- 20 Marks

Question

IAS 33 requires publicly-traded companies to calculate a diluted Earning Per Share (EPS) in addition to their basic EPS for the current year (with a comparative diluted EPS for the previous year), allowing for the effect of all dilutive potential ordinary shares.

Required: a. Explain the purpose of the dilutive measures and discuss THREE types of dilution. (8 Marks)

b. The statement of financial position (extracts) for Ebonyi Limited for the year ended December 31, 2022 is as follows:

| Equity and Liabilities | N’000 |

|---|---|

| Ordinary shares (N1 each) | 12,000 |

| Retained earnings | 36,000 |

| Equity | 48,000 |

| Non-current liabilities: | |

| 5% convertible loan notes | 4,000 |

Additional information: i. As at December 31, 2022, there has been no new issue of shares or loan notes for several years.

ii. The loan notes are convertible into ordinary shares in year 2023 or year 2024 at the following rates.

iii. At 30 shares for every N100 of loan notes if converted at December 31, 2023.

iv. At 25 shares for every N100 of loan notes if converted at December 31, 2024.

v. Company income tax rate is 30% on profit.

Required: Calculate the basic EPS and diluted EPS for year 2022. (8 Marks)

c. IAS 33 allows an entity to disclose an alternative measure of EPS in addition to the EPS calculated.

Required: Identify and explain TWO conditions that are required in accordance with IAS 33 to be complied with where an alternative measure of EPS is shown in the financial statements of an entity. (4 Marks)

Answer

a. The purpose of diluted EPS measures is to provide a warning to investors about potential decreases in EPS if all possible shares were issued. It represents the maximum potential dilution of current EPS, reflecting hypothetical share issuance scenarios under the most dilutive conditions. The three types of dilution are:

- Convertible Instruments: Adjust earnings for saved interest (net of tax) and adjust shares for the increase due to conversion.

- Options to Acquire Ordinary Shares: Adjust shares for the effect of share options or warrants, reflecting the number issued at no consideration.

- Contingently Issuable Shares: Include shares that could be issued based on future earnings or other performance metrics if criteria are met.

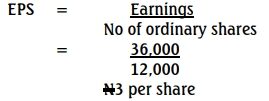

b. Basic Earning Per Share (EPS) for the year ended December 31, 2022

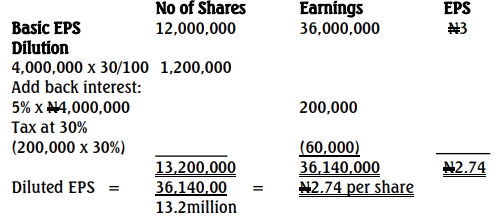

Diluted EPS for the year ended December 31, 2022

c. Conditions for Alternative EPS:

- A reconciliation of the alternative EPS with the amount in the statement of profit or loss.

- The alternative EPS must use the same weighted average share number as IAS 33 calculations.

- Topic: Earnings Per Share (IAS 33)

- Uploader: Kofi