- 30 Marks

Question

Unitarisation Plc is a successful Nigerian Company that recently amended its objects clause to promote national unity and encourage anti-terrorism compliance. The company acquired 60% of the equity share capital of Famous Plc to further this mission. Summarised draft financial statements of the two companies are as follows:

Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 October 2014

| Unitarisation Plc (N’m) | Famous Plc (N’m) | |

|---|---|---|

| Revenue | 51,000 | 25,200 |

| Cost of Sales | (37,800) | (19,200) |

| Gross Profit | 13,200 | 6,000 |

| Distribution Costs | (1,200) | (1,200) |

| Administrative Expenses | (3,600) | (1,920) |

| Finance Costs | (180) | (240) |

| Profit before Tax | 8,220 | 2,640 |

| Income Tax Expense | (2,820) | (840) |

| Profit for the Year | 5,400 | 1,800 |

Statement of Financial Position as at 31 October 2014

| Unitarisation Plc (N’m) | Famous Plc (N’m) | |

|---|---|---|

| Non-current assets: | ||

| Property, Plant & Equipment | 24,360 | 7,560 |

| Current Assets | 9,600 | 3,960 |

| Total Assets | 33,960 | 11,520 |

| Equity & Liabilities: | ||

| Equity Shares of N1 each | 6,000 | 2,400 |

| Retained Earnings | 21,240 | 3,900 |

| Total Equity | 27,240 | 6,300 |

| Non-current Liabilities: | ||

| 12% Loan Notes | 1,800 | 2,400 |

| Current Liabilities | 4,920 | 2,820 |

| Total Equity & Liabilities | 33,960 | 11,520 |

Additional Information:

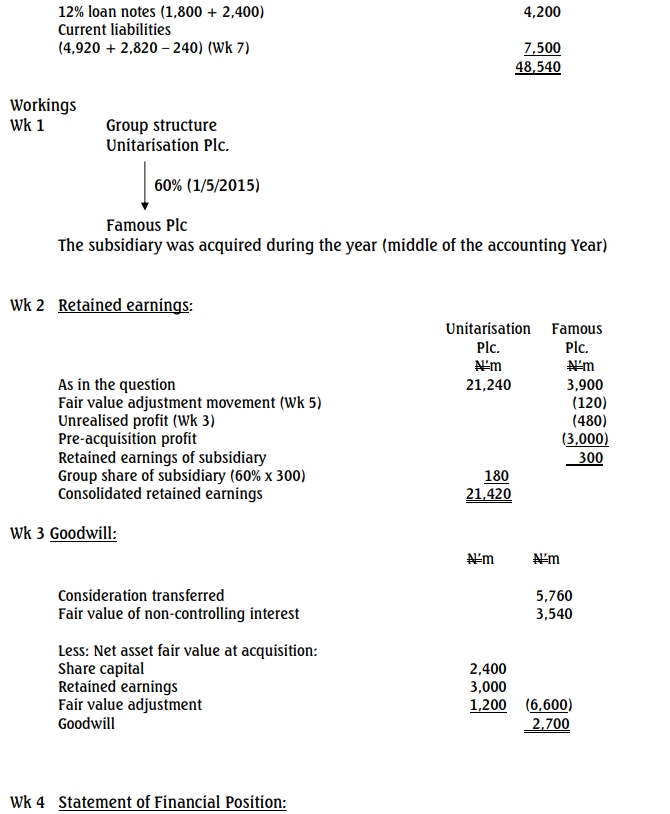

- Shares of Famous Plc were acquired on 1 May 2014, and the issue of shares was not recorded by Unitarisation Plc.

- There is cash in transit of N120,000,000 due from Unitarisation Plc to Famous Plc.

- Non-controlling interests are valued at full fair value; at acquisition, the fair value of non-controlling interests in Famous Plc was N3,540,000,000.

- Famous Plc’s assets’ fair value equaled carrying amounts at acquisition except for one equipment valued N1,200,000,000 above its carrying amount with a 5-year remaining life, using straight-line depreciation.

- The acquisition of 60% of Famous Plc’s shares was settled via a share exchange of two shares in Unitarisation Plc for three shares in Famous Plc, valued at N6 per share.

- Post-acquisition, Unitarisation Plc bought goods from Famous Plc for N4,800,000,000 with a 40% markup; N3,120,000,000 of these goods were unsold by year-end.

- Famous Plc’s trade receivables included N360,000,000 from Unitarisation Plc, with a discrepancy in Unitarisation’s payable ledger.

- Profits or losses are assumed to accrue evenly.

