- 15 Marks

Question

CAROSSI Limited makes quality wooden products such as tables, chairs, benches, and doors. Historically, the company has used mainly financial performance measures to assess the performance of the company as a whole. The company’s Chief Executive Officer has just been informed of the ‘Balanced Scorecard Approach’ and is eager to learn more.

CAROSSI Limited has two Divisions X and Y, each with its own cost and revenue streams. Each Division is managed by a divisional manager who has the power to make all investment decisions within the Division. The cost of capital for both Divisions is 15 percent. Historically, investment decisions have been made by calculating the Return on Investment (ROI) of any opportunities, and presently, the return on investment of each Division is 18 percent.

A recently appointed manager for Division X strongly feels that using Residual Income (RI) to make investment decisions would result in better ‘goal congruence’ throughout the organisation.

Investment Details for Each Division:

| Division X | Division Y | |

|---|---|---|

| Capital required for investment (₦m) | 88.2 | 46.0 |

| Revenue generated from investment (₦m) | 46.4 | 28.1 |

| Net profit margin (%) | 30 | 35 |

The company is seeking to maximise shareholders’ wealth.

Required: a. Describe the Balanced Scorecard Approach to performance measurement. (8 Marks)

b. Determine both the return on investment and residual income of the new investment for each of the two divisions. Comment on these results and take into consideration the manager’s views about residual income. (7 Marks)

Answer

a) Balanced Scorecard Approach: The Balanced Scorecard (BSC) is a strategic performance management framework that incorporates financial and non-financial metrics to provide a comprehensive view of an organization’s performance. The BSC evaluates performance from four perspectives:

- Financial Perspective: Focuses on financial outcomes like profitability, return on investment, and economic value.

- Customer Perspective: Measures customer satisfaction, market share, and customer retention to ensure customer needs are being met.

- Internal Process Perspective: Focuses on internal operational processes that drive customer satisfaction and financial outcomes, aiming to improve efficiency and quality.

- Learning and Growth Perspective: Emphasizes employee skills, knowledge, and development, fostering innovation and organizational growth.

The BSC helps in aligning organizational activities to the vision and strategy, providing a balanced view of performance that encompasses both long-term and short-term objectives.

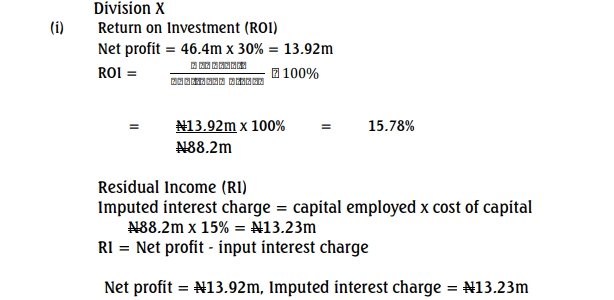

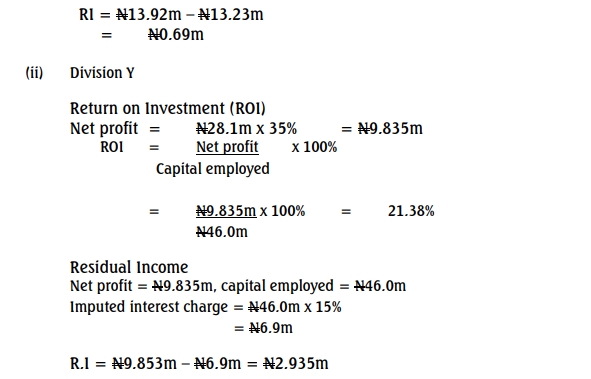

b) Return on Investment and Residual Income:

Comment:

- Return on Investment (ROI): Division Y has a higher ROI of 21.39% compared to Division X’s 15.78%. The ROI for Division Y exceeds the target ROI of 18%, making it a more favorable investment option.

- Residual Income (RI): Division X has a lower RI (₦0.69 million) compared to Division Y (₦2.935 million). Since RI considers the cost of capital, it provides a better indication of the value added by each division. In this case, both divisions generate positive RIs, indicating value addition, but Division Y performs better.

- The manager’s view of using RI aligns better with goal congruence, as RI encourages managers to invest only if it adds value above the cost of capital, preventing suboptimal decisions that might appear profitable under ROI but do not add value to the company as a whole.

- Tags: Balanced Scorecard, Goal Congruence, Investment Appraisal, Residual Income, ROI

- Level: Level 2

- Topic: Balanced Scorecard

- Series: MAY 2015

- Uploader: Theophilus