- 20 Marks

Question

a. The Conceptual Framework for Financial Reporting sets out the concepts that underlie the preparation and presentation of financial statements and considers the various users of these financial statements.

Required:

Identify and discuss the information needs of the different users of financial statements. (10 Marks)

b. The Companies and Allied Matters Act (CAMA) 2020 is the primary source of company law that establishes the requirements for financial reporting by all companies in Nigeria.

Required:

Briefly explain FIVE issues that must be contained in a directors’ report in accordance with CAMA 2020. (5 Marks)

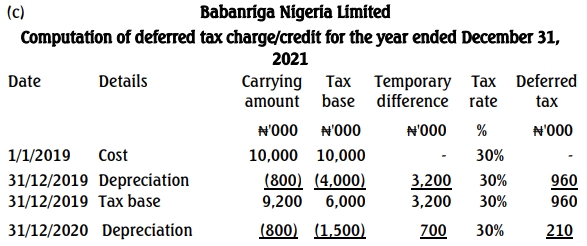

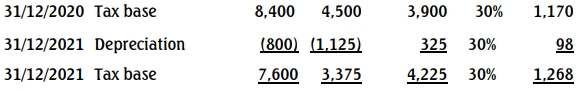

c. Babanriga Nigeria Limited acquired a factory machine for N10 million on January 1, 2019. The machine had an estimated life and residual value of 10 years and N2 million, respectively, and is depreciated on a straight-line basis. In lieu of depreciation, the tax authority allows a tax expense of 40% of the cost of this type of machine to be claimed against income tax in the year of purchase, with 25% per annum of its tax base subsequently on a reducing balance basis. The prevailing company income tax rate is 30%.

Required:

Calculate the deferred tax charge or credit which will be recorded in Babanriga Nigeria Limited’s Statement of Profit or Loss and Other Comprehensive Income for the year ended December 31, 2021, and the deferred tax balance in the Statement of Financial Position at that date. (5 Marks)

Answer

Part a:

Users of Financial Statements and Their Information Needs

- Shareholders/Investors:

- Information Need: They are concerned with the company’s financial performance and stability to assess returns on their investments and the risk involved.

- Purpose: Helps in determining dividend prospects and capital appreciation.

- Government and Regulatory Bodies:

- Information Need: Require data to regulate company activities, determine taxes, and analyze economic indicators.

- Purpose: Ensures compliance with legal requirements and aids in economic policy formulation.

- Employees:

- Information Need: Interested in the profitability and stability of the employer to assess job security, potential salary increments, and retirement benefits.

- Purpose: Aids in career planning and financial stability assessment.

- Suppliers and Creditors:

- Information Need: Require insights into the company’s liquidity and financial health to assess its ability to fulfill payment obligations.

- Purpose: Helps decide whether to extend credit and manage risk.

- Customers:

- Information Need: Concerned with the company’s going concern status, especially if they rely on the company for essential goods or services.

- Purpose: Assures continuity in the supply chain and reliability of business relationships.

- Lenders:

- Information Need: Focus on solvency and liquidity to evaluate the company’s ability to repay loans and interest.

- Purpose: Essential for credit risk assessment and loan decisions.

- Public and Community:

- Information Need: Interested in the company’s social impact, environmental footprint, and contributions to the community.

- Purpose: Evaluates the company’s role in corporate social responsibility.

- Regulators:

- Information Need: Require information to ensure compliance with laws, industry regulations, and accounting standards.

- Purpose: Ensures the company operates within legal frameworks and maintains transparent financial practices.

Part b:

Content of a Directors’ Report in Accordance with CAMA 2020

- Business Development: A summary of the company’s performance, including growth and challenges within the fiscal year.

- Dividend Recommendations: Proposed dividends for shareholders and any allocations to reserves.

- Director Information: Names and details of directors serving during the year, including any appointments or resignations.

- Changes in Non-Current Assets: Details of significant changes in the value of non-current assets.

- Future Developments: Insights into potential future projects or strategic directions, reflecting the company’s growth outlook.

- Market Value of Land: Discrepancies between market and book values of land, if significant.

- Donations and Contributions: Disclosure of charitable donations, specifying beneficiaries if applicable.

- Research and Development: Outline of R&D activities undertaken during the year, if applicable.

- Topic: Conceptual Framework for Financial Reporting

- Series: MAY 2023

- Uploader: Theophilus