- 10 Marks

Question

On April 1, 2017, Higherhigher Limited acquired 60% of the equity share capital of Lowerlower Limited in a share exchange of two shares in Higherhigher for three shares in Lowerlower. The issue of shares has not yet been recorded by Higherhigher Limited. At the date of acquisition, shares in Higherhigher had a market value of N6 each.

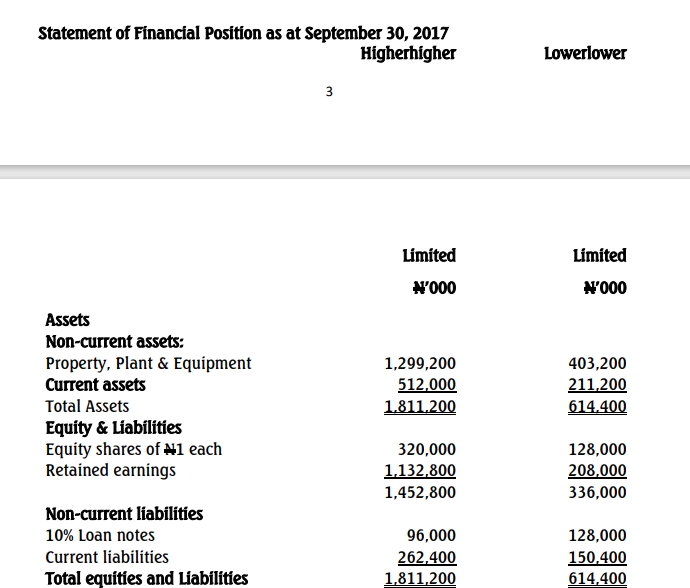

Below is the summarised draft financial statements of both companies:

| Statement of Profit or Loss and other Comprehensive Income for the year ended September 30, 2017 | Higherhigher Limited (N’000) | Lowerlower Limited (N’000) |

|---|---|---|

| Revenue | 2,720,000 | 1,344,000 |

| Cost of sales | (2,016,000) | (1,024,000) |

| Gross profit | 704,000 | 320,000 |

| Distribution costs | (64,000) | (64,000) |

| Administrative expenses | (192,000) | (102,400) |

| Finance costs | (9,600) | (12,800) |

| Profit before tax | 438,400 | 140,800 |

| Income tax expense | (150,400) | (44,800) |

| Profit for the year | 288,000 | 96,000 |

Additional information:

- The fair value of Lowerlower Limited’s assets was equal to their carrying amounts, except for a plant with a fair value of N64m in excess of the carrying amount, which had a remaining life of five years. Straight-line depreciation was used. Lowerlower has not adjusted the carrying amount of its plant.

- Sales from Lowerlower to Higherhigher after the acquisition were N256m, with a 40% mark-up. Higherhigher sold N166.4m of these goods by September 30, 2017.

- Lowerlower’s receivables include N19.2m due from Higherhigher, which didn’t agree with Higherhigher’s payables due to cash in transit of N6.4m.

- Non-controlling interest is measured at fair value. The fair value of the goodwill attributable to the non-controlling interest is N48m.

- Consolidated goodwill was not impaired.

You are required to prepare:

- The consolidated statement of profit or loss and other comprehensive income for the year ended September 30, 2017.

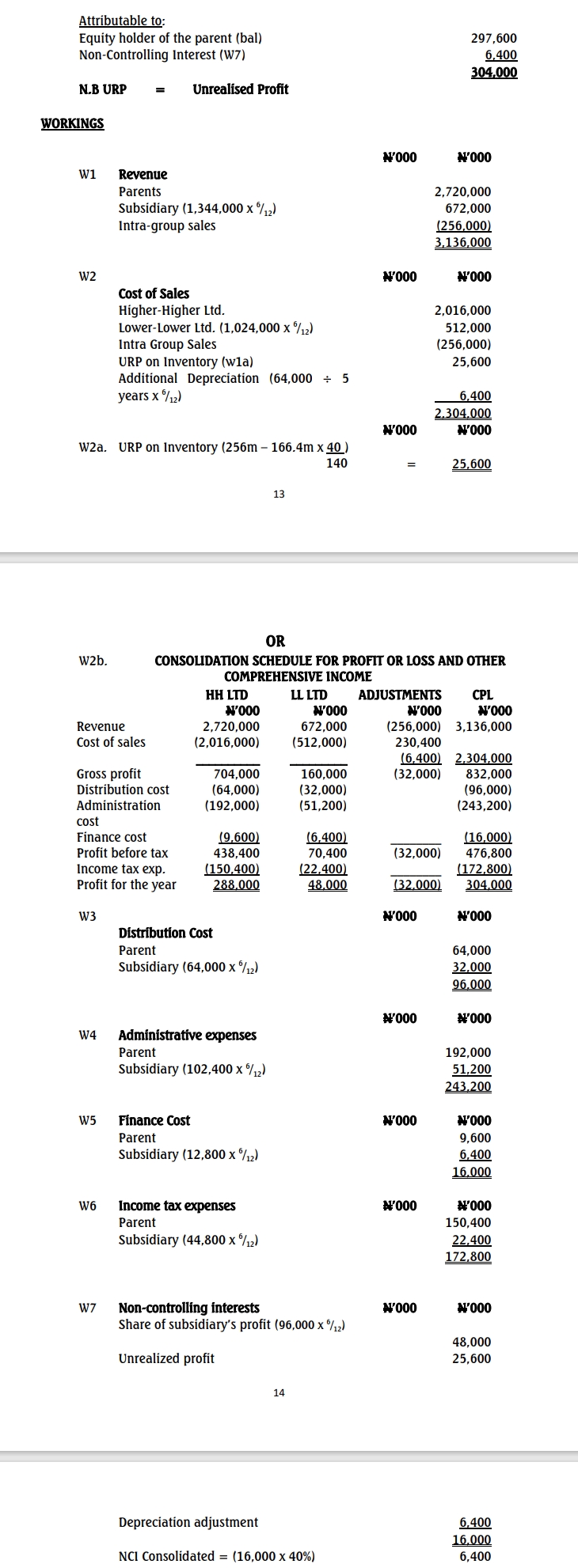

Answer

HIGHER-HIGHER LTD GROUP

Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended September 30, 2017

| Particulars | N’000 |

|---|---|

| Revenue (W1) | 3,136,000 |

| Cost of sales (W2) | (2,304,000) |

| Gross profit | 832,000 |

| Distribution costs (W3) | (96,000) |

| Administrative expenses (W4) | (243,200) |

| Finance cost (W5) | (16,000) |

| Profit before tax | 476,800 |

| Income tax expense (W6) | (172,800) |

| Profit for the year | 304,000 |

- Topic: Consolidated Financial Statements

- Series: NOV 2017

- Uploader: Olaoluwa