Required:

- Prepare Unitarisation Plc Consolidated Profit or Loss and Other Comprehensive Income for the year ended 31 October 2014. (10 Marks)

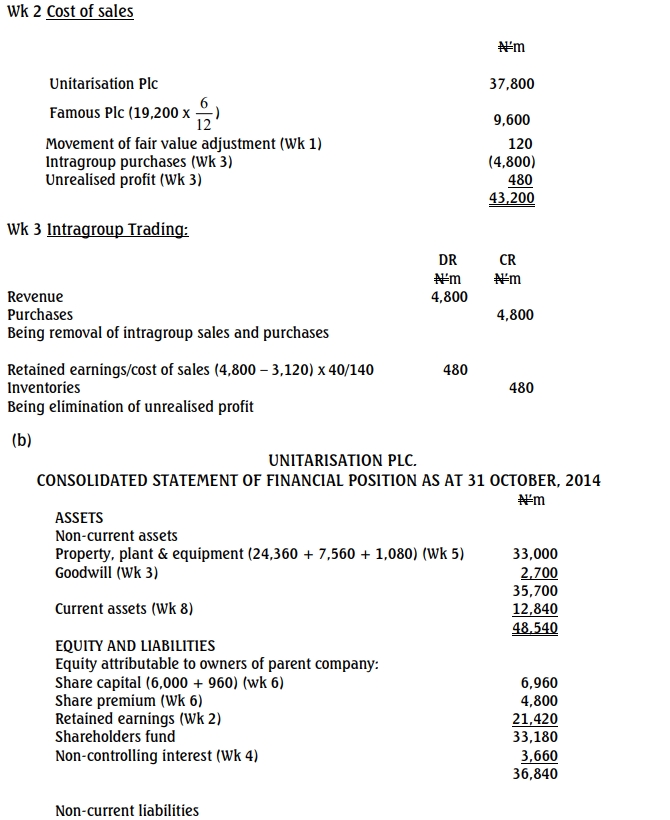

- Prepare Unitarisation Plc Consolidated Statement of Financial Position as at 31 October 2014. (10 Marks)

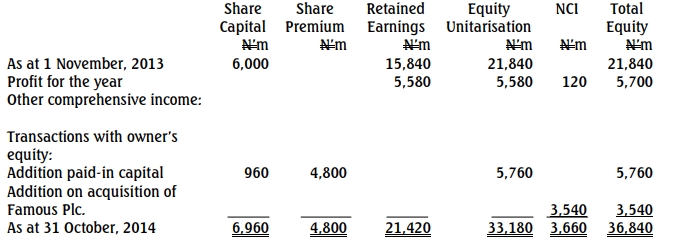

- Prepare the Consolidated Statement of Changes in Equity for the year ended 31 October 2014. (6 Marks)

- Explain “Gain on Bargain Purchase” according to IFRS 3 on Business Combinations. (4 Marks)

Answer

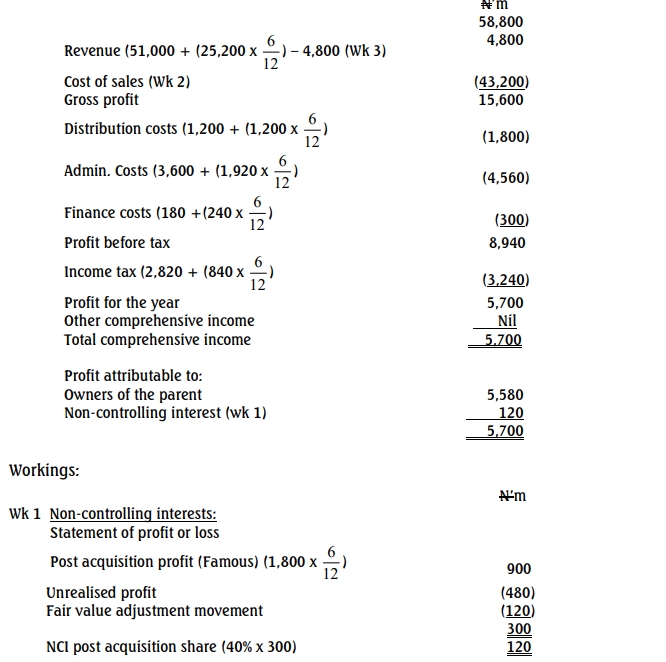

(a) Unitarisation Plc Consolidated Profit or Loss and Other Comprehensive Income for the year ended 31 October 2014

(c) Consolidated Statement of Changes in Equity for the year ended 31 October 2014

(d) Explanation of Gain on Bargain Purchase

Gain on Bargain Purchase arises when the sum of consideration transferred, non-controlling interest, and fair value of any previously held equity interest is less than the net identifiable assets acquired at the acquisition date, creating an immediate gain recognized in profit or loss.

- Topic: Consolidated Financial Statements (IFRS 10)

- Series: MAY 2015

- Uploader: Theophilus