The board of directors of Dragbat Limited, Lagos, a medium-sized company, at its last meeting, deliberated on the company’s tax-related issues vis-à-vis one of its major competitors in the same line of business. The Managing Director presented the audited accounts of the two companies for the previous three years. He affirmed that their company has been paying more corporate and tertiary education taxes than their competitors, while returning lower profit before tax in each of the years under review. The board has since directed the Managing Director to do a thorough investigation on how competitors, according to the Chairman of the board, are having it easy with the tax authorities.

With the assistance of a former course-mate in the university, who works in the Finance unit of a competitor’s organisation, the Managing Director was informed that the competitor was involved in tax planning and tax avoidance activities, which have helped in reducing the company’s tax liabilities over the years.

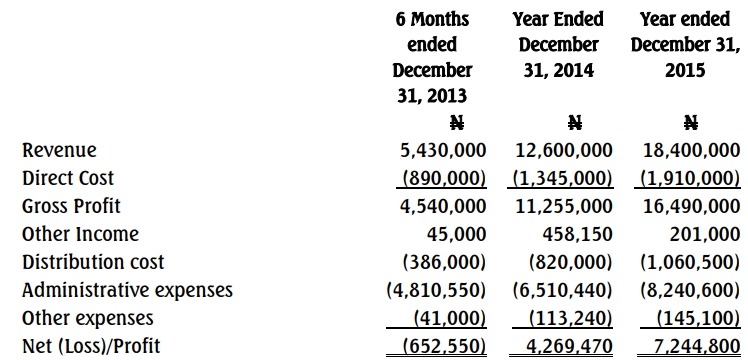

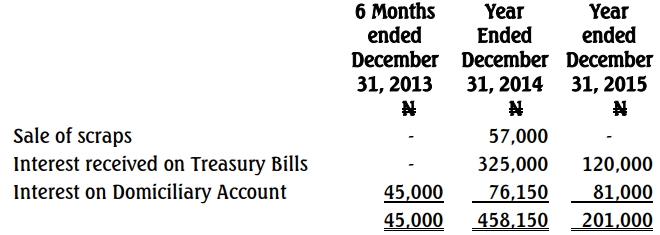

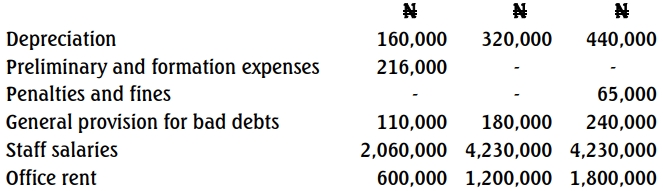

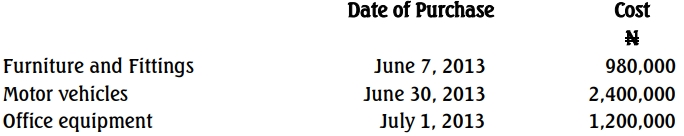

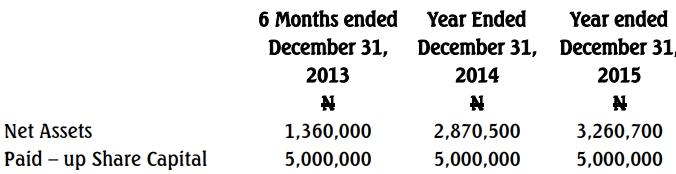

Being an engineer with sparse knowledge of accounting and taxation, the Managing Director has contacted you as the company’s tax consultant to help explain some fundamental issues in tax planning and tax avoidance. To assist with this assignment, the Managing Director of Dragbat Limited provided you with the audited financial statements of the two competing companies for the last three years. He also informed you that the major difference between the two companies is that Dragbat Limited is servicing a loan facility of ₦120 million obtained five years ago, and the company is not finding it comfortable in implementing the terms of the loan, despite its increased profitability over the last three years.

The board will be meeting in a fortnight to consider the report on the preliminary investigation, and the Managing Director expects you to submit your report to him next week.

Required:

As the company’s tax consultant, you are expected to address and advise on the following issues in your report:

a. The concepts of tax planning, tax avoidance, and thin capitalisation. (9 Marks)

b. Tax planning activities and strategies. (6 Marks)

c. Tax implications for companies that practice tax planning, tax avoidance, and thin capitalisation. (5 Marks)