- 7 Marks

Question

Sikaman Plc has three cash-generating units (CGUs), a head office, and a research facility. The carrying amounts of the assets and their recoverable amounts are as follows:

| Unit X | Unit Y | Unit Z | Head Office | Research Facility | Sikaman Plc | |

|---|---|---|---|---|---|---|

| Carrying value (GH¢m) | 500 | 700 | 1,000 | 750 | 250 | 3,250 |

| Recoverable amount (GH¢m) | 645 | 820 | 1,355 | – | – | 2,920 |

The assets of the head office can be reasonably allocated to the three units as follows:

- Unit X: GH¢95m

- Unit Y: GH¢280m

- Unit Z: GH¢375m

The assets of the research facility cannot be reasonably allocated to the CGUs.

Required:

Assuming all assets can be adjusted for impairment, show how the revised/adjusted carrying values of the assets of Sikaman Plc should be determined in line with IAS 36: Impairment of Assets after taking into account any impairment losses in the above scenario. Show the relevant financial statements extracts.

Answer

1. Allocation of Head Office Assets to CGUs

The assets of the head office must first be allocated to the CGUs (Unit X, Unit Y, and Unit Z) based on the amounts provided:

| Unit | Carrying Value | Head Office Allocation | Total Carrying Value |

|---|---|---|---|

| Unit X | 500 | 95 | 595 |

| Unit Y | 700 | 280 | 980 |

| Unit Z | 1,000 | 375 | 1,375 |

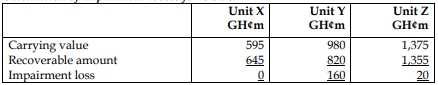

2. Calculation of Impairment Loss

Next, compare the total carrying value of each CGU with its recoverable amount to determine if an impairment loss should be recognized.

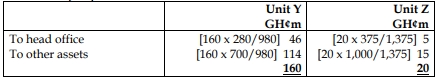

3. Allocation of Impairment Loss to Head Office and Other Assets

Impairment losses are allocated proportionately to the head office assets and other assets in each CGU:

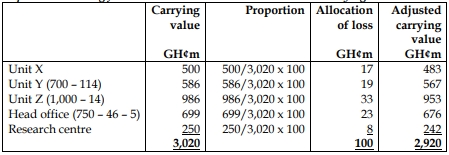

4. Impairment Testing for Sikaman Plc as a Whole

Since the research facility cannot be allocated to the CGUs, an impairment test is conducted on the entity as a whole. The total assets after impairment losses are:

Note: Allocation loss = 3,020 – 2,920 = 100

- Tags: Carrying Value, CGU, Head Office Allocation, IAS 36, Impairment, Research Facility

- Level: Level 3

- Topic: IAS 36: Impairment of assets

- Series: MAR 2024

- Uploader: Theophilus