- 20 Marks

Question

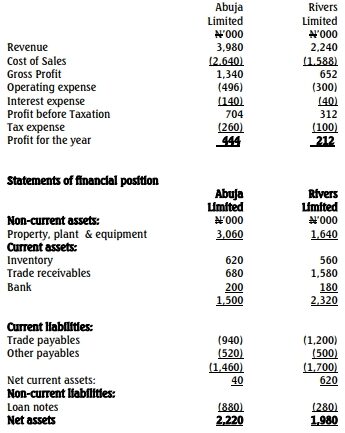

Ibadan Nigeria Limited is considering acquiring a suitable private limited liability company. The board of directors engaged a financial consultant to analyze the financial position of two companies, Abuja Limited and Rivers Limited, which are both receptive to the acquisition. The draft financial statements of the two companies are as follows:

Statements of Profit or Loss

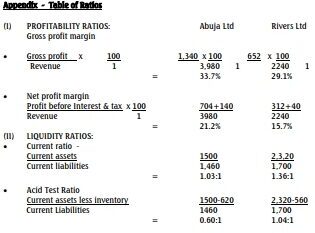

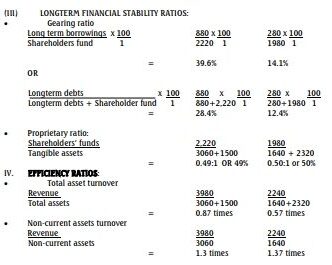

a. Draft a report to the chairman of the board of directors of Ibadan Limited to assess the financial performance and position of the two companies using the following specific ratios: (12 Marks) i. Profitability ratios: Gross profit percentage and net profit margin. ii. Liquidity ratios: Acid test ratio, current ratio, trade receivable period. iii. Long-term financial stability ratios: Gearing ratio and proprietary ratio. iv. Efficiency ratios: Total asset turnover and non-current asset turnover.

b. Explain the limitations of ratio analysis and further information that may be useful to the board of directors when making the acquisition decision. (8 Marks)

Answer

a. XYZ Consultants and

Chartered Accountants

May 15, 2018

The Chairman

Board of Directors

Ibadan Limited,

Nigeria.

Dear Sir,

ANALYSIS OF FINANCIAL PERFORMANCE AND POSITION OF ABUJA LIMITED AND

RIVERS LIMITED

From the computed ratios stated in the appendix. The financial

performance of Abuja Ltd, is better than that of Rivers Ltd as explained below:

The profitability performance of the two companies shows that Abuja Ltd is

better in terms of gross profit percentage and net profit margin;

The outstanding performance of Abuja Ltd in terms of profitability may however

be due to good assets turnover recorded by the company;

However, the liquidity ratios of Rivers Ltd appeared better than that of Abuja

Ltd which means that Rivers Ltd may be able to meet its current financial

obligation better than Abuja Ltd; and

The two companies (Abuja Ltd and Rivers Ltd) are lowly geared which are good

indicators of strong long term financial stability by both companies.

CONCLUSION

However, in view of the fact that Abuja Ltd will be capable of utilising its

resources more efficiently and considering the fact that it is a highly profitable

company with a fairly suitable liquidity position. We would advise that the

directors of Ibadan Ltd should acquire Abuja Ltd

XYZ

FINANCIAL CONSULTANTS AND CHARTERED ACCOUNTANTS

b. Limitations of Ratio Analysis and Additional Considerations

Limitations:

- Heterogeneity: Different business operations may affect comparability.

- Accounting Methods: Variations in accounting policies can distort ratios.

- Lack of Forward-Looking Information: Ratios are historical and may not predict future performance.

- Impact of Inflation: Ratios based on historical cost may not reflect current conditions.

- Subjectivity: Ratios involve judgment and may be influenced by management bias.

Additional Information Needed:

- Profit Forecasts and Cash Budgets: For future performance expectations.

- Current Market Value of Assets: To assess fair valuation.

- Industry Conditions and Risks: For assessing the external environment.

- Quality of Management: To evaluate the operational capabilities.

- Tax Implications: Potential effects on net income and cash flows.

- Uploader: Kofi