- 5 Marks

Question

A Parent Company acquired 60% equity interest in a subsidiary company for N440 million. The market value of the net assets of the subsidiary on the acquisition date was N400 million. The parent company estimates that the full 100% interest in the subsidiary company would have cost N640 million.

Required:

Calculate the goodwill at acquisition date where non-controlling interest is measured:

i. As a proportionate share of the net assets of the subsidiary company.

ii. At fair value (the full goodwill method).

Answer

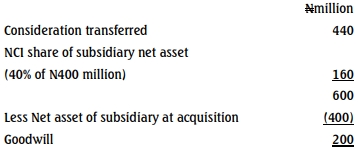

a) i. Calculation of Goodwill at acquisition:

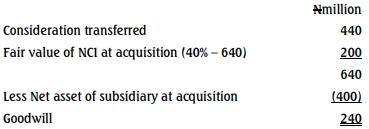

ii. Calculation of Goodwill at acquisition with fair value of NCI:

- Tags: Acquisition, Fair Value, Goodwill, Non-Controlling Interest

- Level: Level 2

- Topic: Business Combinations (IFRS 3)

- Series: MAY 2016

- Uploader: Kwame Aikins