- 20 Marks

Question

Below are the statements of financial position for three companies as of 31 July 2021:

| Statements of Financial Position as at 31 July 2021 | Papa Plc GH¢’million | Mama Plc GH¢’million | Bebe Plc GH¢’million |

|---|---|---|---|

| Non-current assets: | |||

| Property, plant, and equipment | 3,888 | 1,680 | 1,224 |

| Investments | 3,560 | 2,600 | 200 |

| Total non-current assets | 7,448 | 4,280 | 1,424 |

| Current assets: | |||

| Inventories | 1,080 | 368 | 300 |

| Trade receivables | 1,376 | 416 | 100 |

| Cash & bank | 368 | 104 | 64 |

| Total current assets | 2,824 | 888 | 464 |

| Total assets | 10,272 | 5,168 | 1,888 |

| Equity: | |||

| Share capital of GH¢1 each | 4,000 | 1,200 | 640 |

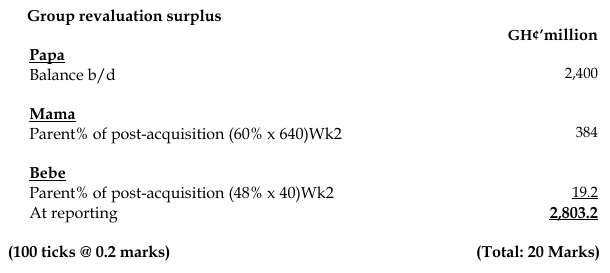

| Revaluation surplus | 2,400 | 960 | 400 |

| Retained earnings | 1,432 | 800 | 760 |

| Total equity | 7,832 | 2,960 | 1,800 |

| Current liabilities: | |||

| Trade payables | 1,144 | 1,080 | 56 |

| Taxation | 1,296 | 1,128 | 32 |

| Total current liabilities | 2,440 | 2,208 | 88 |

| Total equity and liabilities | 10,272 | 5,168 | 1,888 |

Additional information:

