs

The differences between Life Cycle Costing and Traditional Costing Methods are as follows:

i. Traditional costing does not relate research and development costs to the products that caused them. ii. Traditional costs accumulation systems usually total all non-production costs and record them as period costs. iii. Traditional costing system does not consider the life span of a product. iv. Traditional costing system does not consider the decline stage of a product. v. Traditional costing system does not consider the end of life costs or withdrawal costs. vi. Traditional costing system does not analyse the cost/benefits of each option at each stage.

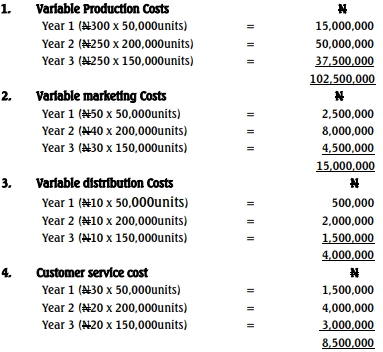

b. Computation of Life Cycle Cost per unit

Working Notes

- Topic: Cost Management Strategies

- Series: NOV 2016

- Uploader: Kwame Aikins