- 9 Marks

Question

The directors of Oluwaseun Plc are disappointed by the draft profit for the year ended September 30, 2015. One of your staff, who is an assistant accountant, has suggested one area where he believes the reported profit may be improved, if it is acceptable to the company’s management.

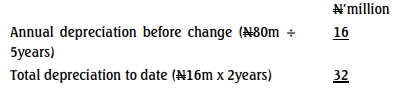

Included in the financial statement of Oluwaseun Plc is an item of plant which had cost N80 million to purchase and install three years ago on October 1, 2012. It is the policy of Oluwaseun Plc to depreciate this plant on a straight-line basis over a five-year period, assuming nil residual value.

The depreciation of the plant has progressed as envisaged, but at the start of the current year (October 1, 2014), the production manager estimated that the plant was likely to last eight years in total from the date of its purchase as against the original five-year period upon which current depreciation is based.

The assistant accountant has calculated that, based on an eight-year life (with no residual value), the accumulated depreciation of the plant at September 30, 2015, would be N30 million (N80 million/8 years × 3). In the financial statements for the year ended September 30, 2014, the accumulated depreciation was N32 million (N80 million/5 years × 2). Therefore, by adopting an eight-year life, Oluwaseun can avoid making a depreciation charge in the current year and instead credit N2 million (N32 million – N30 million) from the accumulated depreciation account to the income statement in the current year to improve the reported profit.

Required:

i. Comment on the acceptability of the assistant accountant’s suggestions. (6 Marks)

ii. Illustrate how the suggestions will affect the financial statements of Oluwaseun Plc based on the correct application of the relevant IFRS. (9 Marks)

Answer

i. In accordance with IAS 8, Accounting policies, changes in accounting

estimate and correction of prior period errors, a change in accounting

estimate involves a change in the periodic consumption of assets which is

similar to the case of Oluwaseun Plc. In line with IAS 8, a change in

accounting estimate should be applied prospectively i.e from the year of

change and in future periods. In addition, IAS 16 – Property, Plant and

Equipment states that when an entity changes its depreciation method and

useful live such should be treated as a change in accounting estimate and

the current and future years depreciation should be based on the carrying

amount of the asset at the date of the change.

Drawing from the above, the assistant accountants’ suggestion of crediting

the income statement with an amount debited from accumulated

depreciation is not acceptable and not in line with IAS 8 and 16.

By applying IASs 8 and 16, the carrying amount in the date of the change i.e 1st

October 2014 is derived as follows:

Therefore carrying amount at 1/10/2014 = N80m – N32m = N48m

So, for the year ended 30 September 2015, the depreciation charge will be

N48m divided by 6 (i.e the revised useful life of 8 less the already used up

life of 2 years). This depreciation charge should be a charge against profit or

loss for the current period and in future periods until a more reliable useful

life is determined.

In conclusion, the effect of this on the financial statements is to reduce the

annual depreciation charge from N16million to N8million. At the end of the

year the carrying amount of the asset would be (N48m – N8m) N40million.

All other things being equal a higher profit would be reported in the current year but would be much lower than it would have been if the assistant

accountant’s suggestion was followed.

- Level: Level 2

- Uploader: Kwame Aikins