- 20 Marks

Question

JB Investments Holding Ltd (JB) is a multinational company that is committed to a policy of expansion into African countries. JB finances foreign projects with loans obtained in the currency in which project cash flows are received. JB financed an operation in Liberia with a syndicated loan of $20 million. Currently, the loan has three years to maturity. The loan requires semiannual interest payments at a fixed rate of 6.5% per annum, but JB prefers a floating interest rate as the pattern of cash flows from the Liberian project has changed.

The Finance Director talked to the creditors about JB’s preference for a floating interest rate. The creditors have agreed to accept a floating rate of LIBOR plus 200 basis points over the remaining three years of the loan term. However, the Finance Director feels that this rate is rather too high considering JB’s credit rating. She is therefore considering two alternatives for managing the interest rate risk exposure.

Alternative 1: Coupon swap with a bank

Engage in a coupon swap with UT Bank through which JB trades-in its fixed rate interest payments obligation for floating rate interest payments. The table below presents UT Bank’s bid and ask quotes for fixed dollar coupon rates:

| Loan term to maturity | Bid | Ask | Treasury note (TN) rate |

|---|---|---|---|

| 2 years | 2-year TN rate + 30 basis points | 2-year TN rate + 40 basis points | 5.3% |

| 3 years | 3-year TN rate + 35 basis points | 3-year TN rate + 50 basis points | 5.9% |

| 4 years | 4-year TN rate + 40 basis points | 4-year TN rate + 60 basis points | 6.7% |

| 5 years | 5-year TN rate + 45 basis points | 5-year TN rate + 70 basis points | 7.8% |

Floating rate quotation: Floating rates are pegged at 6-month dollar LIBOR plus 100 basis points.

Alternative 2: Coupon swap with another multinational company

Engage in a coupon swap with McEwen Ltd, a multinational company that has a floating rate dollar debt but prefers fixed coupon payments. The interest rate on McEwen’s dollar debt is LIBOR plus 150 basis points but it can borrow fixed rate dollars at 8%. Assume JB can borrow floating rate dollars at LIBOR plus 200 basis points.

Required:

(a)

i) Discuss TWO (2) advantages and TWO (2) disadvantages of hedging interest rate risk with an interest rate swap. (4 marks)

ii) Based on the restructuring deal with the creditors and the two interest rate swap alternatives, recommend a hedging strategy for interest payments on the $20 million debt. Support your recommendation with relevant computations. (10 marks)

(b) The Board of Directors of JB Investments Holdings Ltd is considering a transfer pricing policy for the transfer of goods and services among the company and its foreign subsidiaries.

Required:

Explain THREE (3) internal factors (motivations) for transfer pricing, which the board should consider in formulating a transfer pricing policy for the company. (6 marks)

(Total = 20 marks)

Answer

(a) Interest risk management

i) Advantages of hedging interest rate risk with interest rate swap:

- Leveraging on relative borrowing advantage: Swaps allow companies to mutually benefit from their relative borrowing advantage by borrowing in markets where they get the best deal and then swapping for the loan type they actually prefer.

- Flexibility and convenience: Swaps are more flexible than other derivatives like futures and options. They can be arranged in any size and reversed if necessary.

Disadvantages of hedging interest rate risk with interest rate swap:

- Counterparty risk: One party may default on the swap, leaving the other party to bear its obligations. This problem can be mitigated with an intermediary, but that increases transaction costs.

- Lack of liquidity: Swaps are not traded in open secondary markets, making it difficult to liquidate a swap contract if needed.

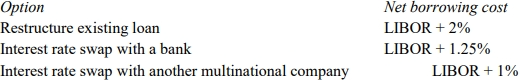

ii) Recommended interest rate risk hedging strategy

The recommended hedging strategy is the one that presents the lowest net

borrowing cost.

Restructure the existing loan

Under this option, the existing fixed rate dollar loan is structured into a floating rate

dollar loan at LIBOR + 200 basis point

Borrowing cost = LIBOR + 2%

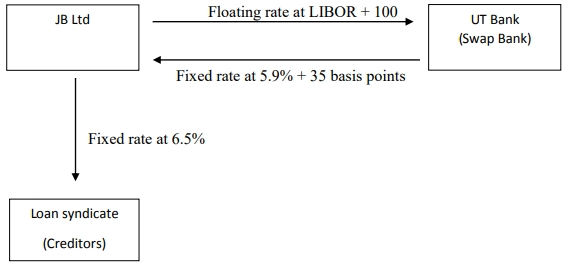

Hedging alternative 1: Engage in interest rate swap with a swap bank

Under this arrangement, JB will get the opportunity to pay floating rate (what it

prefers) at LIBOR + 100 basis points to UT bank (the swap bank) in exchange for

a fixed rate payment (what it does not prefer) at the bid fixed rate, 3-year TN rate

+ 35 basis points. The fixed rate payments from the swap bank will be at the bid

rate as in this case the swap bank will be buying a fixed rate from JB.

