- 1 Marks

FA – May 2012 – L1 – SA – Q12 – Accounting Concepts

Determining the correct presentation of share capital and share premium after a fresh issue of shares.

Question

At 1 January 2011, the capital structure of Jumbo Plc was as follows:

Issued share capital, 10,000,000 ordinary shares of N1.00 each: N10,000,000

Share premium account: N500,000

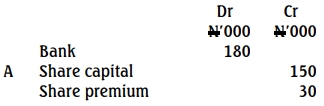

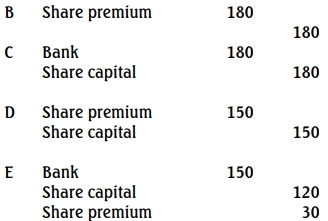

On 1 September 2011, the company made a fresh issue of 500,000 shares at N1.30 each. Which of the following correctly presents the company’s share capital and share premium accounts as at 31 December 2011?

A. Share capital N10,000,000, Share premium N650,000

B. Share capital N10,500,000, Share premium N650,000

C. Share capital N10,650,000, Share premium N500,000

D. Share capital N10,150,000, Share premium N1,000,000

E. Share capital N10,000,000, Share premium N500,000

Find Related Questions by Tags, levels, etc.

- Tags: Financial Position, Share Capital, Share Premium

- Level: Level 1

- Topic: Accounting Concepts

- Series: MAY 2012

Report an error