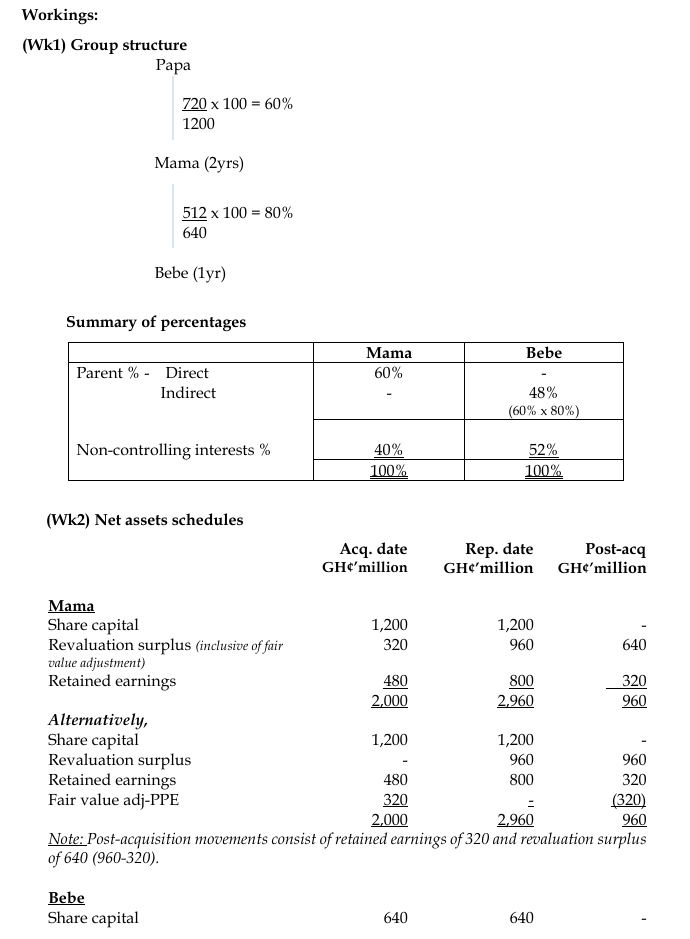

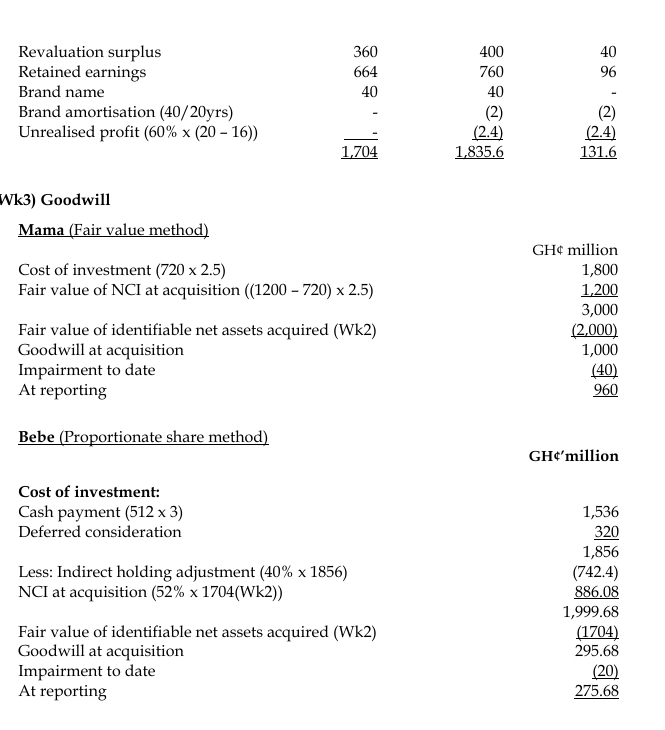

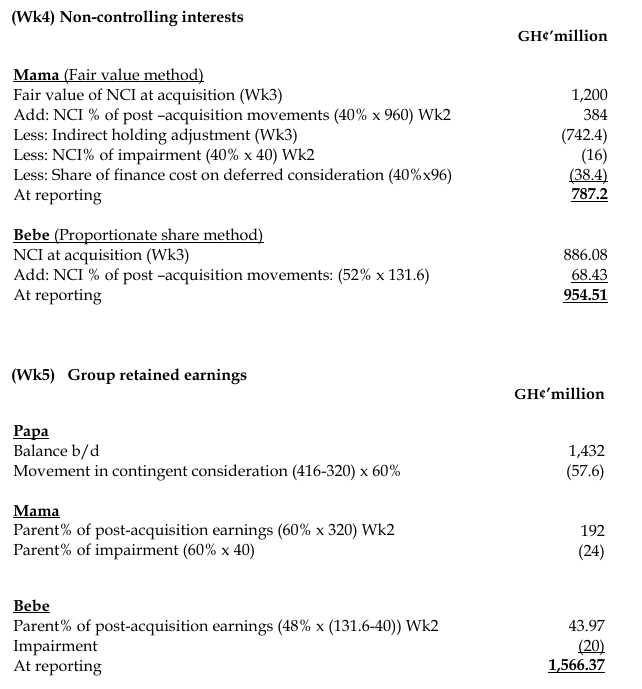

- Papa Plc bought 720 million shares in Mama Plc on 1 August 2019 at GH¢2.50 per share in cash. On that date, Mama’s retained earnings were GH¢480 million, and net assets equaled their carrying amounts except for property, plant, and equipment, which had a fair value excess of GH¢320 million.

- Papa implements a policy of carrying property, plant, and equipment at fair values across group companies from the date of acquisition.

- On 1 August 2020, Mama bought 512 million shares in Bebe Plc. The consideration was GH¢3 per share in cash with an additional payment of GH¢1 per share due on 31 July 2022. The fair value of the contingent consideration was GH¢320 million on 1 August 2020 and GH¢416 million on 31 July 2021. Bebe’s retained earnings were GH¢664 million, and the revaluation surplus was GH¢360 million.

- Bebe controls the brand “Y start,” with a fair value of GH¢40 million and a useful life of 20 years. This has not been recognized in the accounts.

- Papa uses the fair value method for non-controlling interests, using GH¢2.50 per share for this purpose.

- Goodwill impairment loss of GH¢40 million for Mama and GH¢20 million for Bebe was recognized on 31 July 2021.

- Mama bought goods from Bebe for GH¢16 million, with 60% unsold at year-end. These goods cost Bebe GH¢12 million.

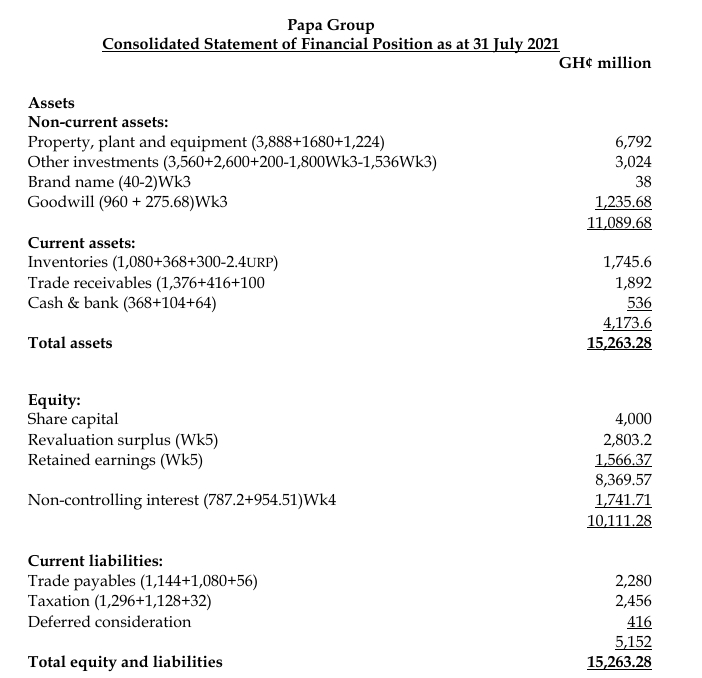

Required: Prepare the Consolidated Statement of Financial Position for Papa Group as of 31 July 2021, in accordance with IFRS.

Answer

- Uploader: Dotse