JB will still honour its fixed rate obligations to the loan syndicate. With the fixed

rate payments received from the swap bank however, much of this fixed rate

obligation is effectively shifted to the swap bank

Note: Though the diagram above aids analysis of interest payments amongst

the parties involved, it is not a requirement to answering the question. Full

credit should be given to a narrative that explains interest flows even without

a diagram.

Net borrowing cost:

That is if JB hedges the interest rate risk with an interest rate swap with UT bank,

its net borrowing cost would be LIBOR + 125 basis points.

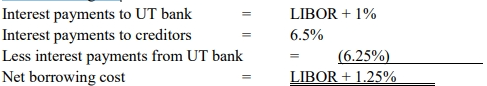

Hedging alternative 2: Engage in interest rate swap with another company

Under this arrangement, the entities will swap currency coupons for the type they

prefer. That is, JB would pay to McEwen the floating rate coupons it prefers and

then receive fixed rate coupons from McEwen. Thus, either entity ends up paying

the interest rate type they prefer.

Comment on swap arrangement:

JB would maintain its fixed rate debt, which is at 6.5%; and McEwen keeps its floating rate

debt, which is at LIBOR + 1.5%. And under the swap arrangement, JB pays floating rate

(LIBOR + 1.5%) to McEwen in exchange for a fixed rate (7%). JB then pays 6.5% out of

the fixed interest payment from McEwen to its creditors, and saves 0.5% on the fixed rate

side. On the floating rate side, JB pays LIBOR + 1.5% to McEwen instead of LIBOR + 2%

to creditors if the loan is restructured, and thus saves another 0.5%.

JB effectively ends up paying a floating rate; gains 1%, which reduces its borrowing cost

to LIBOR + 1%

Working:

Take the floating rate that is swapped to be what McEwen could pay under swap (i.e.

LIBOR + 1.5%).

Given that the swap gains are shared equally, the fixed rate that would be swapped is

calculated as under:

![]()

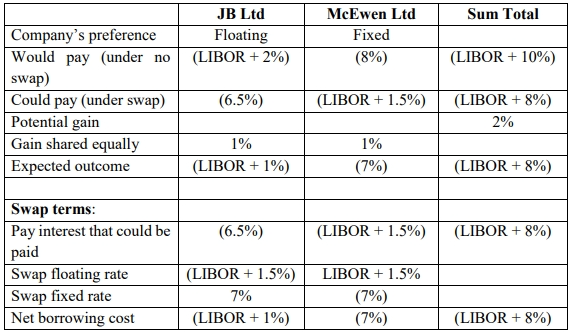

Summary:

Recommended hedging strategy

Hedging with interest rate swap with McEwen Ltd is recommended as it present the lowest

net borrowing cost.

JB maintains its fixed rate debt contract with loan syndicate, and engages in a fixed-forfloating interest rate swap with McEwen. Under the swap arrangement, JB pays floating

rate coupons at LIBOR + 1.5% to McEwen in exchange for fixed rate coupons at 7%.

JB then pays 6.5% out of the fixed rate coupons it receives from McEwen to the loan

syndicate. Thus, JB effectively shifts the risk associated with the fixed interest rate

obligation to the counterparty, McEwen.

(b) Internal motivations for transfer pricing

- Performance Evaluation:

Transfer pricing can be used to evaluate the performance of different divisions or subsidiaries. By treating them as profit centers, the prices set for inter-company transactions allow management to assess the profitability of each unit and hold them accountable for their financial results. - Management Incentives:

A well-designed transfer pricing system can serve as a motivation for managers by linking their compensation to the financial performance of their divisions. This encourages efficient management and decision-making aligned with the overall goals of the company. - Tax and Financing Considerations:

Transfer pricing allows a company to strategically allocate profits to subsidiaries in jurisdictions with lower tax rates or favorable financial environments, minimizing the overall tax burden and optimizing the company’s cash flow and financing.

- Tags: Interest Rate Swap, Internal Factors, Motivation, Risk Hedging, Transfer Pricing

- Level: Level 3

- Uploader: Kwame Aikins