- 20 Marks

Question

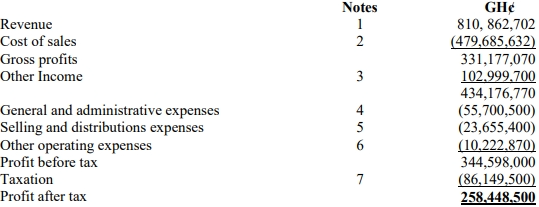

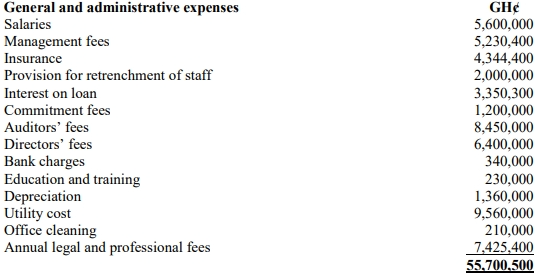

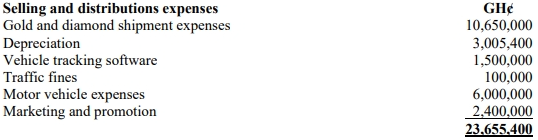

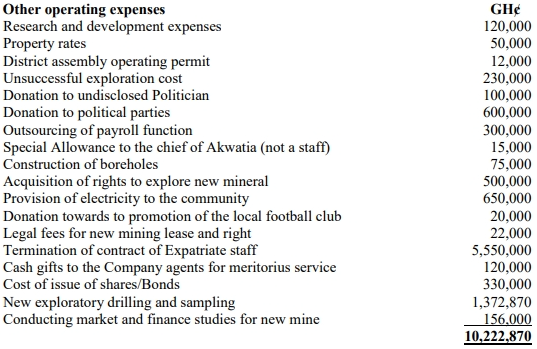

Akwatia Gold Mines was established ten years ago. For the year ended 31 December 2020, the following income statement was prepared and submitted to the Ghana Revenue Authority as part of its financial statement.

Akwatia Gold Mines

Income Statement for the Year Ended 31/12/2020

1.

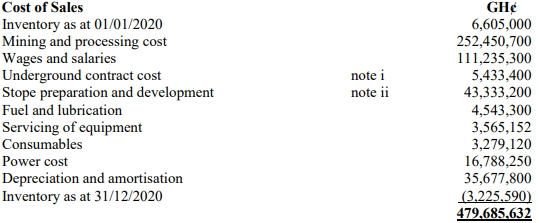

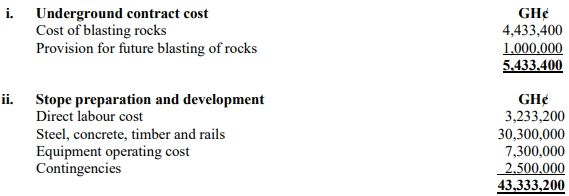

2.

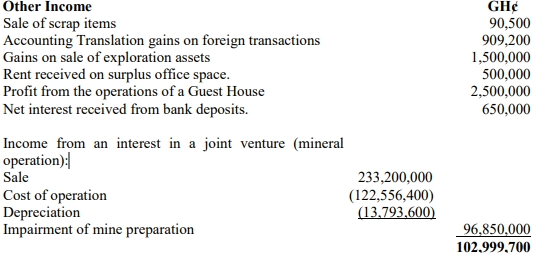

3.

4.

5.

6.

7.

The capital allowance agreed for the period was GH¢24,320,500.

Required:

a) Compute the chargeable income of the company and the tax payable. (15 marks)

b) Advise Akwatia Gold Mines on how to identify opportunities within the tax laws to optimise tax payable for the year ended 31 December 2020. (5 marks)

Answer

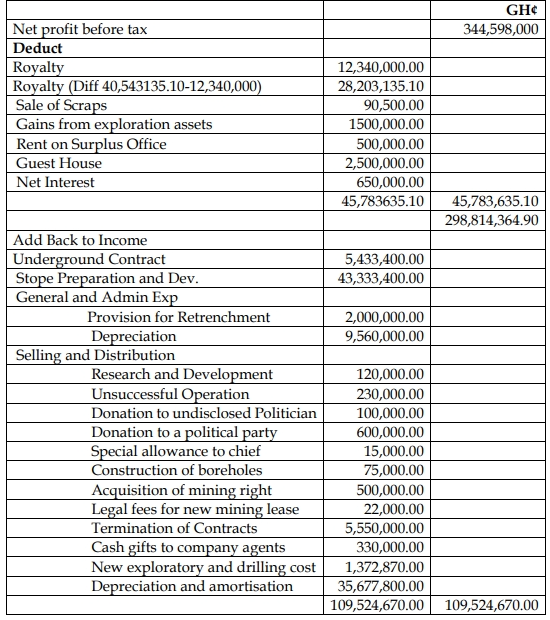

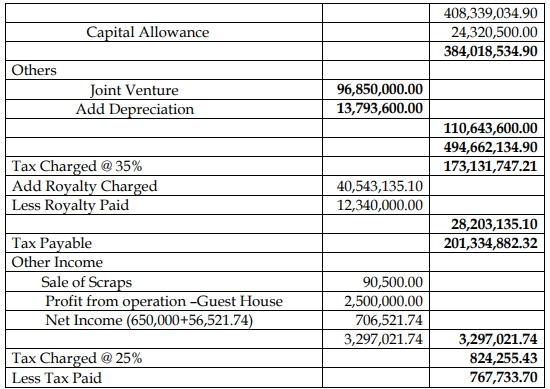

a) Akwatia Gold Mine Limited

Computation of Chargeable Income for the year of assessment 2020

b) Opportunities within the tax laws to assist Akwatia Gold Mines to optimise tax payable include:

- Capitalisation of mining rights and exploration costs: Mining companies can capitalize the costs of acquiring mining rights and exploratory expenses. This allows the company to claim capital allowances, thus reducing the tax burden.

- Retention of foreign exchange: A portion of foreign exchange earnings may be retained for the purchase of spare parts or other inputs, ensuring efficient operations without tax impositions.

- Exemption from import duties: Akwatia Gold Mines can benefit from exemptions on customs duties for machinery and equipment imported for mining activities. If such equipment is not diverted for other purposes, these exemptions can lead to significant tax savings.

- Employee tax exemptions: Employees housed at the mine site are exempt from PAYE taxes on housing allowances, which can optimize the company’s employee-related tax liabilities.

- Carry forward of losses: Akwatia Gold Mines can carry forward losses for up to five years. This would allow them to deduct previous years’ losses from current income, thereby reducing taxable income.

- Stability agreements: The company could enter into a stability agreement with the government, ensuring that the company is protected from changes in tax laws, exchange controls, and import duties for an agreed period.

- Topic: Business income - Corporate income tax, Minerals and mining

- Series: NOV 2021

- Uploader: Kwame Aikins