- 15 Marks

Question

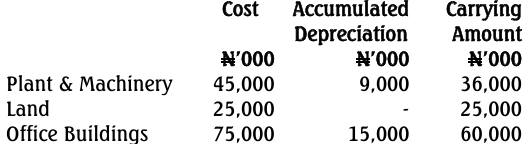

Skelewu Nigeria Limited owns the following Property, Plant and Equipment as at 31 December 2011.

Additional pieces of information are:

(i) Plant and Machinery are depreciated on a straight-line basis over 5 years. The plant & machinery was acquired on 1 January 2011.

(ii) Land is not depreciated.

(iii) Buildings are depreciated on a straight-line basis over 25 years.

(iv) Depreciation on office buildings is not deductible for tax purposes, but for the plant and machinery; tax deductible is granted over a period of 3 years in the ratio 50:30:20 percent of cost consecutively.

(v) The accounting profit before tax amounted to N15,000,000 for the 2012 financial year and N20,000,000 for the year 2013. These figures include non-taxable revenue of N4,000,000 in year 2012 and N5,000,000 in year 2013.

(vi) Skelewu Nigeria Limited had a tax loss on 31 December 2011 of N12,500,000. The tax rate for year 2011 was 35% and 30% for each of the years 2012 and 2013.

Required:

a. In accordance with IAS 12 on Income Taxes, differentiate between Current Tax and Deferred Tax. (2 Marks)

b. Prepare the Deferred Tax Account for the year ended 31 December 2013. (10 Marks)

c. Advise the Directors of Skelewu Nigeria Limited on the reasons why it is necessary to recognize or make provision for Deferred Tax in the company’s Financial Statements. (3 Marks)

Answer

(a) Current Tax vs. Deferred Tax

Current Tax:

- Current tax refers to the amount of income tax payable or recoverable in respect of the taxable profit or loss for the current period. It is calculated based on the tax laws and rates applicable at the end of the reporting period.

Deferred Tax:

- Deferred tax arises from temporary differences between the carrying amount of an asset or liability in the statement of financial position and its tax base. It represents the tax effect of these differences that will result in future tax payments or benefits.

(b) Deferred Tax Account for the Year Ended 31 December 2013

1.

Workings:

Plant

2. Income Tax Expense

(c) Reasons for Recognizing Deferred Tax

- Obligation Recognition: Deferred tax provides a clearer picture of future tax obligations and enhances the accuracy of the financial statements. It reflects the potential increase in taxes payable due to timing differences.

- Profit Realization: By recognizing deferred tax, Skelewu Nigeria Limited ensures that profits are not overstated, thereby preventing overpayment of dividends and misrepresentation of financial health.

- Regulatory Compliance: Recognizing deferred tax is essential for compliance with accounting standards (IAS 12) and reflects the company’s adherence to financial reporting regulations.

- Tags: Current Tax, Deferred Tax, Depreciation, Plant and Equipment, Property

- Level: Level 2

- Topic: Property, Plant, and Equipment (IAS 16)

- Series: NOV 2014

- Uploader: Kofi