- 30 Marks

Question

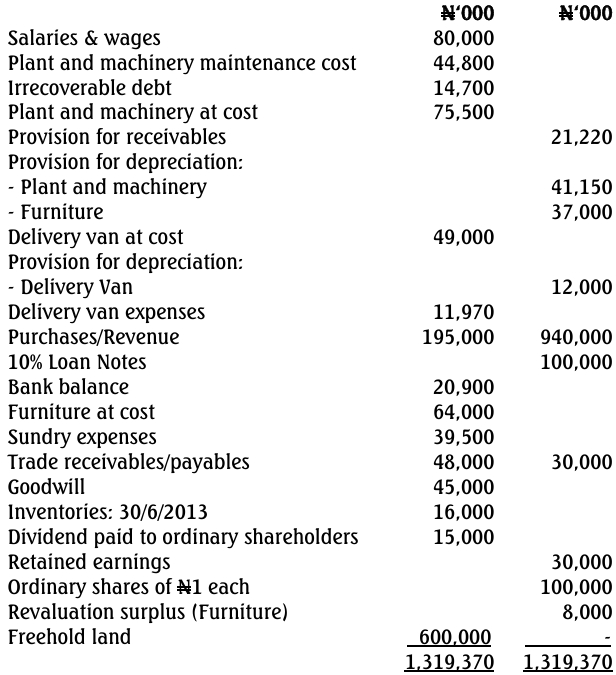

The Trial Balance of Excellent Plc. as at 30 June 2014 is as follows:

The following notes are relevant:

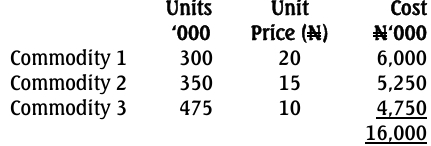

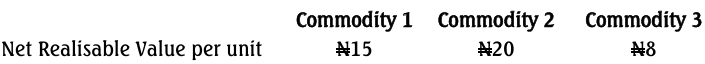

i. Inventories as at 30/6/2013:

The net realisable values of these commodities per unit are as follows:

ii. Inventories on 30 June 2014 amounted to N9,000,000

iii. Prepaid salaries and wages were N10,000,000

iv. Included in the plant and machinery maintenance cost was depreciation of

N14,800,000.

v. The allowances for receivables are no longer required. The outstanding 10%

loan notes interest was paid on 30 June 2014 and this has not been accounted

for. The fair value of goods is N40,000,000 at the end of the year.

vi. The value in use of delivery van for the year 30 June 2014 is N31,000,000. The

prevailing market interest rate is 21% per annum and the Discounting Factor for

this year is 0.8264.

vii. The fair value of delivery van at an arm’s length transaction as at 30 June 2014

was N28,000,000 and the cost to sell was N2,000,000. All non-current assets

were depreciated at 10% per annum on reducing balance basis.

viii. Current tax provision for the year is N165,000,000.

Required:

a. Identify any FOUR of the cost items that are EXCLUDED in the valuation of inventories under IAS 2. (4 Marks)

b. Calculate the following:

- (i) Value of opening inventories to be included in the Statement of Profit or Loss and Other Comprehensive Income. (2 Marks)

- (ii) The present value in the use of delivery van (1 Mark)

- (iii) The fair value and recoverable amount of delivery van (2 Marks)

- (iv) The carrying amount and impairment if any on delivery van (2 Marks)

c. Prepare the Statement of Profit or Loss and Other Comprehensive Income (OCI) and Statement of Changes in Equity for the year ended 30 June 2014. (11 Marks)

d. Prepare the Statement of Financial Position as at 30 June 2014. (8 Marks)

Show all relevant workings

Answer

(a) Excluded costs in IAS 2 on inventories include the following:

- Abnormal amount of wasted materials, labour, or other production costs.

- Storage costs, unless those costs are necessary in the production process before a further production stage.

- Administrative overheads that do not contribute to bringing inventories to their present location or condition.

- Selling costs.

bi.

(ii) Present Value in Use of Delivery Van

- Value in use = N31,000,000.

(iii) Fair Value and Recoverable Amount of Delivery Van

- Fair value of delivery van = N28,000,000.

- Cost to sell = N2,000,000.

- Recoverable amount = higher of fair value less cost to sell (N26,000,000) and value in use (N31,000,000).

- Therefore, the recoverable amount is N31,000,000.

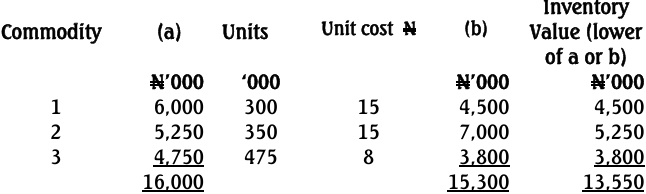

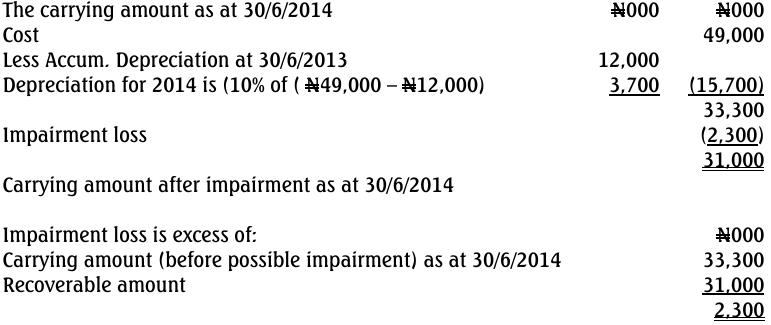

(iv) Carrying Amount and Impairment of Delivery Van

- Carrying amount calculation:

