You are the tax controller of Rex Pharmaceuticals (Nigeria) Limited, having its head office at Ketu in Epe local government of Lagos State.

In the past three years, the company had been subjected to an array of taxes by different revenue authorities within Lagos State and indeed the entire country.

Apart from the Companies Income Tax, Withholding Tax is another tax that the company‟s management is concerned about. The Managing Director is very much worried that this multiplicity of taxes is taking its toll on the company‟s financials.

The company is already facing myriads of problems ranging from high cost of capital which led to increase in cost of production and attendant reduction in profit. The company‟s goods are becoming uncompetitive compared with imported similar goods. The long term effect is either reduction in work force or relocation to a more favourable economic environment. The Managing Director has invited you to his office to discuss the following issues:

(i) Whether as a corporate body, the company ought to be subjected to myriads of taxes beyond the corporate tax;

(ii) The jurisdiction of the tiers of government in the imposition and collection of taxes;

(iii) Withholding Tax;

(iv) Pay-As-You-Earn (PAYE) as it affects the staff; and

(v) Capital Gains Tax.

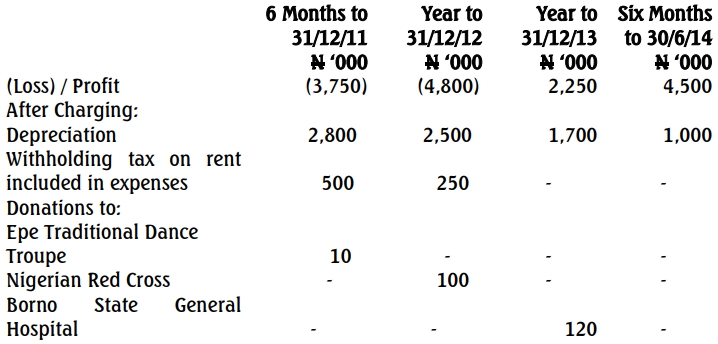

You have also been provided with the following information:

- The company‟s technical agreement with the foreign head office and the need to remit funds;

- Non-resident directors are to receive N2,500,000;

- Staff P.A.Y.E has been centralised;

- Dividend has been paid to shareholders in different parts of the country, and those resident in Kogi State of Nigeria, received N375,000;

- Land for a factory in Abuja was purchased from Alhaji Garuba Maito who resides in Kano;

- The company received N4,500,000 as net dividend from an associated company, Laiketop Limited, for the year ended September 30, 2014;

- In the audited financial statements of Rex Pharmaceuticals for the year ended December 31, 2015, a dividend of N9,500,000 was proposed. Out of this amount, N3,500,000 was from dividend received from Laiketop Limited while the balance was from a Total Profit of N22,500,000 from other trading activities; and

- Out of the thirty employees in Abuja, five are resident in Suleja, Niger State.

You are required to prepare a memo to the Managing Director explaining the following:

(a) i. Double/Multiple Taxation.

ii. Double Taxation Treaty.

iii. Multiple Taxation in Nigeria.

iv. Measures put in place to reduce cases of multiple taxation in Nigeria.

v. Withholding Tax with respect to (i) to (v).

vi. Penalty for non-deduction/remittance of Withholding Tax. (12 Marks)

(b) The arms of government empowered to legislate on tax matters by the Constitution. (4 Marks)

(c) Relevant tax authority and the Withholding Tax due, if any. (4 Marks)

(d) i. The appropriate description of the income received from Laiketop Limited.

ii. The tax due from other trading activities of Rex Pharmaceuticals.

iii. Amount to be recouped by Rex Pharmaceuticals, if any.

iv. Net amount received by shareholders of Rex Pharmaceuticals.

v. Relevant section of the law to buttress your points in (i) and (ii) above. (10 Marks)