- 20 Marks

Question

a. Explain the following, stating their importance to investors in evaluating financial performance:

i. Earnings per share (EPS)

ii. Price earnings ratio (PE ratio)

(6 Marks)

b. The issued and fully paid share capital of Almond Nigeria Limited, which has remained unchanged since the date of incorporation until the financial year ended March 31, 2015, includes the following:

- 2,400,000,000 ordinary shares

- 600,000,000 6% participating preference shares of N1 each

The company has been operating at a profit for a number of years. As a result of a very conservative dividend policy in previous years, there is a large accumulated profit balance on the statement of financial position.

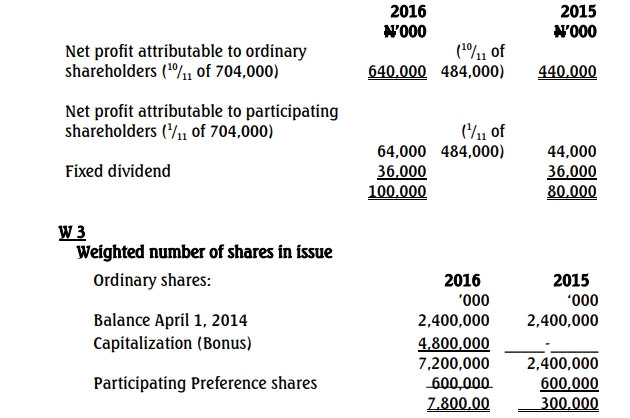

On July 1, 2015, the directors decided to issue two bonus shares to all ordinary shareholders for every one previously held.

The following is an extract of the group statement of profit or loss and other comprehensive income for the year ended March 31, 2016:

Almond Nigeria Limited

Extract of Group Statement of Profit or Loss and Other Comprehensive Income for the Year Ended March 31, 2016

| 2016 | 2015 | |

|---|---|---|

| Profit for the year | N740,000 | N540,000 |

| Other comprehensive income | – | (20,000) |

| Total comprehensive income | N740,000 | N520,000 |

| Total comprehensive income attributable to: | ||

| Owners of parent | N680,000 | N480,000 |

| Non-controlling interest | N60,000 | N40,000 |

| Total comprehensive income | N740,000 | N520,000 |

The following dividends have been paid or declared at the end of the period:

| Dividend Type | 2016 | 2015 |

|---|---|---|

| Ordinary | N330,000 | N240,000 |

| Preference | N69,000 | N60,000 |

Note: The participating preference shareholders are entitled to share profits in the same ratio in which they share dividends after payment of fixed preference dividends. They will also share the same benefit as ordinary shareholders if the company is liquidated.

Required:

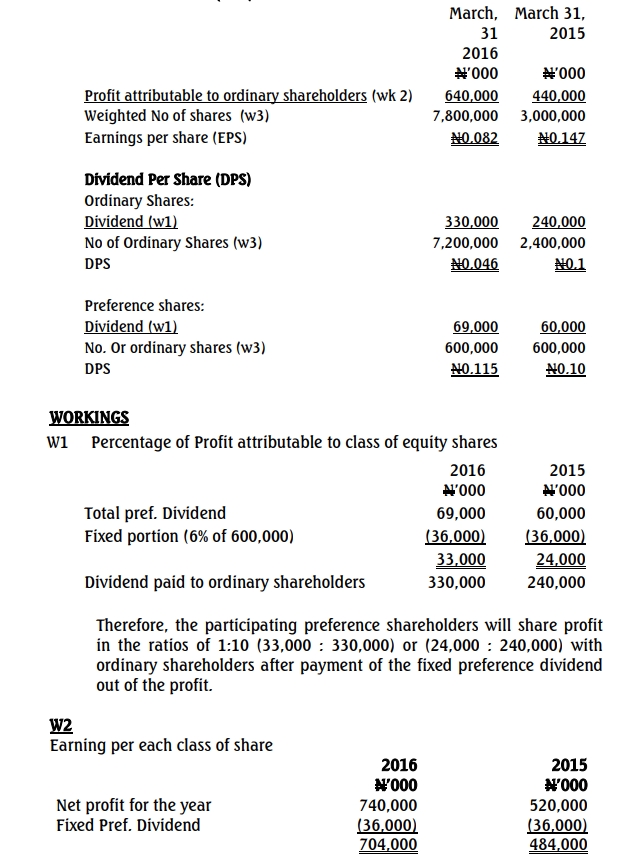

- Calculate the earnings per share (EPS) in accordance with IAS 33 and the dividend per share (DPS) for the years ended March 31, 2015, and 2016. (10 Marks)

- Discuss the limitations of earnings per share (EPS) as a measure of a company’s performance. (4 Marks)

Answer

a. Explanation and Importance to Investors

i. Earnings Per Share (EPS)

Earnings per share (EPS) represents the portion of a company’s profit attributed to each outstanding share of common stock. It is calculated by dividing the net profit attributable to ordinary shareholders by the weighted average number of shares outstanding. EPS helps investors gauge the profitability of the company on a per-share basis and is a crucial metric for assessing financial health and earnings potential.

Importance:

- Used by investors as a key measure of company performance.

- Offers insight into financial health, aiding investment decisions.

- Serves as an input in calculating the Price Earnings Ratio.

- Influences stock price and investor confidence.

ii. Price Earnings Ratio (PE Ratio)

The PE ratio is the ratio of a company’s current share price to its earnings per share. It indicates how much investors are willing to pay per dollar of earnings and provides a measure of the stock’s market value relative to its earnings.

Importance:

- Helps determine whether a stock is over or undervalued.

- Indicates expected future earnings strength.

- Higher PE ratios often reflect investor confidence and potential for growth.

b. EPS and DPS Calculation

c. Limitations of Earnings Per Share (EPS)

- Comparability Issues: Different accounting policies across firms can make it difficult to compare EPS across companies meaningfully.

- Lack of Inflation Adjustment: EPS does not consider inflation effects, potentially skewing long-term performance comparisons.

- Narrow Measure of Performance: While EPS reflects profitability, it ignores other aspects of performance like cash flow and asset utilization.

- Susceptibility to Manipulation: Management might manipulate EPS figures to make them appear higher, potentially misleading investors.

- Tags: Dividend per share, EPS, Financial Performance, IAS 33, PE Ratio

- Level: Level 2

- Topic: Earnings Per Share (IAS 33)

- Series: MAY 2017

- Uploader: Theophilus