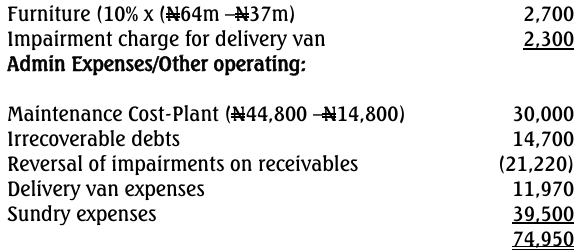

c.

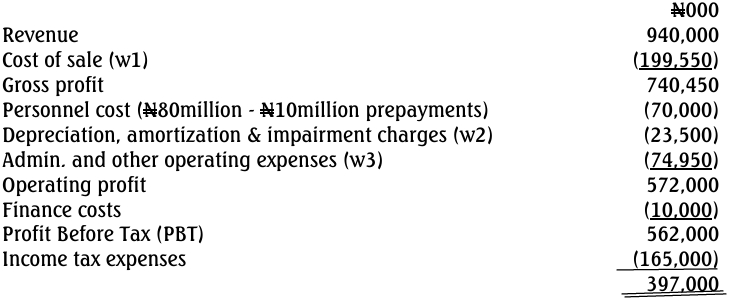

EXCELLENT PLC

Statement of Profit or Loss and Other Comprehensive Income for the year ended

30 June 2014

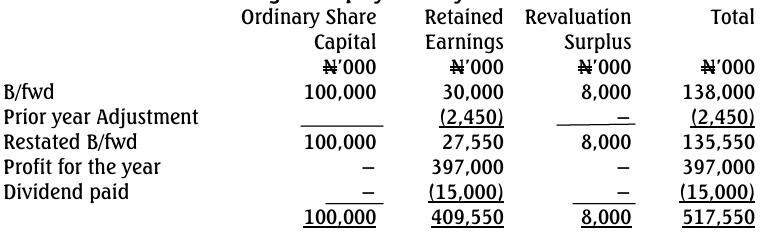

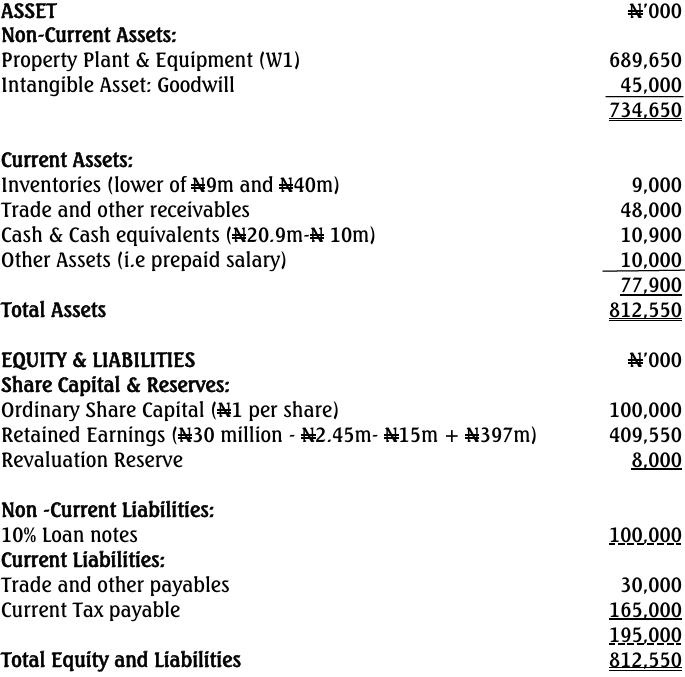

EXCELLENT PLC.

Statement of Changes in Equity for the year ended 30 June 2014

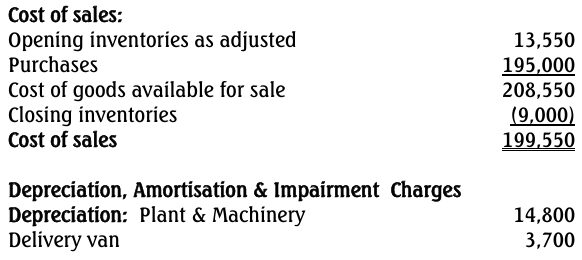

WORKINGS:

EXCELLENT PLC.

Statement of Financial Position as at 30 June 2014

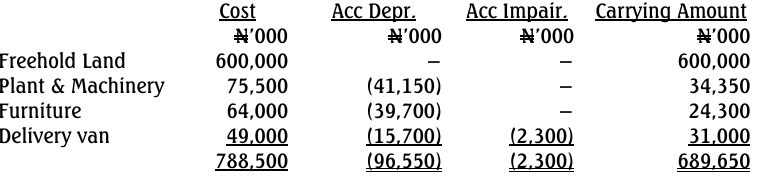

WORKINGS:

1. Statement of Changes in Property, Plant and Equipment

- Uploader: Kofi