- 15 Marks

Question

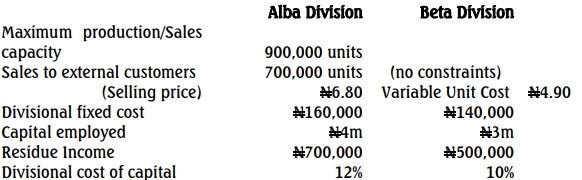

Zona Tango (ZT) plc is a holding company with four divisions, including Alba and Beta Divisions. Alba Division produces a component that it sells externally, and can also transfer to other divisions within the group.

Beta Division uses the components from Alba Division as a raw material for its final product. The division can also obtain the components from external suppliers. The components, when obtained from Alba Division, undergo further processing at a cost of ₦4.50 per unit before they are sold to the external market.

The Board of Directors, in order to implement a new Appraisal Review, has set up a performance scheme for the divisional managers. A performance target for the next financial year has been set, and the following budgeted information relating to the two divisions has been prepared:

Beta Division has asked Alba Division to quote a transfer price for units of the components.

Required:

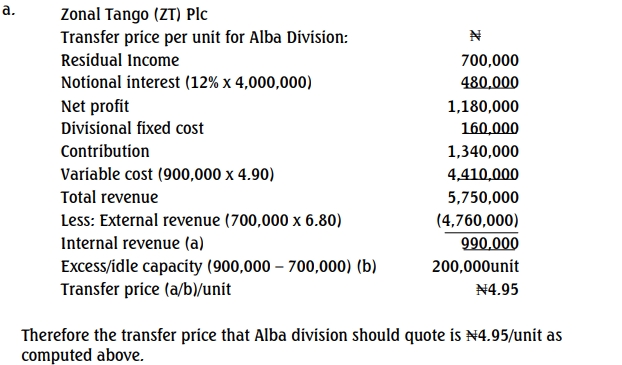

a. Calculate the transfer price per unit which Alba Division should quote to Beta Division in order that its budgeted residual income target will be achieved. (3 Marks)

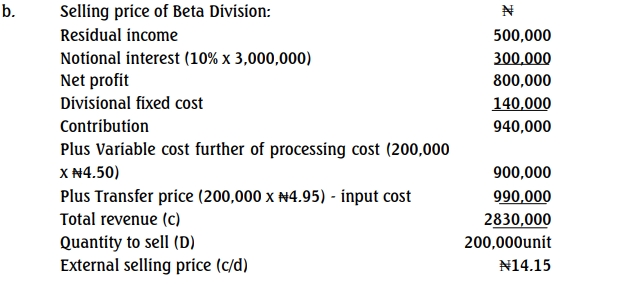

b. Calculate the selling price per unit which Beta Division should quote to the external market in order that its budgeted residual income target will be achieved, based on the transfer price quotation. State clearly your assumptions. (3 Marks)

c. Explain why the transfer price calculated in (a) may lead to sub-optimal decision-making from the point of view of ZT plc, taken as a whole. (5 Marks)

d. In what circumstances will a negotiated transfer price be used instead of a market-based price? (4 Marks)

Answer

c. Sub-optimal Decision-making Due to Transfer Price:

The transfer price calculated in (a) may lead to sub-optimal decision-making for ZT plc because Alba Division is charging Beta Division more than the variable cost of ₦4.90 per unit. This inflated transfer price increases the cost for Beta Division, potentially reducing its competitiveness in the external market. From the perspective of ZT plc as a whole, setting a transfer price higher than the variable cost can lead to inefficiencies, as the group may not maximize its overall profits.

d. Circumstances for Negotiated Transfer Price:

A negotiated transfer price is used in the following circumstances:

- Absence of an External Market Price: When there is no external market for the product or service, managers must negotiate a fair price internally.

- Custom or Unique Products: If the product being transferred is unique to the company, there may not be a comparable market price, necessitating negotiation.

- Excess Capacity: If the supplying division has excess capacity, it may be willing to negotiate a lower transfer price to utilize its resources.

- Temporary Market Conditions: When market prices are volatile or influenced by short-term factors, a negotiated transfer price can provide stability.

- Topic: Divisional Performance Measurement

- Series: MAY 2024

- Uploader: Theophilus